XRP Spot ETFs Inevitable? Ripple’s Regulatory Breakthrough Paves the Way

Wall Street’s ETF machine is eyeing its next crypto target—and XRP might be next in line. After Ripple’s landmark legal clarity, analysts say a spot ETF is now a question of ’when,’ not ’if.’

The SEC’s Stumbling Block Cleared

With XRP no longer tangled in securities limbo, asset managers can finally draft filings without sweating over legal landmines. BlackRock’s Bitcoin ETF blueprint? Consider it copied, pasted, and ready for a fresh coat of paint.

Institutional Demand Simmers

Market makers are already whispering about OTC XRP volumes ticking up—classic pre-ETF positioning. Meanwhile, crypto’s favorite revolving door spins again: ex-SEC suits now lobbying for the very products they once blocked.

The Ironic Finish

Nothing accelerates financial innovation quite like the fear of missing out—or the scent of fresh management fees. Goldman Sachs will underwrite the ETF, Citadel will market-make it, and your pension fund will buy it at a 2% premium. The circle of life.

CME’s XRP ETFs outperform ETH ETFs?

That being said, the newly launched XRP ETFs have quickly outpaced ethereum [ETH] Futures ETFs in performance, signaling robust institutional interest.

If this momentum continues, XRP could challenge Bitcoin [BTC] Futures ETFs. However, reaching that level remains ambitious. BTC ETFs regularly see trading volumes in the billions.

Still, the early success of XRP products strengthens the case for Future spot ETF approvals.

Riding this institutional wave, XRP has seen a significant price rally. It jumped 1.33% to $2.33, with Open Interest surging to $4.69 billion, at press time.

Day one of trading — Details

CME Group data reveals that XRP Futures had a strong debut. On launch day, four standard contracts traded hands, each representing 50,000 XRP. This accounted for about $480,000 in notional volume at an average price of $2.40.

Most of the activity came from 106 micro contracts, each covering 2,500 XRP. Together, they contributed over $1 million in additional volume.

This trading pattern indicates that large players are entering the market. At the same time, smaller institutional participants are actively engaging with XRP Futures from the start.

Despite the SEC delaying its ruling on multiple crypto ETFs, including those tied to XRP and solana [SOL], momentum around XRP investment vehicles keeps growing.

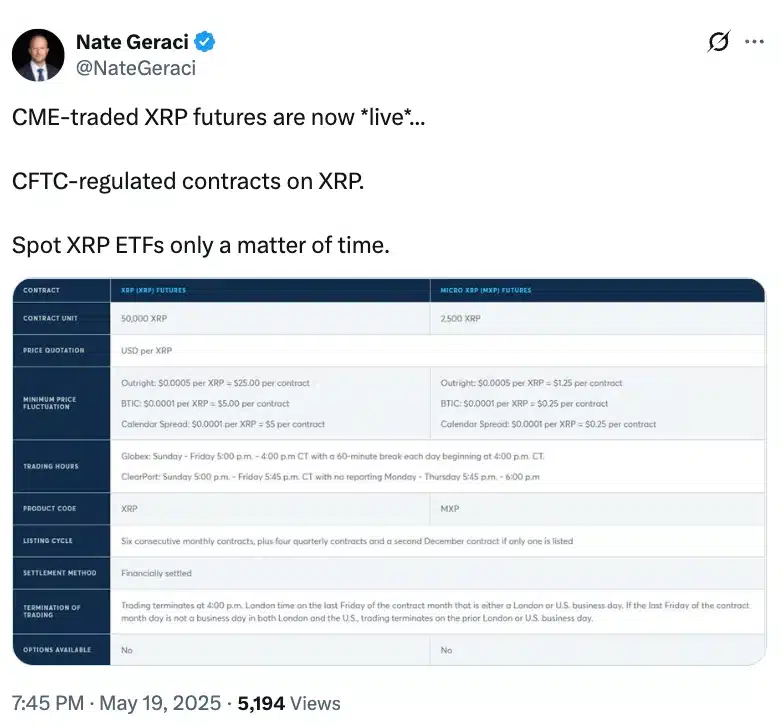

ETF Store President comments on spot XRP ETF

Remarking on the same, the president of the ETF Store, Nate Geraci, recently emphasized on X (formerly Twitter) that spot XRP ETFs are inevitable.

This highlights the significance of CME’s live, CFTC-regulated XRP Futures contracts.

Source: Nate Geraci/X

In fact, sentiment on decentralized prediction platform Polymarket also remains optimistic, with an 83% probability priced in for eventual approval.

But, with Franklin Templeton’s application now pushed to the 17th of June, the coming weeks may prove pivotal in shaping the next phase of institutional access to XRP.

Subscribe to our must read daily newsletter