Bitcoin Smashes $111K Barrier—Here’s the Fuel Behind the Rally

Digital gold just got a whole lot shinier. Bitcoin rockets past $111,000, leaving traditional finance scrambling to justify their 2% yield products.

The catalysts? Institutional FOMO meets hyperbitcoinization—Wall Street’s latest ’hedge’ play looks more like a surrender.

Market mechanics at work: Supply shock from halvings meets demand surge from corporate treasuries. Even your dentist’s portfolio is now 5% BTC.

The cynical take: Watch legacy banks suddenly ’discover’ blockchain tech now that their clients demand exposure. Where was this enthusiasm at $30K?

One thing’s clear—the orange coin isn’t asking for permission anymore. It’s rewriting the rules.

Bitcoin breaks new ground!

Bitcoin surged past $111K on the 21st of May, setting a new all-time high and closing the daily candle at $110K on Binance.

Source: TradingView

The MOVE caps off a week of steady gains, with BTC climbing over 10% since 17th May. Notably, the RSI was at 77.42 at press time, indicating overbought conditions as traders pushed prices into uncharted territory.

While momentum remains strong, technical signals suggest the rally could be entering a phase of heightened volatility.

Bitcoin races past Google!

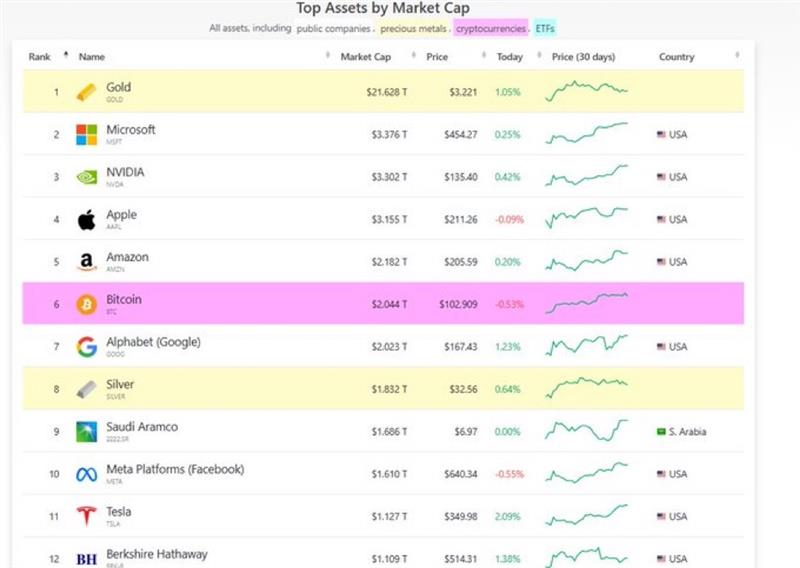

With a market capitalization exceeding $2.17 trillion, bitcoin has officially surpassed Alphabet (Google) to claim the sixth spot among the world’s largest assets.

It now ranks just behind Amazon, Apple, NVIDIA, Microsoft, and gold. The milestone places Bitcoin ahead of traditional heavyweights like silver, Saudi Aramco, and Meta.

Source: X

With mounting bullish momentum, BTC has nowhere to go but up.

What’s behind the surge?

Bitcoin’s climb past the $2 trillion market cap mark is a result of changes across the external environment.

Source: X

Having reached its first trillion faster than most assets in history, Bitcoin is increasingly seen as a hedge in a changing financial landscape.

In Japan, where inflation continues to climb, the king coin is gaining traction as a practical alternative to fiat and traditional stores of value.

In the U.S., concerns over fiscal stability have added to its appeal.

Robert Kiyosaki, author of “Rich Dad Poor Dad,” recently pointed to failed U.S. Treasury bond auctions as a red flag, suggesting that trust in government debt is waning.

“Good news. Gold will go to $25,000. Silver to $70. Bitcoin to $500 k to $ 1 million.”

His message was clear: Americans are turning to Bitcoin.

Source: X

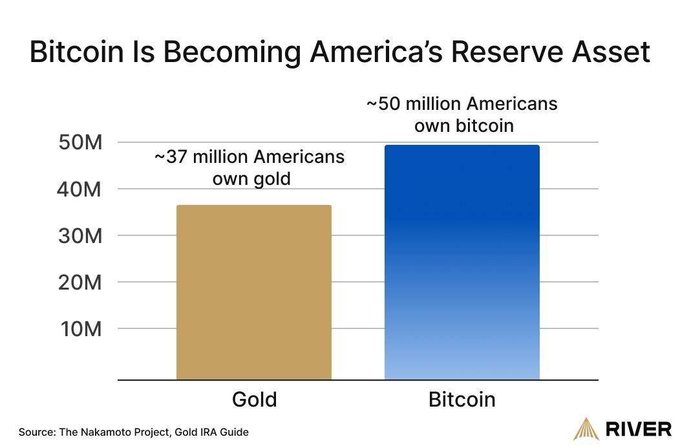

This sentiment is confirmed in data showing Bitcoin holders outpacing those accumulating gold — a notable reversal in investor behavior.

Subscribe to our must read daily newsletter