Bitcoin Poised for $135K Surge in 100 Days as VIX Tanks—Analyst Doubles Down

Volatility’s collapsing, and one analyst says Bitcoin’s primed for a moonshot. The crypto could rocket to $135,000 within three months—just in time for Wall Street’s next ’unexpected’ liquidity crisis.

Here’s the kicker: the VIX (aka Wall Street’s ’fear gauge’) is nosediving while BTC holds steady. Classic setup for a volatility squeeze that sends traders scrambling for hard assets. Meanwhile, traditional finance keeps pretending stablecoins are the real risk—ignore those repo market tremors, folks.

Pro tip: When the VIX drops this hard, something’s about to break. Bitcoin’s either the life raft or the wrecking ball. Place your bets.

Low inflation, positive macro to fuel BTC?

In an email statement, 21Shares crypto investment specialist David Hernandez told AMBCrypto,

“If this trajectory (easing inflation, nation-state adoption) continues, price targets of $200,000 by year-end now seem increasingly realistic.”

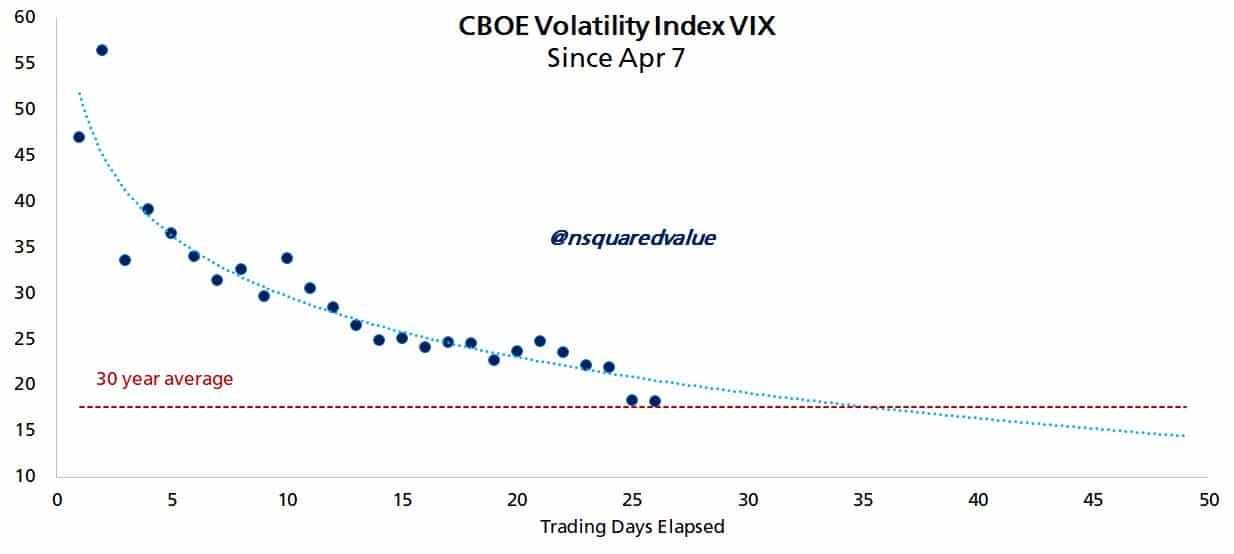

Likewise, Timothy Peterson, a BTC network analyst, noted that the US-China trade deal triggered the VIX (volatility index) to drop to a ‘normal’ 30-year average.

The VIX decline and lower inflation were a perfect set-up for a ‘risk-on’ rally, added Peterson.

“Inflation just came in lower than expected. This will be a ‘risk on’ environment for the foreseeable future.”

Source: X

For those unfamiliar, VIX tracks future price swings and, by extension, the market fear gauge.

Simply put, with the US-China tariff war out of the way, market fear (higher VIX) has been replaced by risk-on (lower VIX) sentiment.

In an X post on the 1st of May, Peterson highlighted that a potential VIX dip to 18 could push BTC to $107K in 3 weeks and +$135K in 100 days.

“A continuation of this path, and VIX

What’s next in the short term?

