Uniswap Bulls Charge Back—But Smart Traders Know Timing Is Everything

UNI’s rally sparks optimism—yet seasoned traders smell a trap. The DeFi darling’s resurgence has speculators buzzing, but charts whisper caution.

Price action looks juicy—if you ignore the looming resistance levels. Liquidity pools fill while ’hodl’ tweets multiply—classic signs the herd is arriving late.

Here’s the kicker: every ape chasing this pump forgets Uniswap’s governance token still trades 60% below its ATH. But hey—since when did math stop a crypto degenerate?

Whales start accumulating

As such, whales are returning to the market. A notable example—highlighted by Lookonchain—showed one whale scooping up 401,573 UNI worth $2.46 million from Binance.

Such a massive purchase signals confidence in the market, as this whale views the current value as cheap enough to take a strategic position.

Source: Coinalyze

It wasn’t just this single buyer

Looking at Uniswap’s Spot Volumes, buyers purchased 3.18 million UNI tokens, with the market recording a positive imbalance of 907,000 UNI.

It suggests that buyers are dominating the market. This reflects a strong demand for the altcoin.

Source: Coinalyze

The demand for the altcoin is especially high in the futures market.

Looking at the Funding Rate on UNI, this metric has held positive over the past three days. This implies that investors in the futures market are betting on prices to rise, thus, they are mostly taking long positions.

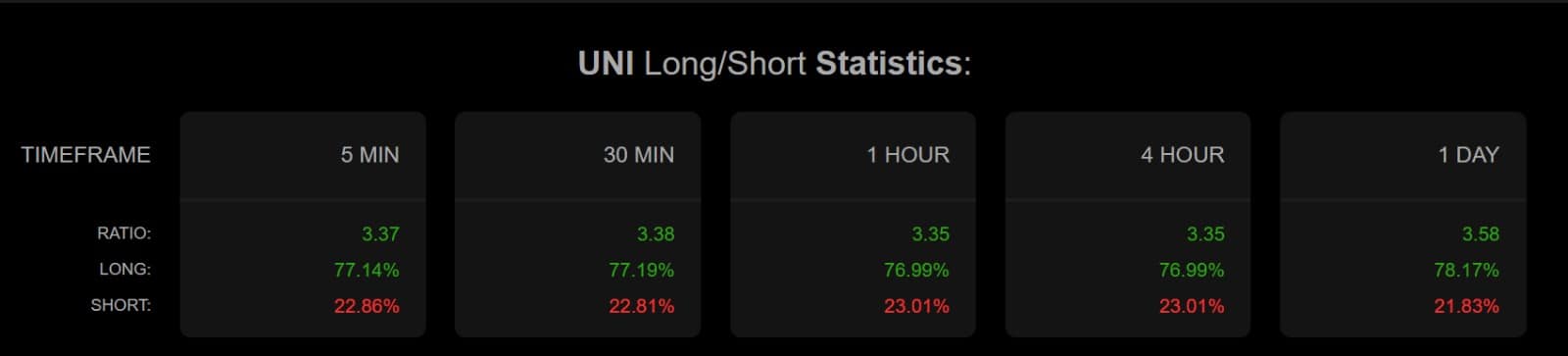

Data aligns with this as it showed that 78% of all UNI futures positions are long, while shorts only account for 21.83%.

Such a huge gap implies that investors expecting prices to rise are the majority in the market. This reflects strong bullish sentiment among investors that can result in higher prices if the market doesn’t experience a long squeeze.

Source: Coinalyze

Usually, a high demand leads to an upward pressure on prices. Thus, if the demand observed here holds, we could see Uniswap make a strong rebound on its price charts.

What’s next for UNI?

According to AMBCrypto’s analysis, Uniswap had been experiencing strong demand.

As such, buyers are returning to the market.

The $6.00 level has held strong as support. After tagging $5.80, UNI bounced to $6.30, driven by rising demand from both whales and retail traders.

If this strength holds, a retest of $7.08 and then $7.60 may follow.

However, if demand wanes and buyers retreat, UNI could slip back toward $5.70. The next few sessions will likely decide whether this is a true trend reversal or just a relief bounce.

Subscribe to our must read daily newsletter