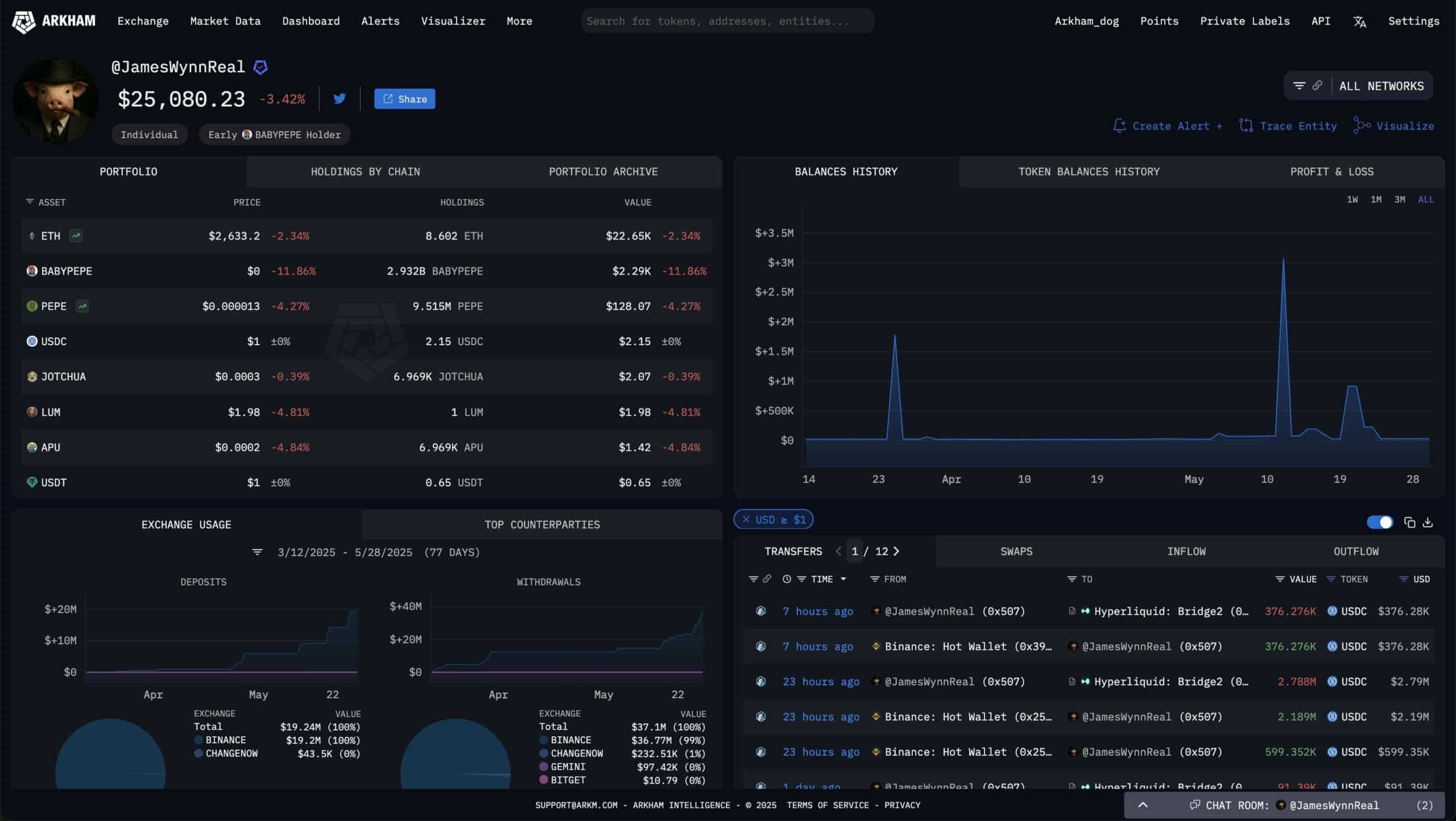

$99 Million Vanishes in James Wynn Crypto Liquidation—Market Trembles

Crypto markets reel as another nine-figure liquidation hits—this time, $99 million evaporates in the James Wynn saga. Traders brace for ripple effects.

Another day, another ’black swan’ event—just add it to the ledger. Liquidation cascades threaten fragile bullish sentiment, but hey, volatility is a feature, not a bug, right?

Source: Arkham Intelligence

Bitcoin’s fall triggered mass liquidations

The dip under $105K didn’t just shake one whale. It sparked a broader wave of liquidations across crypto exchanges.

Wynn’s massive exit headlined a volatile session.

Derivatives data showed Open Interest spiked briefly, then collapsed—classic signs of Leveraged wipeouts playing out in real time.

Source: CoinGlass

Short-term holders taking a step back

The impact has not stopped being exclusive to whales.

On-chain data shows a huge reduction in short-term holders following the correction. This refers to addresses holding bitcoin for fewer than 155 days.

The fall in the cohort signals reduced speculative appetite, further sparking growing hesitance signals among traders who have been contributing to the current rally.

With short-term holders offloading, long-term holders’ dominance could rewrite BTC’s short-term price patterns soon.

Source: CryptoQuant

What this means for Bitcoin going forward

James Wynn’s liquidation is a story of caution. The events reveal how volatile and unforgiving the current market conditions can also be for seasoned investors.

Though price action has not maneuvered a clear path, the shrinking pool of short-term holders may suggest a period of consolidation is imminent.

Subscribe to our must read daily newsletter