Solana’s Q1 Performance Was All Gas—Now the Market Waits for SOL’s Price to Ignite

Solana’s network activity exploded in Q1—developer adoption surged, NFT volumes spiked, and meme coins flooded the chain. But SOL’s price barely budged. Can the token catch up to its own hype in Q2?

The Bull Case: Fundamentals vs. Price

Transaction volumes hit record highs, yet SOL remains 60% below its ATH. Some call it lagging price discovery; others whisper about overhyped ’usage’ metrics masking speculative frenzy.

The Cynic’s Take

Wall Street’s old adage applies here too: ’Revenue is vanity, profit is sanity.’ Solana’s ’activity’ won’t matter until it translates into sustained demand for SOL—not just gas-fee arbitrage and degenerate gambling.

Q2’s make-or-break question: Will SOL’s price finally reflect its chain’s velocity—or will this be another ’vibes-only’ rally that leaves bagholders whispering ’next cycle’?

Q1 snapshot: Record activity amid price pressure

Messari’s DEEP dive breaks down Solana’s Q1 blowout in key metrics.

Chain GDP popped 20% QoQ to $1.2 billion, while stablecoin supply rocketed 145% to $12.5 billion – USDC alone up 148% to $9.7 billion.

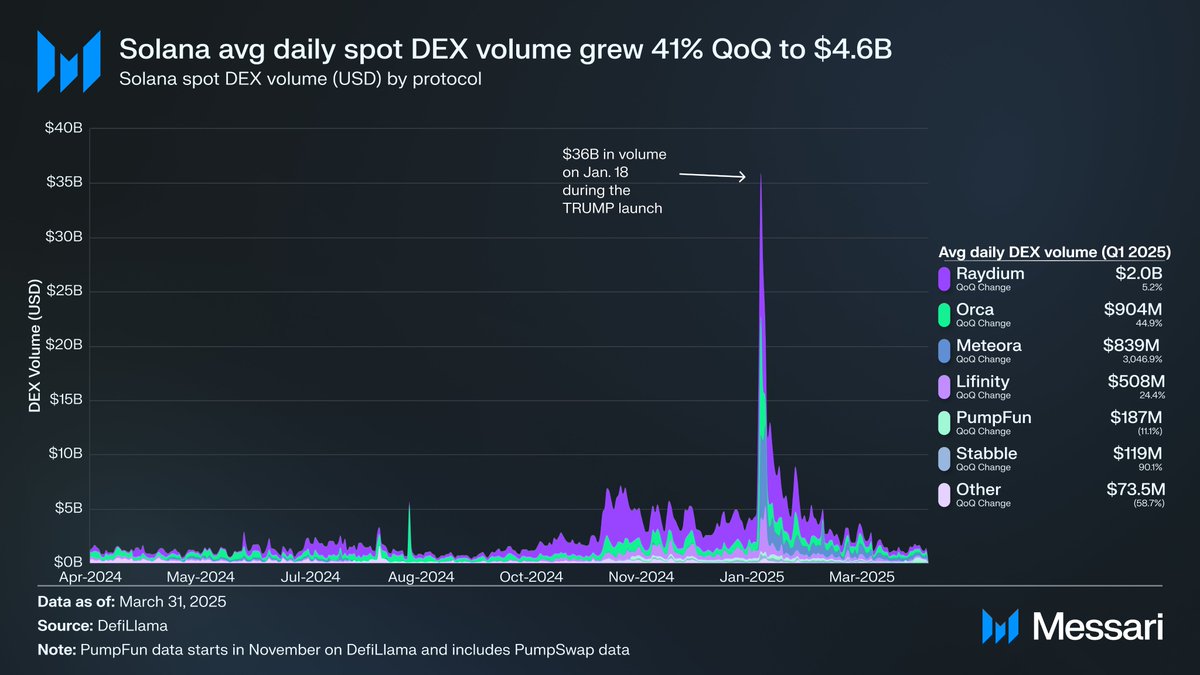

In fact, daily DEX volume hit $4.6 billion on average, spiking to a staggering $36 billion on the 18th of January — that’s more than 10% of Nasdaq’s daily trading.

Source: Messari

Big players like BlackRock and ApolloGlobal launched real-world assets (RWA). Plus, prediction markets like Polymarket added Solana support, showing the network is attracting serious capital and use cases.

This hypergrowth over 90 days confirms Solana’s devs are methodically stacking bricks for the next big DeFi and Web3 wave, reinforcing AMBCrypto’s thesis that a spot Solana ETF could be closer than the market thinks.

But let’s keep it real: Fundamentals are only half the battle.

If SOL can’t turn this on-chain strength into price alpha and reward patient holders during the FUD grind, a pullback to the Q1 floor of $95 is on the table. And the early warning signs are flashing.

LTH sell-off sparks doubts over Solana’s Q2 conviction

Solana kicked off Q2 at $124.56 and has since ripped to $167.72 – a clean 34.4% leg up.

Early dip buyers are comfortably in the green, with cost basis anchored NEAR the $95 Q1 floor, now sitting 75% above spot.

Unrealized gains are piling up, but with late longs crowding in, the setup’s looking ripe for exit liquidity.

On the 14th of May, Coin Days Destroyed (CDD) spiked to a monthly high of 1.7 billion as SOL printed $176.65.

Source: Glassnode

For context, a spike in CDD suggests older, high-conviction holders are offloading into strength.

Since that peak, SOL has shed nearly 6%, echoing past cycles where major CDD blowouts coincided with market tops.

Therefore, for Q2 to stay bullish, Solana needs more than just usage metrics. Instead, it needs a sustained bid-side conviction and fresh capital inflows to convert its operational strength into actual quarterly returns.

Otherwise, this rally risks turning into another round of distribution masked by high activity.

Subscribe to our must read daily newsletter