SUI Nears $1B Stablecoin Milestone—Fuel for a Price Surge or Just DeFi Hype?

Move over, Ethereum—SUI’s stablecoin ecosystem is quietly approaching a critical threshold. With $1B in stablecoins now in play, traders are betting big on a liquidity explosion.

The mechanics are simple: more stablecoins mean deeper DeFi pools, sharper yields, and (theoretically) higher demand for SUI tokens themselves. But will this translate to price action, or is it just another case of ’number go up’ theater?

Market watchers point to SUI’s recent infrastructure upgrades—cheaper transactions than Solana, slicker smart contracts than Aptos—as hidden leverage. Meanwhile, skeptics whisper about vaporware treasuries and the 127th ’game-changing’ L1 of this cycle.

One thing’s certain: if SUI pumps post-milestone, every VC-backed chain will suddenly ’prioritize stablecoin growth.’ Bankers love a good bandwagon—especially when they drove it there themselves.

SUI’s growing edge in strategic L1 market contention

Time and again, AMBCrypto has spotlighted SUI’s rising dominance in the L1 space, as it continues to post impressive numbers across critical on-chain metrics.

From liquidity depth to user participation and DEX volumes, it’s giving serious competition to legacy blockchains that once held near-monopolistic control over Core network fundamentals.

Now, with its stablecoin supply breaking through the $1 billion barrier, SUI is loading up even more dry powder. Hence, intensifying the competition and setting the stage for a heated showdown in the L1 space.

Source: DefiLlama

As the chart above shows, USDC dominates the stablecoin landscape on SUI with a 70.55% share. These stablecoins aren’t just inert reserves. Instead, they’re capital in waiting.

The 13.54% weekly jump in SUI’s stablecoin market signals a risk-off pivot, but when the market environment shifts back to risk-on, that sidelined liquidity could flip active.

Hence, igniting swaps, LP inflows, and Leveraged positioning. With that kind of liquidity primed for activation, SUI looks poised to challenge the $4 resistance.

Consequently, opening the floodgates to price discovery and putting a fresh all-time high firmly within striking distance.

Gaining ground on real-world utility and investor ROI

Two CORE pillars underpin any high-conviction investment: Utility-driven fundamentals and asymmetric upside potential. SUI is currently firing on both fronts.

Ecosystem devs are actively scaling real-world applications, while capital allocators are taking notice — and profits.

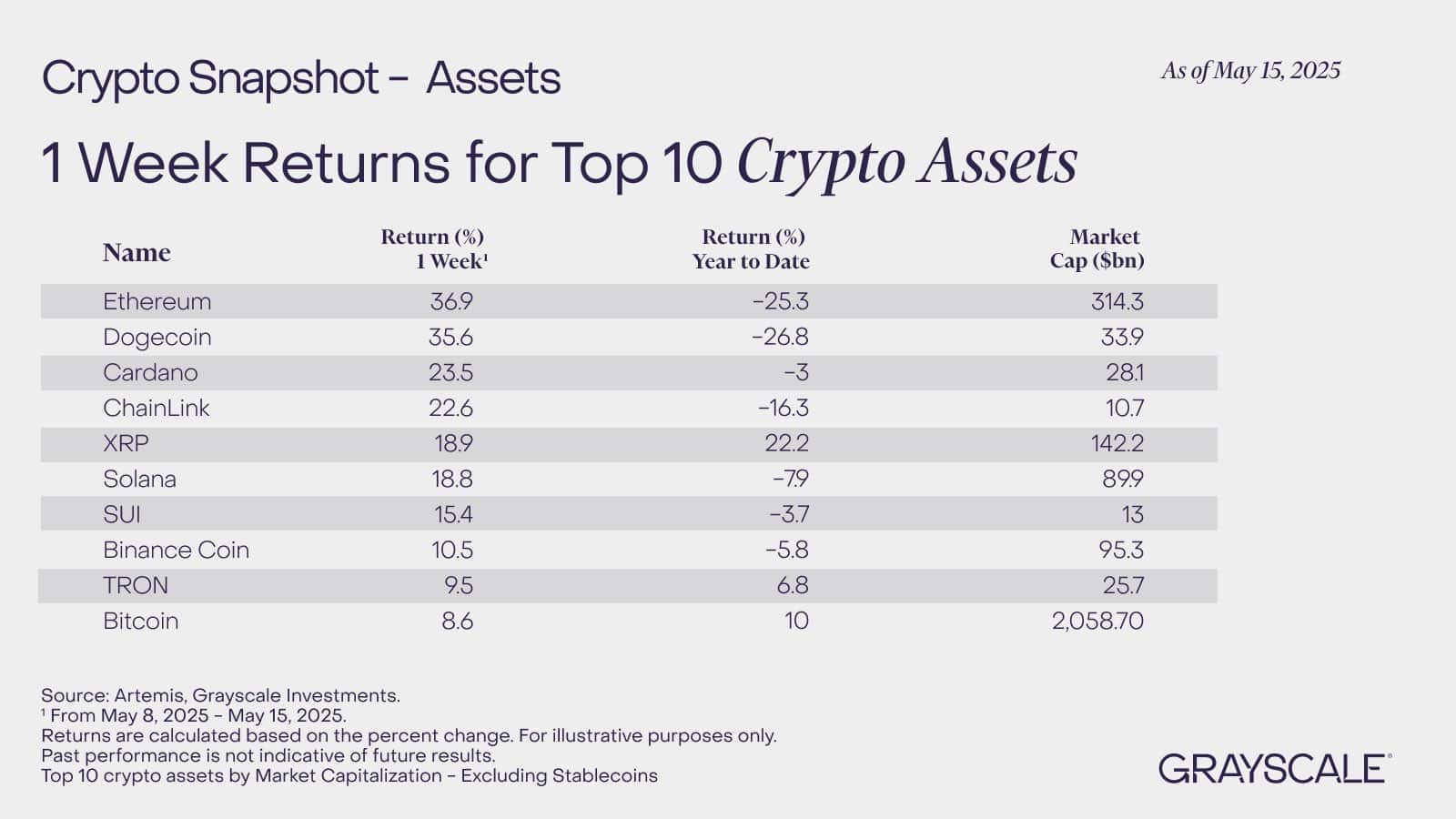

According to Grayscale’s latest snapshot, SUI ranked in the top 10 crypto assets by weekly returns, notching an impressive 15.4% gain between the 8th to the 15th of May.

That return profile outpaced stalwarts like TRX, BNB, and even BTC, while narrowing the gap with solana [SOL] — a notable feat in a saturated L1 landscape.

Source: Grayscale

What’s more, this wasn’t random upside. The performance came as Bitcoin [BTC] tagged a local high at $105,755, triggering a wave of rotational capital into high-beta alt L1s.

Coupled with strong sidelined liquidity, tactical capital rotation, solid on-chain utility, and bullish ROI signals, SUI’s recent pullback looks more like a healthy consolidation than a breakdown.

Long story short: This dip feels more like a quick breather than a breakdown. Keep your eyes on SUI — that $5 all-time high might be closer than you think.

Subscribe to our must read daily newsletter