$3.8B Floods Into Ethereum—So Why Isn’t User Adoption Budging?

Ethereum’s treasury swells with billions, yet network growth flatlines. What gives?

The institutional money’s here—hedge funds are circling, whales are accumulating. But Main Street? Crickets. Gas fees still bite, Layer 2 onboarding feels like IKEA assembly, and let’s be real—your aunt still thinks ‘ETH’ is a typo.

Meanwhile, Wall Street’s quant jockeys are too busy overengineering derivatives to notice the adoption bottleneck. Classic finance: always solving the wrong problem with six zeroes attached.

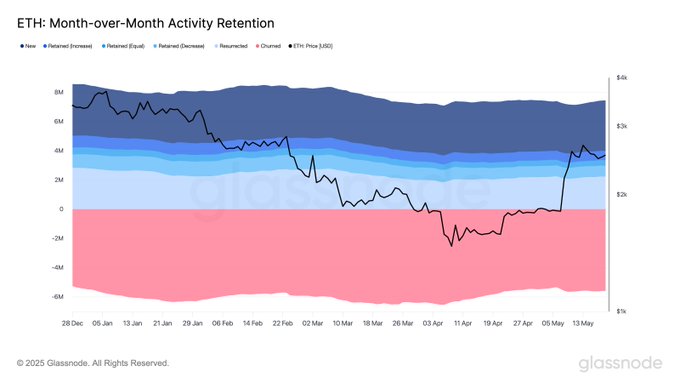

Source: Glassnode

However, L2 activity across Base, Arbitrum One, and OP Mainnet bounced back nearly 50% in May, from 8.7 million users to 13 million active addresses.

ETH’s capital inflows

Despite the sluggish L1 network activity, ETH capital inflows surged by $3.8 billion after the upgrade, as realized cap growth showed.

Glassnode added that the Realized Cap (total capital stored in the asset) broke its Q1 downtrend, marking renewed investor interest in the altcoin in Q2.

Source: Glassnode

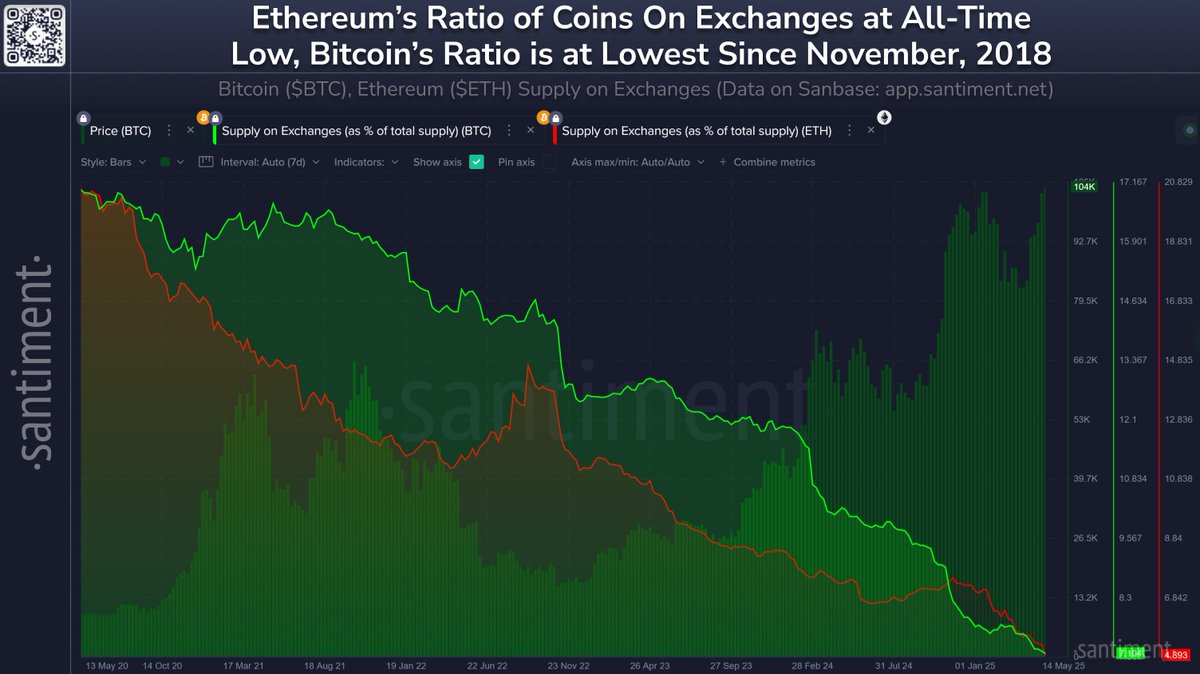

If the trend continues, the ETH price could be primed for an extra uptrend. This bullish outlook was also supported by an impending supply shock on exchanges.

Notably, ETH supply on exchanges has dropped to a 10-year low below 5%, Santiment data showed.

“Ethereum has under 4.9% of its supply on exchanges for the first time in its 10+ year history.”

Source: Santiment

There were 15.3 million fewer ETH on exchanges, underscoring a strong accumulation trend. This meant reduced sell pressure and potential supply crunch, a perfect set-up for an explosive run-up if demand accelerates.

However, there was increased profit-taking from the Q2 recovery gains, which could lead to a brief cool-off in the rally in the short term.

But market positioning remained bullish since late April and in the mid-term.

According to Options data, 25 Delta Skew was negative for the 1-week (-3.5%)and 1-month period (-4%), suggesting higher demand for calls (bullish bets) than puts (bearish bets).

Source: Velo

Simply put, the market was pricing in a higher chance of a likely upward rally for ETH. At press time, ETH traded at $2.5K, about 60% from its current cycle high of $4K.

Subscribe to our must read daily newsletter