Bitcoin’s Bull Run Déjà Vu: 2024’s Key Indicator Flashes Again—Time to Buckle Up?

Bitcoin traders are seeing ghosts—the same technical indicator that signaled 2024’s explosive rally just reappeared. Cue the sweaty palms and margin calls.

The Pattern Playbook

When this signal last hit, BTC ripped past its ATH within months. Now? The chart looks like a carbon copy—right down to the whale accumulation patterns.

But Here’s the Catch

Macro conditions aren’t 2024’s cheap-money paradise. The Fed’s still playing inflation whack-a-mole, and crypto’s favorite bagholder—the retail trader—is busy losing shirts on meme stocks.

History doesn’t repeat, but it rhymes. Whether that rhyme spells ’moon’ or ’doom’ depends on who’s holding leverage when the music stops.

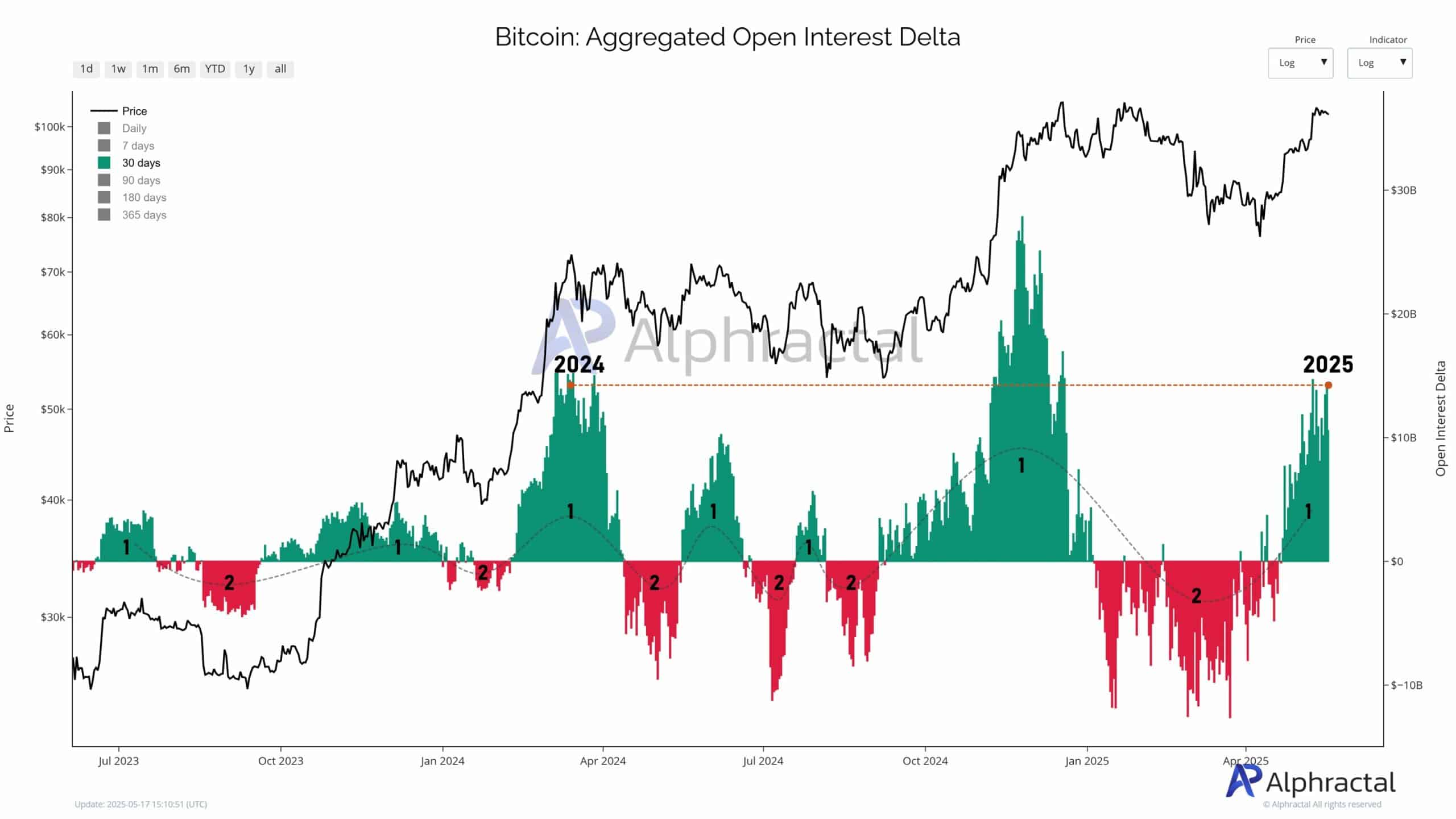

Two clear phases are playing out

The Open Interest (OI) cycle has generally been explained by analysts as having two phases. Phase 1 is marked by a rapid accumulation of positions—this usually shows a positive Delta.

And then Phase 2, where the positions begin to unravel, reversing the Delta into being negative. This back-and-forth process shows a rhythm of leverage and sentiment.

