$219B Floodgates Open: Ethereum Braces for Its Next Mega Surge

Ethereum’s ecosystem just hit a staggering $219 billion in capital—now the market holds its breath for ETH’s next explosive move.

### The Liquidity Tsunami

With institutional money piling in, Ethereum’s network resembles a coiled spring. Traders whisper about ’the big one’—but will it be a moonshot or a classic crypto fake-out?

### Smart Money’s Dilemma

VCs and hedge funds can’t decide whether to FOMO in or wait for the inevitable 20% correction. Meanwhile, retail investors keep buying Starbucks with their ETH gains.

### The Cynic’s Corner

Wall Street still doesn’t understand DeFi—but that won’t stop them from launching another Ethereum ETF with 2% management fees.

Source: Messari/X

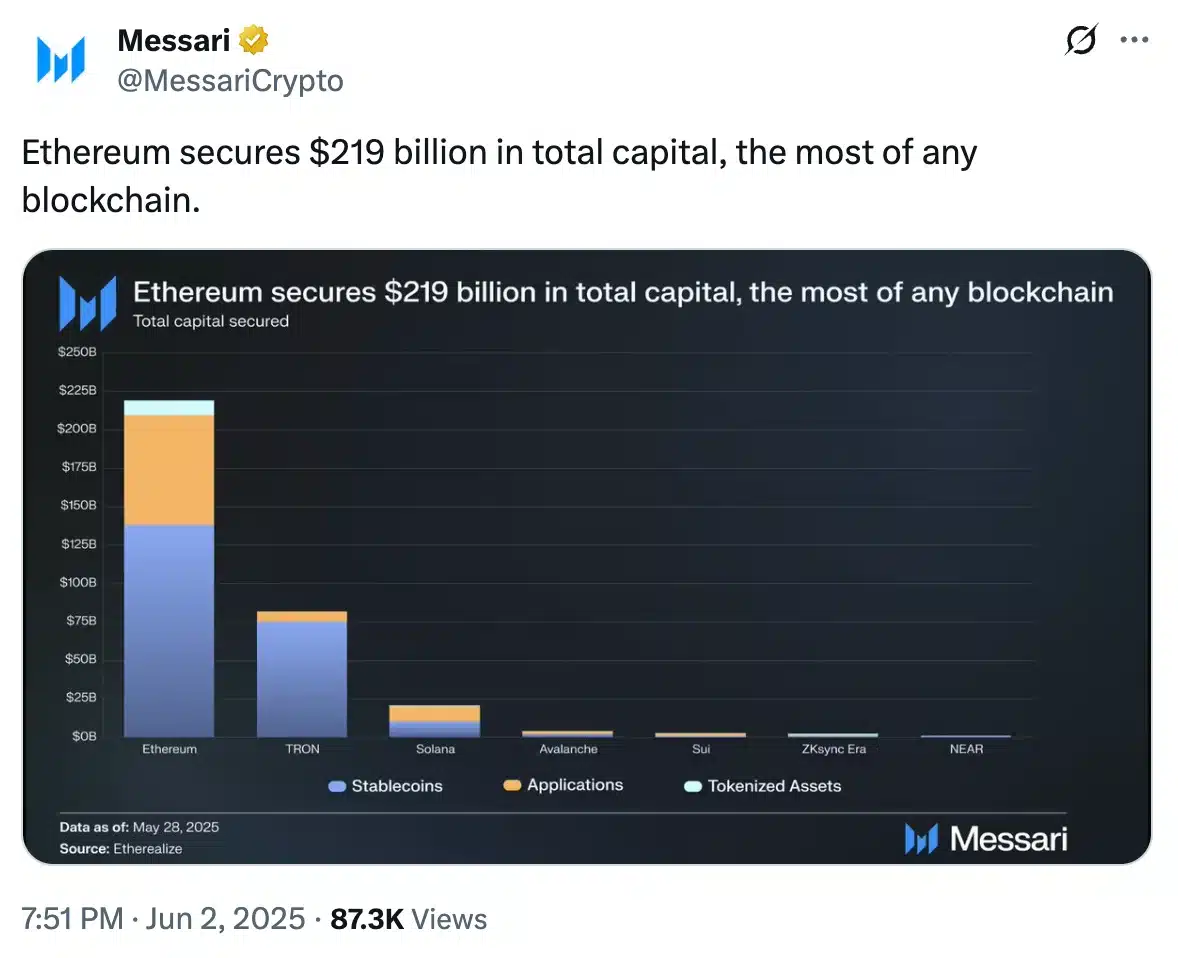

That being said, Ethereum continues to dominate the blockchain space in both capital allocation and application deployment.

Of the $219 billion secured on-chain, a significant portion stems from stablecoins, highlighting their foundational role in ETH’s ecosystem, according to data visualized by Messari.

Ethereum outperformed in these metrics

Beyond capital, Ethereum leads in decentralized applications, particularly in areas like NFTs, DeFi, and staking.

DeFiLlama data reveals that the network holds a Total Value Locked (TVL) of $61.10 billion, further cementing its leadership.

