Bitcoin Leaves Alts in the Dust: The Great Crypto Divergence of 2025

The king isn’t sharing its throne. While Bitcoin flirts with new highs, altcoins are stuck in a sideways purgatory—turns out ’digital gold’ still outshines the rest of the treasure chest.

Market watchers expected a rising tide to lift all boats this cycle. Instead, BTC’s dominance cuts through the hype like a laser through shitcoin whitepapers. Trading volumes tell the story: blue-chip alts are bleeding against BTC pairs while institutional money piles into the OG crypto.

Some analysts point to ETF flows; others whisper about vaporware projects finally getting called out. Either way, the ’altseason’ playbook needs rewriting—if Wall Street’s pouring champagne, Main Street’s still drinking hopium.

Dissecting the divergence

Before the 2022 bear market hit, during the 2021 cycle, Bitcoin topped out around $69,000 in November, and altcoins pretty much followed the move.

Case in point: Ethereum hit its all-time high at about $4,891, Solana peaked near $236, Binance Coin [BNB] got up to $671, and even Dogecoin [DOGE] made it to $0.73.

All in all, liquidity flowed hot and heavy across the board, fueling a broad-based rally. This synchronized upswing? That’s the OG “altseason” in full effect. Fast-forward to now, and that synchronized rotation is missing.

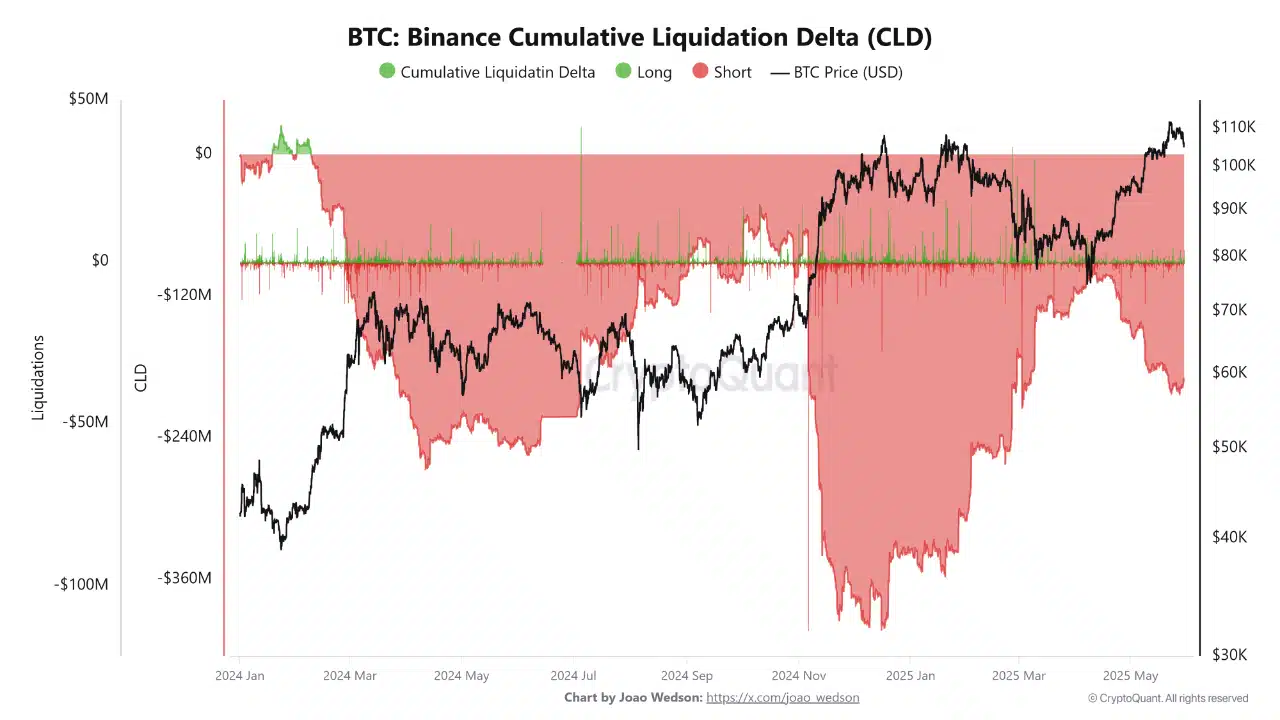

What’s changed? CryptoQuant’s on-chain metrics reveal a clear divergence. Since the launch of the bitcoin ETF, liquidation behavior has split sharply between BTC and the rest of the market.

On Binance, Bitcoin’s Cumulative Liquidation Delta (CLD) shows shorts got crushed by roughly $190 million, meaning bears were getting squeezed hard as BTC climbed higher.