Source: Alphractal

At the time of writing, data from Alphractal shows we may be entering another Phase 1. And like in previous bitcoin bull runs, the pace and form of this trend are being observed.

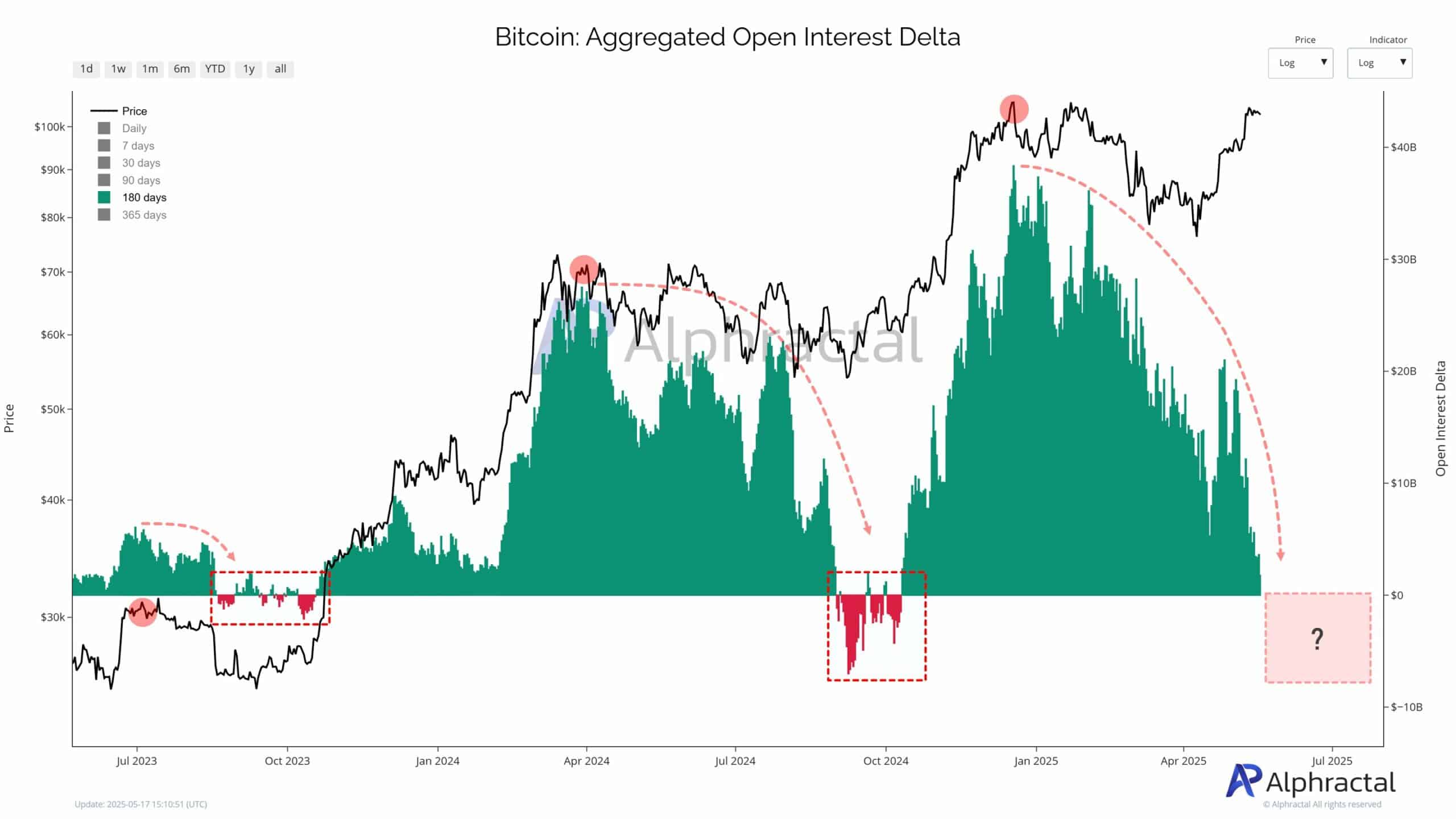

What the 180-day Delta reveals

Looking beyond the short term, the 180-day OI Delta is more informative.

In the past, sudden drops in Bitcoin Delta foreshadowed massive liquidations. These events tend to soak through over-leveraged long positions. Interestingly, they often coincide with market bottoms.

At press time, the 180-day Delta hovers just above zero. If it flips red, it could mark the start of another accumulation phase.

This transition is often where large investors begin quietly loading up.

Source: Alphractal

Bitcoin whales are following a familiar pattern

Over the past two years, similar Delta shifts have preceded major Bitcoin rallies, notably in October 2023 and early 2024. During those periods, aggressive OI spikes signaled strong upward momentum.

However, this time, the pattern has changed. OI has not surged as sharply, suggesting that large players are adopting a more cautious approach.

This behavior aligns with how whales typically operate—they drive market momentum but withdraw strategically, making their movements important to watch.

Subscribe to our must read daily newsletter