TRON Network’s USDT Volume Explodes: $600B Record Shatters Expectations

Move over, Wall Street—the blockchain just rewrote the liquidity playbook. TRON’s USDT transactions just blasted past $600 billion, proving stablecoins now move faster than a hedge fund’s excuses during a market crash.

Why this matters:

- The network’s ATH cements TRON as the dark horse of dollar-pegged settlements

- Transaction velocity leaves legacy finance choking on its own settlement dust

- Watch for regulators to suddenly ’discover’ stablecoins now that the number’s too big to ignore

This isn’t just growth—it’s a tectonic shift in how value moves globally. And traditional banks? Still trying to fax their confirmations.

Source: Token Terminal

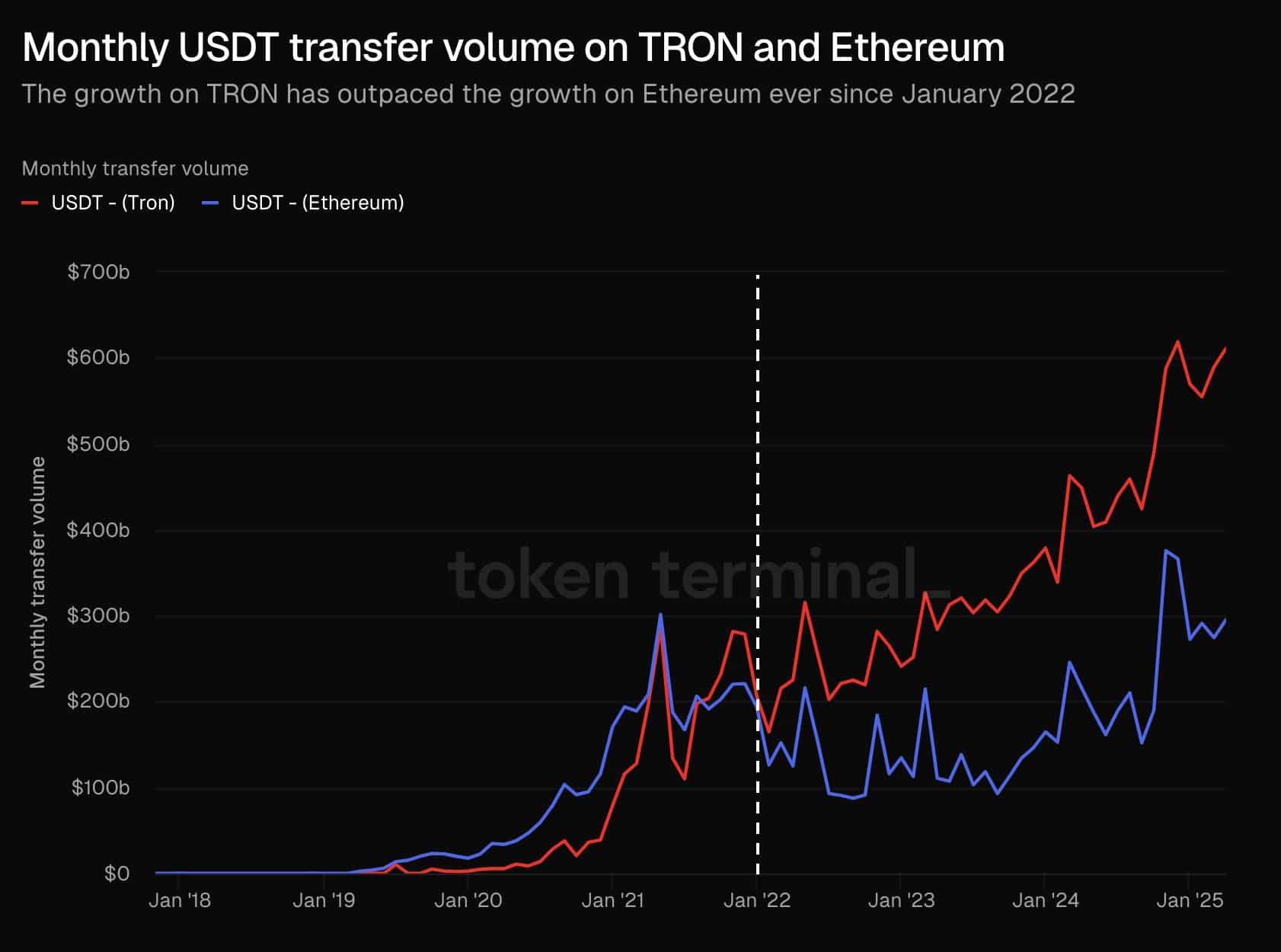

Growth gap emerges between TRON and Ethereum

The shift to TRON for transfer of USDT has been driven by its lower gas fee and faster confirmation rates. Higher fees than Ethereum’s have motivated users, particularly those in emerging economies, to switch away.

The trend has created a noticeable divergence. TRON’s stablecoin base is now processing radically more volume on a day-to-day basis than Ethereum’s, with the gap continuing to grow too.

More activity can awaken altcoin’s lagging momentum

Though viewed as a fading giant when compared to newer Layer-1s, network activity on the tron network has been painting a different picture. For example – The surge in USDT volumes is a sign of high underlying demand.

This on-chain activity has the potential to breathe new life into TRON’s price action. In the view of top analysts, network momentum is more likely to be reflected in renewed investor sentiment, especially when it is driven by real usage.

A surge past $0.2755 on the charts will push the altcoin’s price on another bullish run.

Source: TradingView

Are whales accumulating?

A noticeable wave of big whale orders has supported the hike in transaction volumes. In fact, whales have been steadily buying TRX at or close to its press time price levels.

Such episodes are generally seen as strong bullish signals. Whale accumulation during network expansion usually alludes to long-term positioning, and not short-term speculation.

Source: CryptoQuant

TRON’s quiet turnaround?

While TRON has not grabbed the headlines like solana or Ethereum of late, its fundamentals have been strong behind the scenes. Its all-time USDT volume and strategic whale involvements might hint at a potential turning point.

If the trend continues, TRX could possibly regain attention slowly — Not through HYPE cycles, but through consistent network utility.

Subscribe to our must read daily newsletter