Source: CryptoQuant

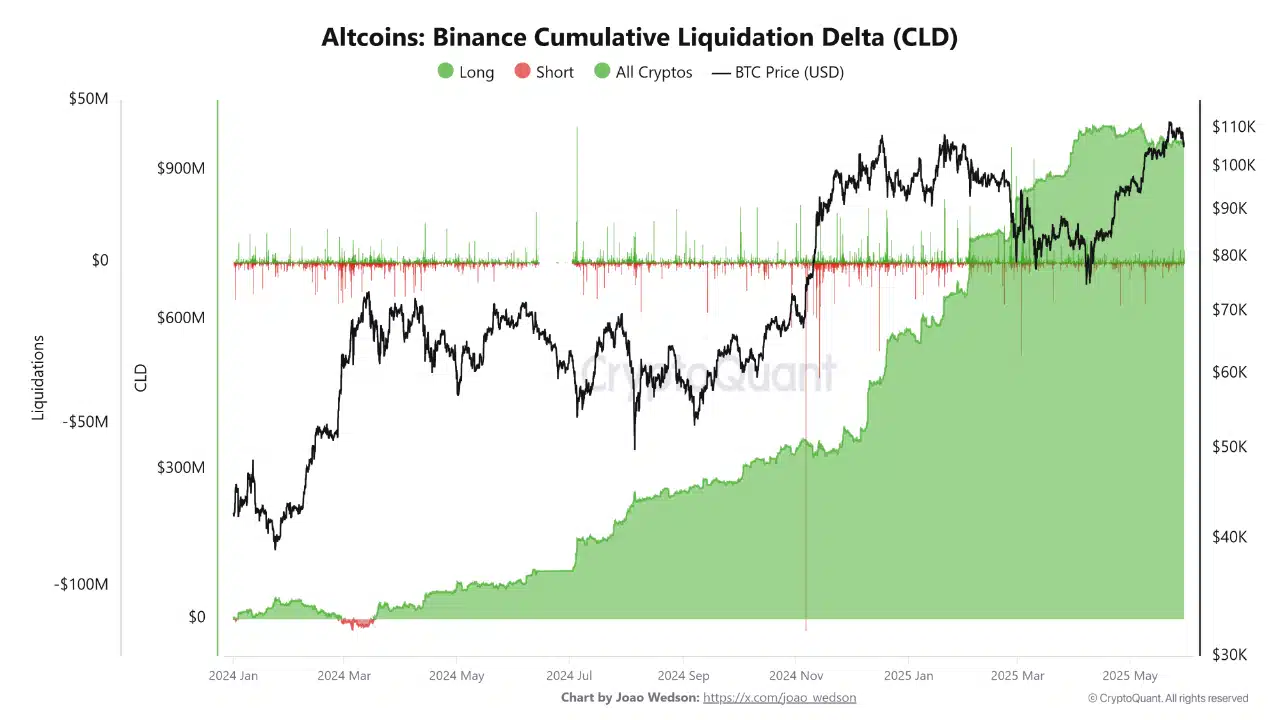

Meanwhile, altcoins played a completely different game. Long liquidations dominated the scene, outpacing shorts by nearly $1 billion.

This tells us traders were betting big on an “altseason” that never showed up, and paid the price for it. Since December 2024, this gap has only grown wider.

While BTC keeps steamrolling shorts and breaking new ground, Leveraged altcoin bulls are getting liquidated left, right, and center as capital stays locked confidently into Bitcoin.

Altcoins stuck in a long squeeze loop

It’s no surprise the big-name alts didn’t follow Bitcoin to new highs. But even without hitting that level, the damage was done. Alts still took the hit. Some even posted double-digit drawdowns.

Why? Because when BTC flirts with local tops or breaks key resistance, capital usually starts to trickle into alts – traders trying to front-run the elusive “altseason.”

But this time, that rotation got rug-pulled. No follow-through, no structural breakout. Instead, just speculative inflows and overexposed longs.

And it shows. Since April 2024, altcoins’ Cumulative Liquidation Delta (CLD) has been consistently skewed toward long liquidations.

Source: Glassnode

Put simply, as BTC approaches new highs, structural demand consolidates around it. Altcoins? Left out in the cold. That makes any capital flowing into high-caps like ETH, SOL, or XRP more speculative.

What comes next? Liquidation cascades. Failed breakouts. Resistance levels that act like brick walls. Basically, it’s a classic liquidity loop.

So next time Bitcoin pushes into price discovery, betting on a full-blown 2021-style “altseason” might be jumping the gun.

Unless these mega-caps attract organic bid support, a fresh all-time high remains a tall order.

Subscribe to our must read daily newsletter