According to Artemis Analytics, Ethereum leads all blockchains in net capital FLOW across DeFi bridges. This highlights its strong liquidity and ecosystem trust.

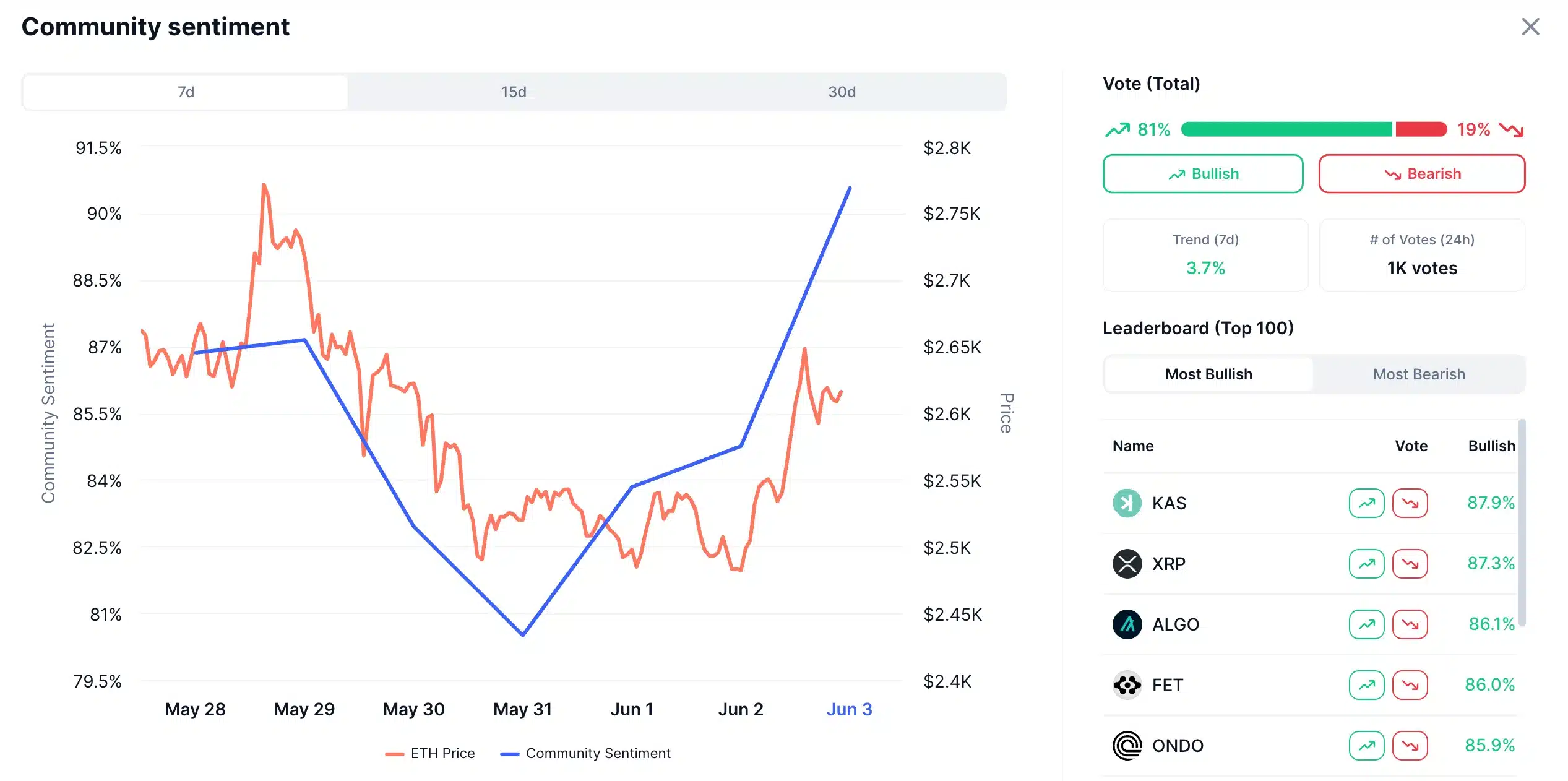

Meanwhile, Ethereum’s price momentum has been reinforced by a shift in social sentiment, which has turned bullish, per CoinMarketCap.

Source: CoinMarketCap

Is the sentiment bullish or bearish?

Technical indicators such as the Relative Strength Index (RSI) reflect this positive outlook, remaining above the neutral threshold.

However, the MACD indicator still hints at lingering bearish pressure, suggesting the bulls haven’t fully taken over yet.

Source: Trading View

Despite this, traders remain optimistic, closely watching near-term resistance levels to safeguard against potential reversals.

Contributing to the Optimism is the recent Pectra upgrade, which, while boosting confidence, has also drawn the attention of attackers exploiting the newly introduced EIP-7702 feature.

Nonetheless, with current momentum and market sentiment, Ethereum could be on track to challenge the $3,000 mark shortly.

Subscribe to our must read daily newsletter