Ethereum Blasts Past $2,700—Here’s Why Traders Aren’t Popping Champagne Yet

ETH’s rally hits a fresh high—but lurking metrics suggest this party might have a last call.

Warning signs flash as open interest spikes and exchange reserves creep up. Classic ’buy the rumor, sell the news’ setup? Wall Street would be proud.

Meanwhile, crypto degens ignore fundamentals (again) while chasing the next gamma squeeze. Some things never change.

Short squeeze ignites as ETH breaks $2.7K

Ethereum’s surge past the $2,700 resistance level triggered a sharp liquidation event on Binance, wiping out over $50 million in short positions, according to CryptoQuant data.

Source: CryptoQuant

This zone, highlighted as a liquidity cluster on the Liquidation Delta chart, became a magnet for stop-loss orders as ETH pierced through.

Source: CryptoQuant

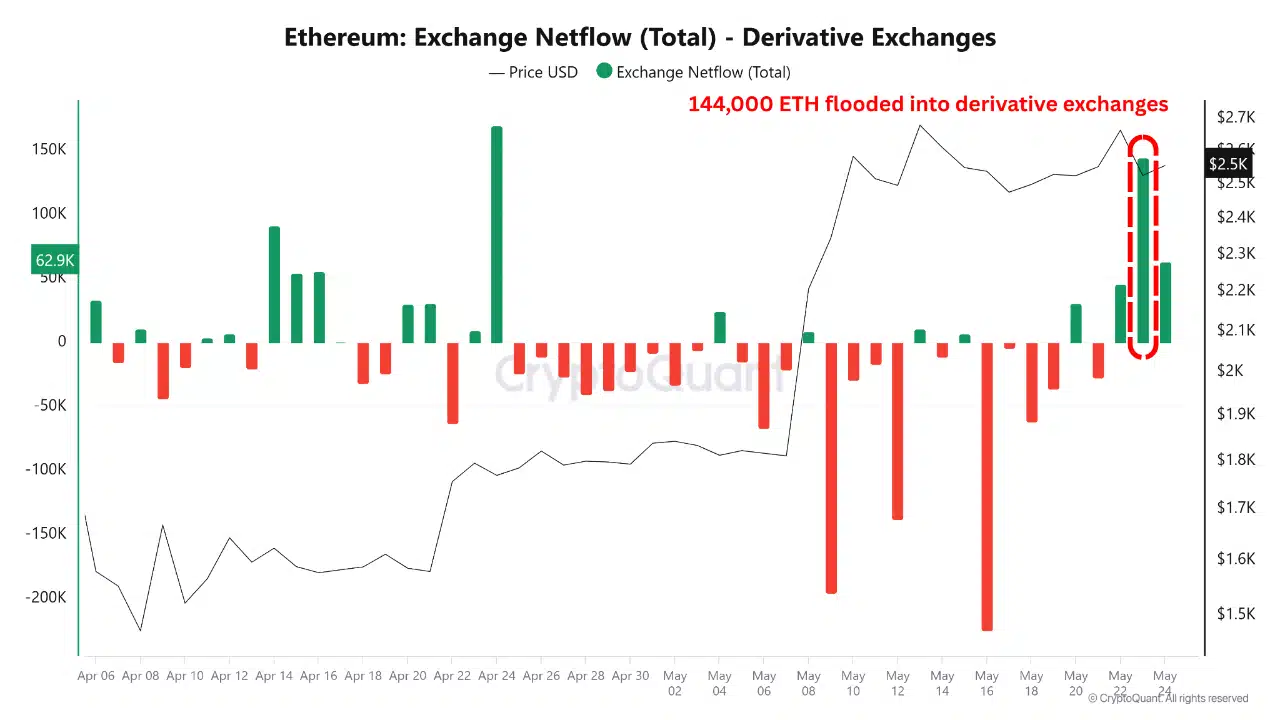

However, that squeeze was immediately followed by over 144,000 ETH flowing into Derivatives Exchange Reserves—a red flag. Such inflows typically precede renewed short positioning, not trend continuation.

While the bulls briefly claimed victory, the rapid inflows and heatmap pressure suggest caution may be warranted amid the initial euphoria.

Ethereum-Bitcoin correlation collapses

For years, Ethereum and Bitcoin moved in near-lockstep, often sharing a correlation above 0.7. But that relationship has nearly evaporated.

According to CryptoQuant, ETH’s 1-year Correlation with BTC plunged to just 0.05 as of the 22nd of May – down from 0.63 at the start of the year.

Source: Cryptoquant

This sudden decoupling disrupts one of the crypto market’s most consistent patterns, forcing a reassessment of traditional portfolio strategies.

More critically, it coincides with ETH’s relative underperformance during Bitcoin’s rally.

Decoupling dampens momentum

Ethereum’s divergence from Bitcoin is eroding market confidence. Without the tailwind of synchronized BTC rallies, Ethereum’s ecosystem is struggling to sustain growth.

Retail participation appears to be thinning, and leading L2s like Optimism, Arbitrum, and Polygon have failed to gain traction in 2025. Forecasting models that once hinged on Bitcoin’s directionality are losing predictive power.

Ethereum may be evolving into a more autonomous asset driven by internal fundamentals, but that independence risks isolating it during bull cycles.

For now, the decoupling seems to be more just wind than evolution.

Subscribe to our must read daily newsletter