Ethereum’s $6K Target for 2025: Analytics Firm Doubles Down on Bullish Bet

Ethereum’s price trajectory just got a rocket boost—one analytics firm predicts ETH will smash past $6,000 by 2025. Here’s why.

The Bull Case: Institutional Adoption Meets Scarcity

With ETFs looming and the Merge cutting supply, ETH’s fundamentals look stronger than a Wall Street trader’s espresso habit. The firm cites rising staking yields and Layer-2 adoption as key catalysts.

The Skeptic’s Corner

Sure, $6K sounds juicy—until you remember crypto analysts also predicted flying cars by 2020. But this time, the math might actually add up.

Whether you’re stacking sats or rolling your eyes, one thing’s clear: Ethereum’s next act could make Bitcoin’s volatility look like a savings bond.

ETH catalysts

The SEC has postponed its decision on staking applications for spot ETH ETFs from Grayscale and Hashdex, pushing the review period to between June and October.

But most analysts, including Magadini, believe this extra staking yield (3% per year) could be a key catalyst for demand for spot ETH ETFs, eventually rallying ETH.

In fact, the executive pointed to recent strong bullish inflows targeting $3.5K and $6K by year-end, suggesting traders are positioning for such a scenario.

“ETH block trades last week saw some very bullish FLOW in EOY December options. $3,500 / $6,000 call spreads traded for 30,000x contracts through 10 distinct trades. The total premium spent here was a little over $7 million.”

Call options are bullish bets or protection for the upside, reflecting bullish sentiment for future price action. Puts, on the contrary, refer to the opposite and downside protection, underscoring a bearish bias.

Simply put, traders expected ETH to rally between $3.5K and $6K by December 2025.

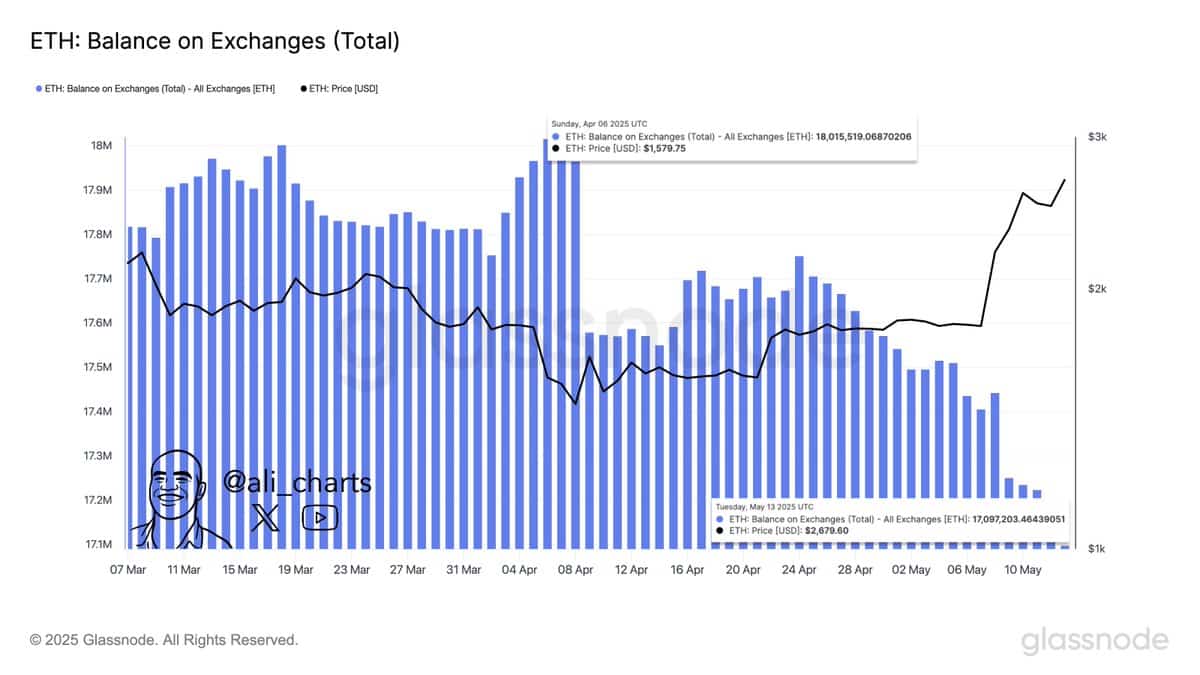

On-chain data also supported the continued uptrend thesis. Since April, over 1 million ETH (about $2.38 billion) have been moved from exchanges between April and mid-May.

This mirrored broader accumulation amid the renewed altcoin surge.

Source: Glassnode

That’s a significant reduction in selling pressure that could further boost the rally. Despite the mid-term bullish outlook, ETH’s short-term momentum weakened slightly at press time.

According to crypto trader and analyst, Income Sharks, ETH’s On Balance Volume (OBV) retreated, suggesting reduced volume that could drag the rally.

Source: Income Sharks/X

Besides, he added that the formation of a bearish head and shoulder pattern could drag ETH lower if validated.

On the daily price chart, however, ETH flashed a golden cross, a formation that sometimes precedes massive rallies.

Source: ETH/USDT, TradingView

Subscribe to our must read daily newsletter