TRON Outpaces Ethereum with $23.4B Daily USDT Volume – Here’s Why It Matters

Ethereum’s dominance in stablecoin transfers just took a hit—TRON now moves more USDT daily, clocking $23.4B in transactions. The blockchain wars just got hotter.

Subheader: The Fee Factor

TRON’s lower gas fees are siphoning volume from Ethereum, as traders chase efficiency over brand loyalty. Even Wall Street’s spreadsheet jockeys can’t ignore those savings.

Subheader: Network Effect or Temporary Fluke?

While TRON celebrates, skeptics note its centralized architecture—because nothing screams ’decentralized future’ like a founder with a reality TV show.

Closing jab: Meanwhile, Ethereum maximalists are too busy calculating their next staking yield to notice the competition.

Tron: The leading network for transactions

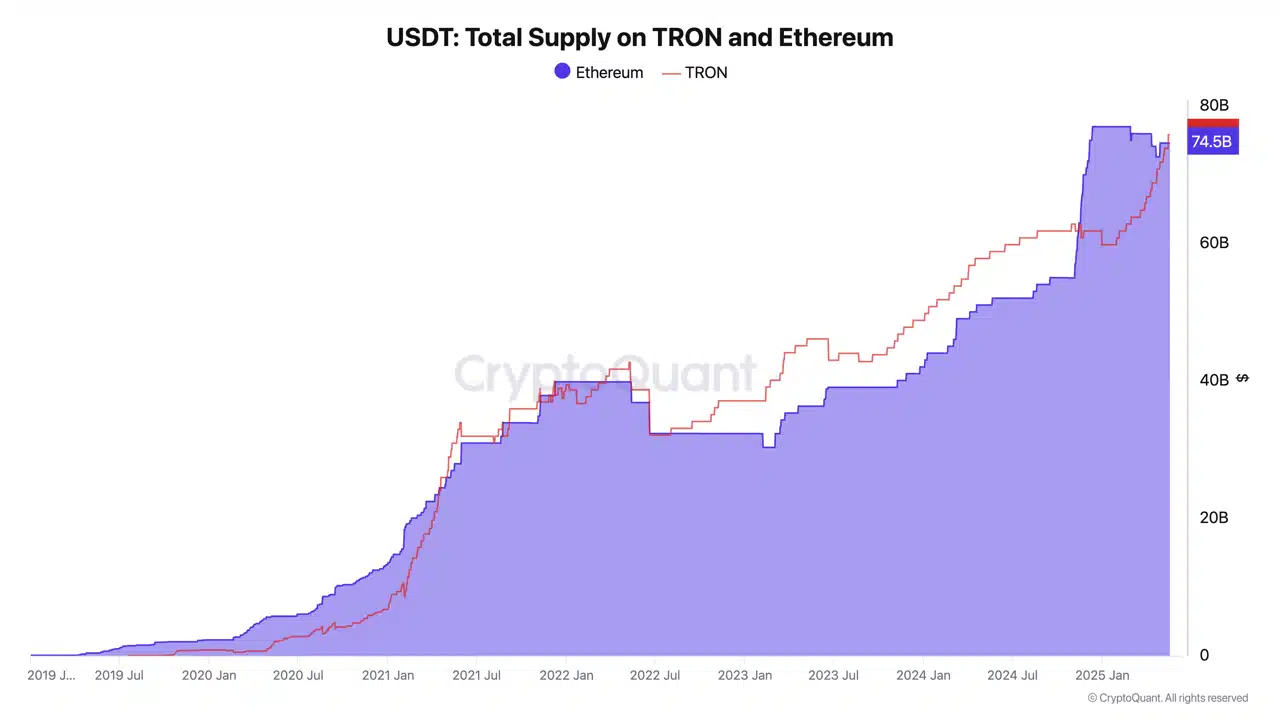

A recent report by CryptoQuant has revealed that Tron has solidified its position as the top blockchain for USDT activity, both in terms of supply and transaction volume.

Source: CryptoQuant

With over 283 million USDT transfers processed in 2025 alone, the network has become a critical infrastructure LAYER for stablecoin-based payments.

Source: CryptoQuant

TRON now holds a USDT supply of $75.8 billion, surpassing Ethereum. It also consistently processes higher daily transaction volumes, recently hitting a record $23.4 billion.

With an average of 2.4 million transactions per day, TRON’s growing adoption in retail and cross-border payments is evident. This surge is largely driven by its low fees and greater accessibility compared to legacy blockchain networks like Ethereum.

Tron is gaining steam

While Solana [SOL] continues to dominate overall network revenue, Tron has quietly surged. The network is ahead of Ethereum, posting $13.1 million in fees between 12-18th May.

Source: X

Tron’s consistent lead in transaction count and USDT volume is now translating into growing network revenue.TRX eyes higher ground

Tron’s expanding dominance in the stablecoin space appears to be lifting its native token, TRX. Over the past two weeks, TRX has climbed steadily.

The token was trading at $0.272 at press time – up over 10% in May. The RSI was at 66.21, nearing overbought territory, hinting at strong bullish sentiment.

Source: TradingView

A bounce from recent consolidation suggests that investors are beginning to price in TRX’s growing relevance. If momentum continues, a breakout above $0.28 could open doors to multi-month highs.

Subscribe to our must read daily newsletter