Bitcoin’s Wall Street Surge: How ETF Mania and Macro Jitters Fuel the Rally

Wall Street’s love affair with Bitcoin just hit hyperdrive—ETF inflows are pumping the price, but lurking macro risks could yank the rug any second.

Here’s what’s driving the frenzy—and why traders are sweating behind their Bloomberg terminals.

ETF gold rush: Institutional money floods in, turning crypto’s wild west into a manicured hedge fund playground. Cue eye-rolls from Bitcoin OGs.

Macro tremors: Inflation data, rate whispers, and geopolitical spasms keep hodlers glued to Fed speeches like junkies to a ticker tape.

Bonus cynicism: Nothing unites Wall Street suits like chasing returns—until the exits get crowded. History rhymes, but the SEC ain’t writing sonnets.

Inside the U.S. Bitcoin vault

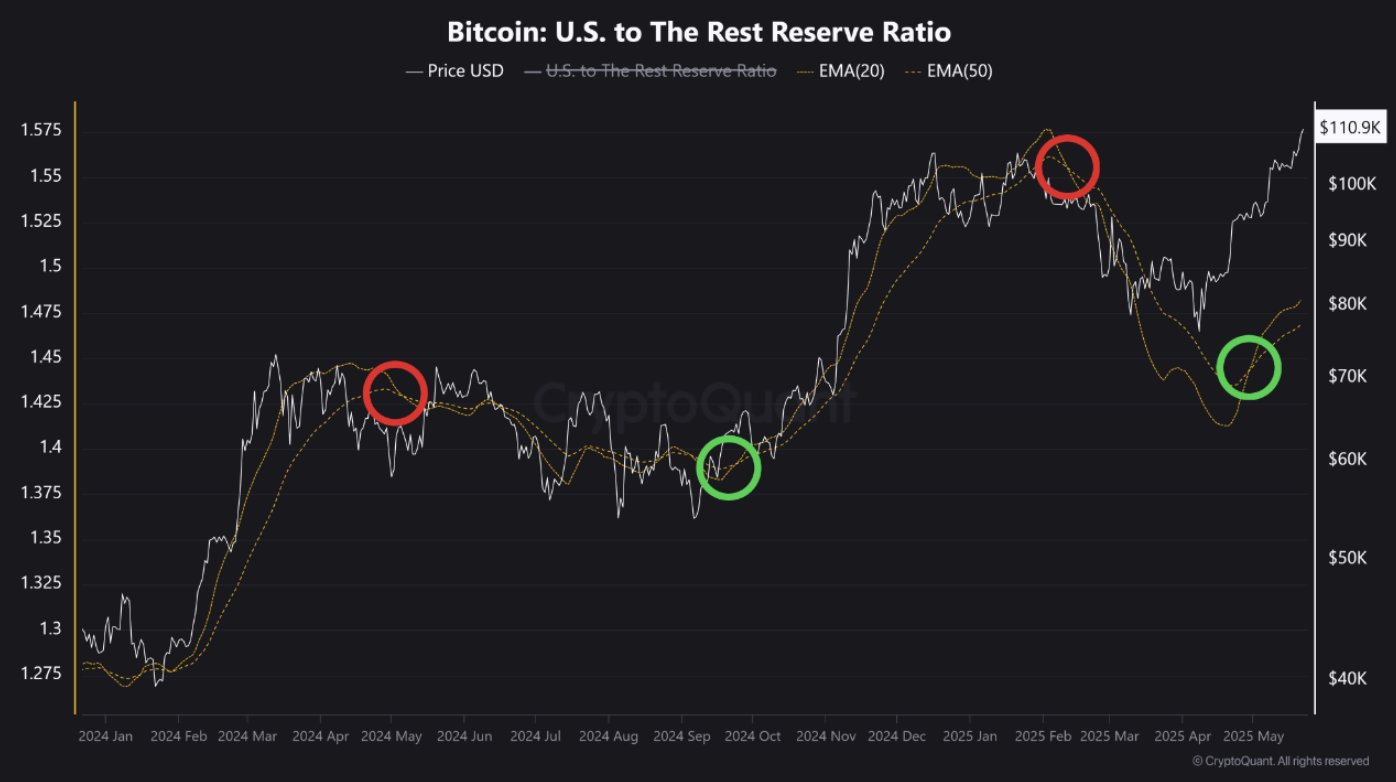

CryptoQuant data is flashing a key signal: When the BTC U.S. to Rest Reserve Ratio spikes, it often marks heavy accumulation by U.S. players that sets up golden crosses – prime setups for bull runs.

Right now, that familiar pattern is lighting up again. The recent green circle pinpoint critical “dip zone” identical to Q4 2024, which kicked off a monster 75% rally.

Source: CryptoQuant

Fueling this golden cross, U.S. Bitcoin spot ETFs are on a tear, logging seven straight days of net inflows.

The latest on the 22nd of May pulled in a staggering $935 million, with BlackRock’s IBIT ETF alone hauling $877 million, perfectly syncing with BTC’s 1.81% daily close at $111,917.

Overlay that with a green Coinbase Premium Index (CPI) and you’ve got a setup that echoes previous accumulation-to-expansion cycles. If this rhythm holds, BTC’s next price discovery zone could stretch all the way up to the $192.5k handle.

Will Wall Street’s appetite turn momentum into mania?

Nobody can forget the post-“Trump pump” crash. Bitcoin smashed through two consecutive all-time highs in under 30 days, only to get caught in a volatility vortex that sent it spiraling.

The 20th of January marked the inflection point. As TRUMP re-entered the Oval Office, risk markets recoiled. Headlines were stacked with tariff revival chatter, sticky inflation prints, and a Fed signaling tighter for longer.

Wall Street rotated defensive — and so did crypto.

That’s when the BTC: U.S. to Rest Reserve Ratio flipped red, showing U.S. investors were pulling back fast. Big outflows from U.S. exchanges lined up perfectly with Bitcoin’s fall to $76k, all in less than 100 days.

Source: TradingView (BTC/USDT)

Looking forward, if tariffs chill and inflation cools, risk-on flows could continue surging, pumping fresh U.S. capital into Bitcoin’s veins.

But beware — macro FUD is a lurking beast. When it rears, Wall Street’s defensive mode kicks back in.

That golden cross? It’s bullish, but chasing a November-style 75%+ blast off rally? Too optimistic for now.

Subscribe to our must read daily newsletter