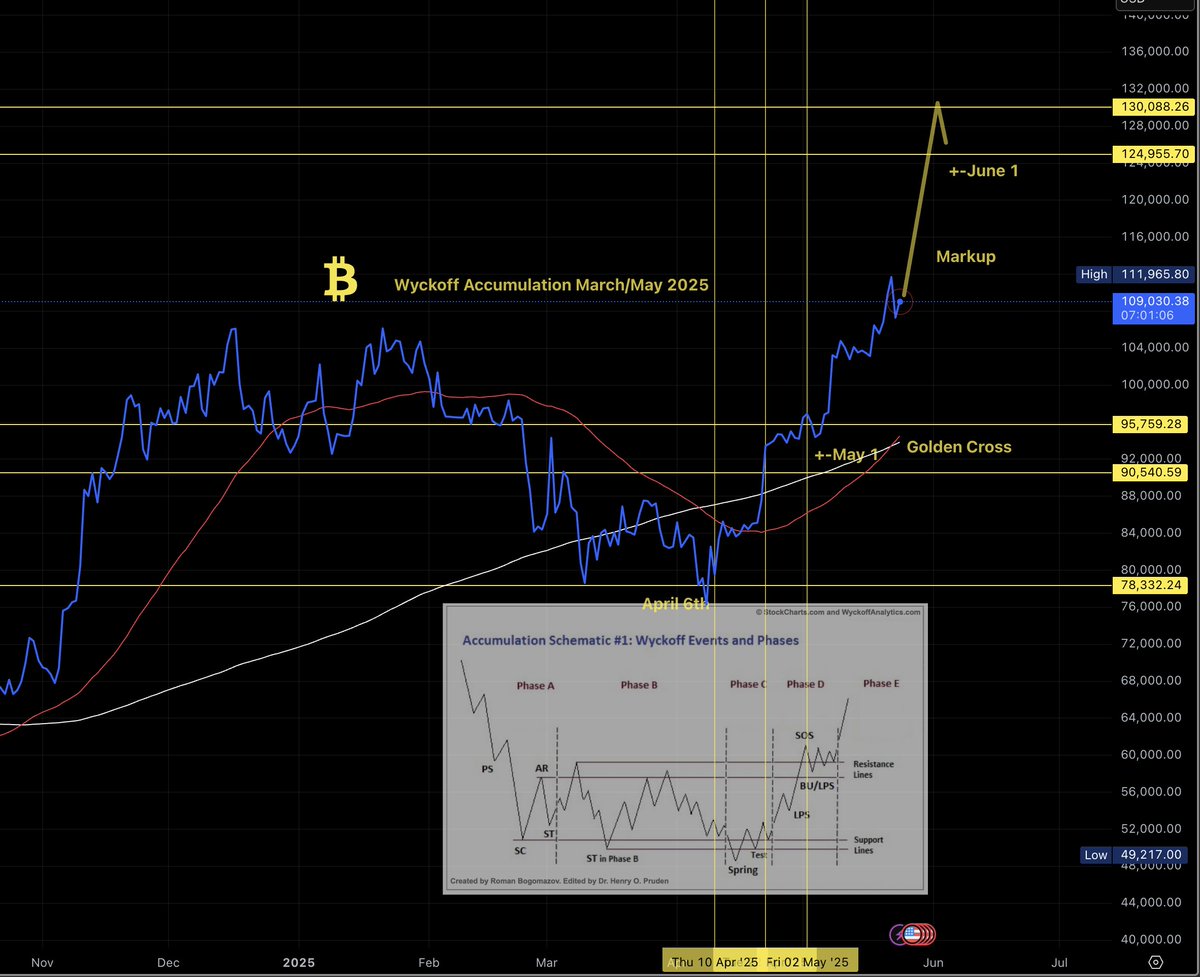

Bitcoin Enters Wyckoff Phase E – Path to $125K+ Now in Play

Crypto’s sleeping giant stirs again as BTC charts hint at explosive breakout potential.

Wyckoff’s Phase E—the ’markup’ stage where institutions quietly accumulate—could propel Bitcoin past its previous all-time highs. Traders are eyeing $125K as the next psychological barrier, with on-chain data showing whales positioning for a major move.

Meanwhile, Wall Street still can’t decide whether to FOMO in or short it into oblivion—some things never change.

Source: X

The real question remains—what happens beyond that?

U.S. Senate crypto bills could initiate the next market phase

From a highly regarded market analyst’s tweet, the next cycle for Bitcoin could either be a distribution phase or a re-accumulation phase.

The likeliest, in his view, is re-accumulation, particularly with the U.S. Senate set to vote on key crypto legislation soon.

Of course, regulatory events inject volatility. But they could also support institutional confidence, especially if legal clarity emerges around digital asset classifications.

Addresses withdrawing Bitcoin are declining

On-chain metrics add fuel to the current rally.

The declining number of Exchange Withdrawing Transactions—a key indicator tracking how often BTC is moved to private wallets, suggested selling pressure may be dwindling.

Picking up on the decline, the resulting fade in selling pressure may act as a stealthy bullish driver, reducing overhead resistance and powering price momentum.

This pattern aligns with the analyst’s projection of a distribution move NEAR $260K by August or September, assuming market supply remains constrained.

Source: CryptoQuant

Policies and price action to watch

With bitcoin firmly in Wyckoff Phase E and backed by a ‘golden cross,’ near-term momentum is firm.

Macro conditions like regulation and on-chain trends will, however, dictate what happens next.

If the market goes through, re-accumulation or distribution will be contingent on investor sentiment and the fate of legislation on the pending Bitcoin bills.

Subscribe to our must read daily newsletter