Dogecoin Bleeds for 5 Straight Days – But Whale Activity Hints at a Reversal

Dogecoin’s price chart looks like a ski slope this week – down 23% and counting. Yet blockchain sleuths spot whales quietly accumulating DOGE while retail panics. Classic.

On-chain data shows three wallets scooping up $12M worth of DOGE during the dip. Either they know something we don’t, or this is another case of ’smart money’ playing chicken with meme traders.

Meanwhile, traditional finance pundits clutch their pearls. ’Such volatility! Much risk!’ – as if their 0.5% high-yield savings accounts are saving anyone from inflation.

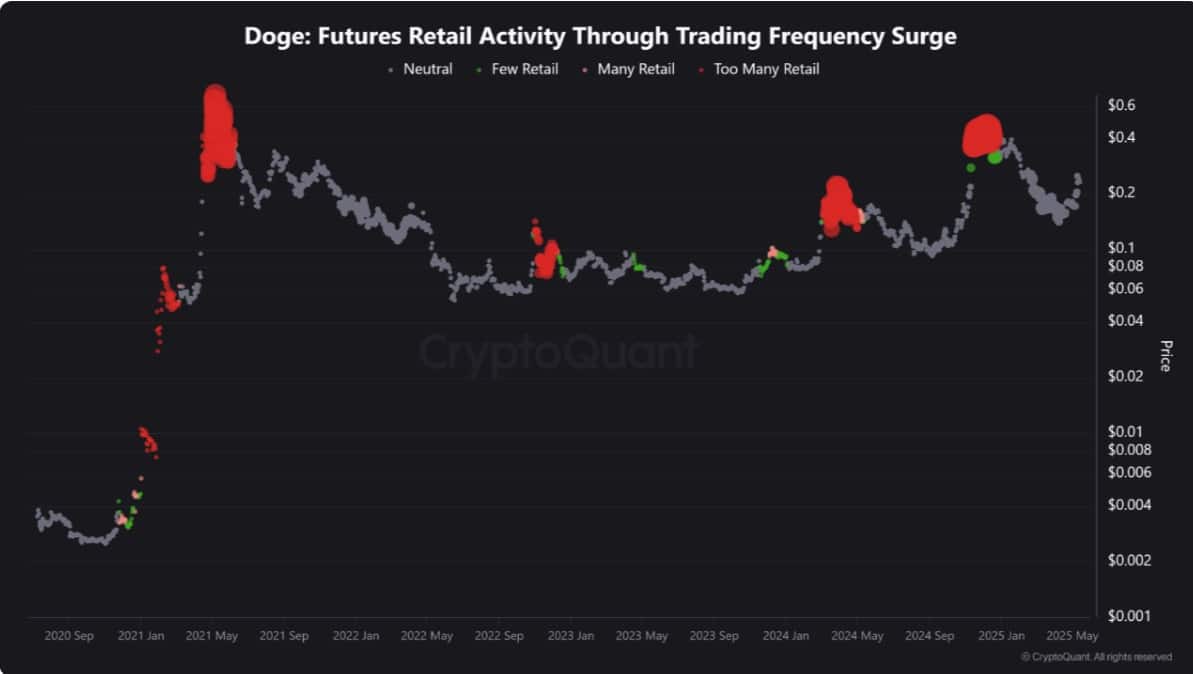

Source: CryptoQuant

The chart shows a sharp rise in high-frequency retail participation, historically a sign of market overheating.

But here’s the twist: while “too many retail” signals have often coincided with price peaks, other metrics paint a different picture this time.

Retail traders are overexposed—but smart money isn’t selling

When analyzing Dogecoin’s Funding Rate, it’s evident that most market participants are taking long positions.

Across various exchanges, except for Bybit Stable M and Binance Stable M, retail investors are primarily going long. This suggests that investors in the Futures markets are generally optimistic about Dogecoin.

These patterns of activity often emerge NEAR price peaks, indicating potential market overheating.

What DOGE charts suggest

According to AMBCrypto’s analysis, Doge is yet to reach its price top, and the recent pullback is an overall correction.

On the contrary, the memecoin is currently undervalued, and there’s still more room for growth.

Looking at Dogecoin’s MVRV Ratio, it sat around 1.03. Historically, Dogecoin’s MVRV ratio has signaled tops around 3.5 to 5.

Currently, the market is within the neutral zone, where the market is barely in profit. Thus, there are no incentives to sell.

Source: Santiment

This is even more so since the Dogecoin long-term holders are currently sitting on unrealized losses.

Moreover, the MVRV Long/Short Difference has plunged to -39.83%, indicating long-term holders are underwater. When that happens, they tend to stay put.

Source: Santiment

Of course, when long-term holders don’t sell, they absorb pressure from short-term profit-taking. That dynamic often sets the stage for recovery.

On top of that, large wallets have been buying aggressively. Whales accumulated over 1 billion DOGE over the past month. Historically, that level of accumulation only happens when prices are viewed as cheap.

Source: X

So far, on-chain metrics show no proof of a peak—only a cooling off. If accumulation continues and retail exposure eases, DOGE may revisit $0.24 in the short term.

Subscribe to our must read daily newsletter