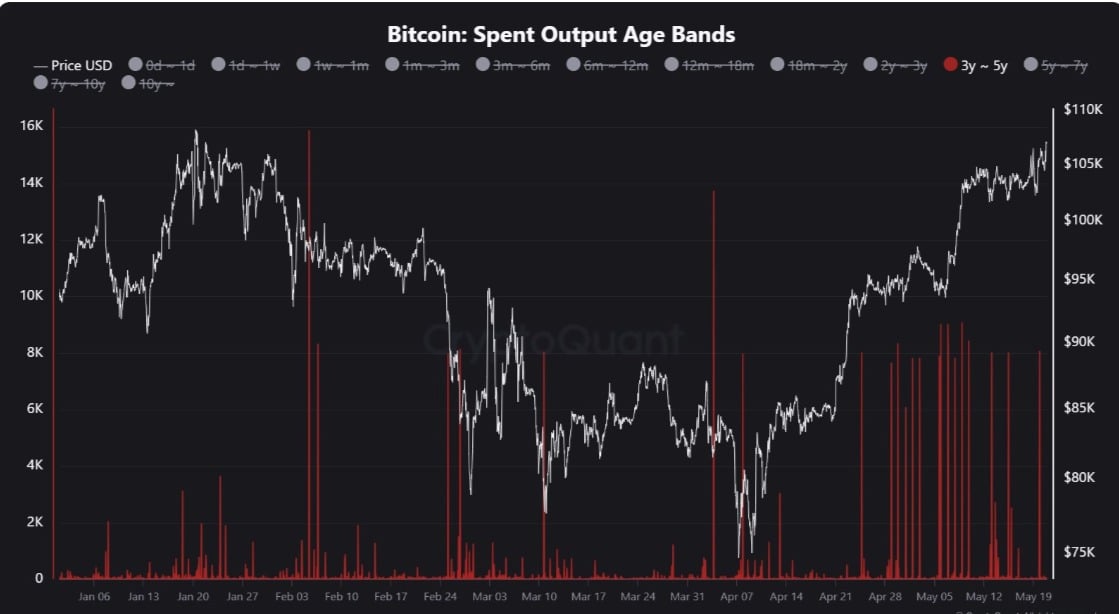

8,511 BTC On the Move: Long-Term Holders Send a Market Signal

Bitcoin’s old guard just made a statement—8,511 coins shaken loose from deep storage. Are LTHs taking profits or positioning for the next rally?

Follow the money: When whales shift holdings, markets listen. This isn’t rookie day-trading—it’s cold, calculated movement from players who’ve weathered multiple cycles.

The cynical take? Wall Street still can’t decide if this is a ’digital gold’ play or just gambling with better math. Meanwhile, the OGs keep stacking—and moving—their chips.

Source: CryptoQuant

The reactivation led to a rise in the 90-day Coin Days Destroyed (CDD). This suggests that, as Bitcoin’s price climbs, older coins are being redistributed, potentially reaching new market participants.

In the past day, CDD spiked from 5 million to 29 million, signaling fresh demand. Additionally, average dormancy fell from 42 to 33, indicating that new buyers are actively entering the market.

Source: CryptoQuant

Assessing Grayscale’s Bitcoin transfer

According to Maartunn, the latest movement of old Bitcoin appears to have originated from Grayscale, which transferred the BTC to newly created addresses.

However, it remains uncertain whether this volume reflects actual ownership changes or an internal adjustment.

Historically, Grayscale’s ETF flows have sometimes been negative, and these movements may be linked to upcoming or recent outflows.

Still, Exchange Netflow data suggests this transfer is likely an internal reshuffling, meaning the reactivated BTC has not been deposited into exchanges.

Source: CryptoQuant

Exchange Netflow shows that bitcoin has recorded three consecutive days of negative value. A sustained period of negative netflow indicates markets are seeing more withdrawals than deposits, which is usually a bullish signal.

Looking at CDD, it currently sits at 23.8 million, a decline from 29 million. This marked a 6 million drop over the last day. A drop here suggests that large holders have started to reduce their expenditure after the recent surge.

This is often interpreted as bullish, as long-term holders are starting to take a step back in the market.

Impact on BTC

While the movement of old coins can raise concerns, this recent transfer was not directly deposited into the exchanges.

The reactivated Bitcoin remains in private wallets, meaning it has not negatively affected price action. Accumulators still dominate the market, reinforcing a bullish outlook.

However, if Grayscale decides to sell these coins, it could trigger outflows and push BTC down to $104K. On the other hand, if current conditions persist, Bitcoin’s uptrend is likely to continue, potentially surpassing $107K and reaching $108K.

Subscribe to our must read daily newsletter