HYPE Token Rides Bitcoin’s Coattails – Here’s Why That Matters

When Bitcoin sneezes, altcoins catch a cold—or in HYPE’s case, a rocket ride. The meme token’s price action is mirroring BTC’s rally with eerie precision, sparking debates about whether this is organic growth or just speculative froth.

Correlation play or copycat move? Either way, traders are treating HYPE like a leveraged Bitcoin bet—minus the institutional oversight, naturally. The token’s 24-hour volume suggests retail FOMO is alive and well, though seasoned crypto vets know this dance usually ends with someone holding the bag.

Funny how these ’decentralized’ assets still can’t shake their dependency on Bitcoin’s gravitational pull. Maybe Satoshi should’ve minted a ’market sentiment’ token while he was at it.

HYPE could correlate with Bitcoin

Following Bitcoin’s all-time high, only a few tokens have mirrored this upward trend, HYPE among them.

AMBCrypto’s analysis links HYPE’s recent MOVE to whale activity, particularly among those holding significant liquidity and using Hyperliquid—its native platform—for large futures trades.

Whale action led the charge.

The most impactful trigger appeared to be a $1.07 billion long position, now up $28 million in Unrealized PNL.

Source: CoinGlass

Large trades like this often spark confidence among retail investors, who see strong potential in HYPE. As a result, the altcoin has risen from a low of $26.13 on the 20th of May to a current price of $30.45.

On top of that, market sentiment leaned bullish. Longs made up 51.17% of positions, edging out shorts at 48.83%.

Does trading activity match the bullish sentiment?

Trading activity shows a positive correlation that could further drive HYPE’s growth. According to Artemis, Hyperliquid generated the highest Trading Fees in the past 24 hours, closing at $3.2 million.

Source: Artemis

This trading activity reflects surging interest across its ecosystem. Over the last 30 days, Annualized Fees surpassed $639 million, representing a 37.24% increase in price.

Meanwhile, Staked HYPE ROSE to 423.4 million, reducing the available circulating supply just as demand spiked.

Source: Artemis

This dynamic could trigger a supply squeeze, as the circulating supply fails to keep up with rising demand.

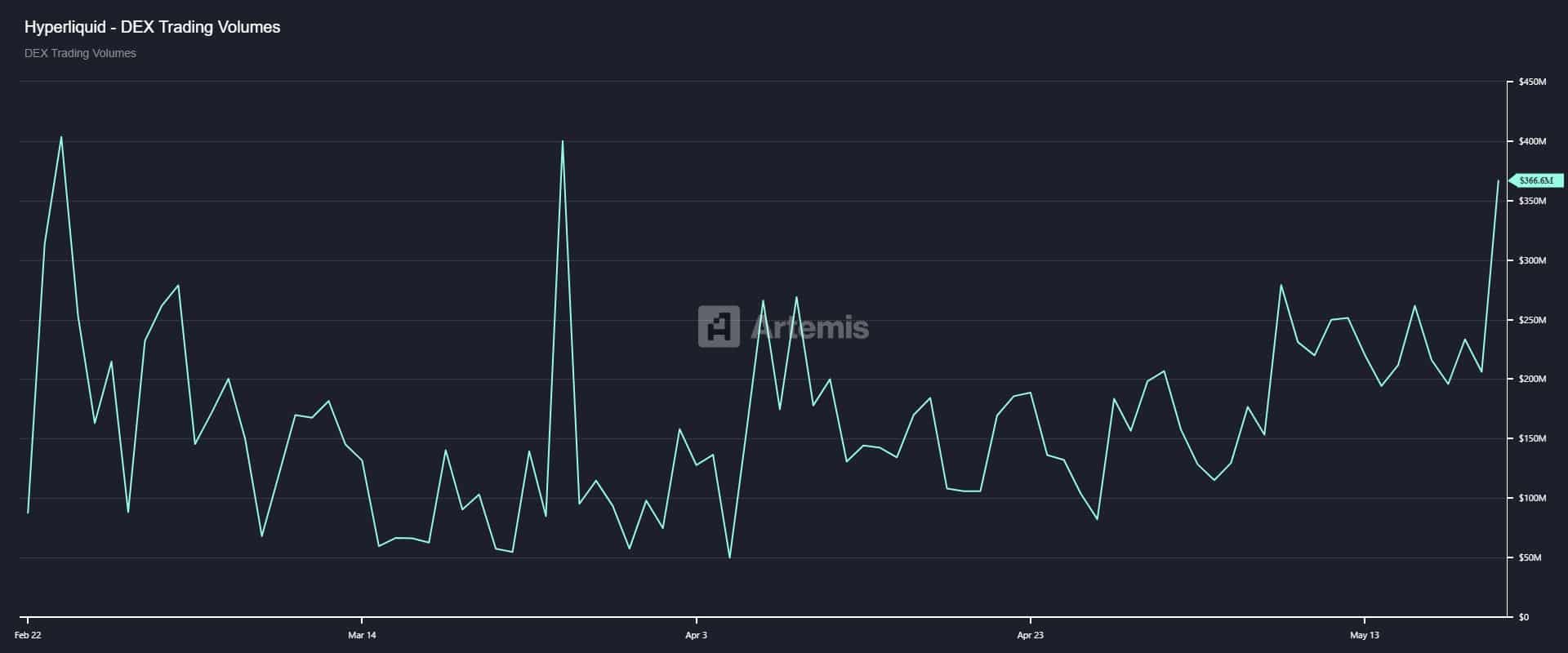

Across decentralized exchanges (DEXes), HYPE’s trading activity has grown significantly. In the past 24 hours, volume has hit a new milestone of $366.6 million.

Source: Artemis

This marks a significant level of interest, as this DEX Trading Volumes was last reached on the 26th of March. A 30-day outlook shows that current trading volume is up 97.46% from its earlier base value.

Subscribe to our must read daily newsletter