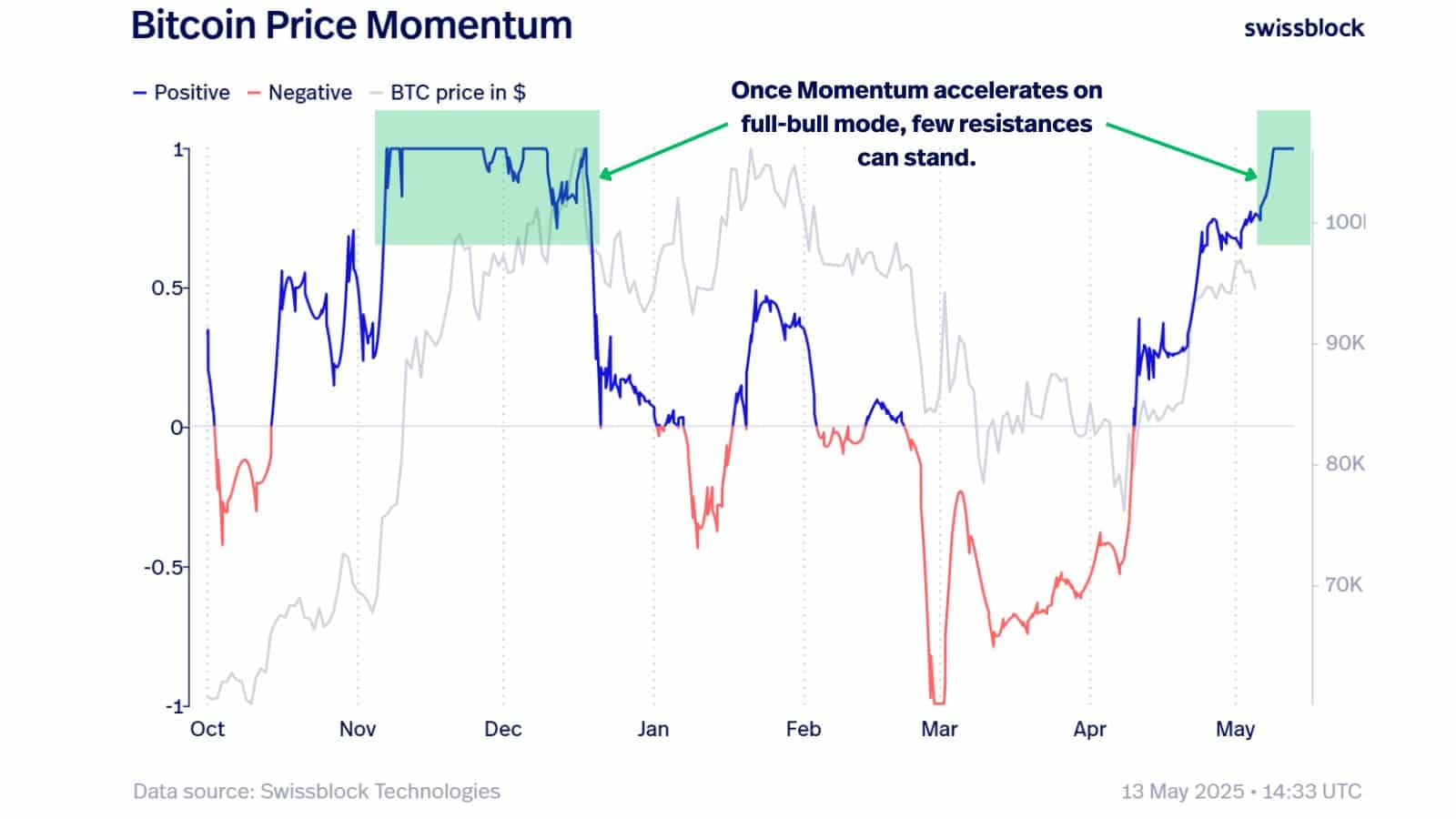

However, the jump to a new ATH may not be a smooth ride, according to a report by crypto research firm Swissblock.

The firm cited past BTC price momentum and stated a potential correction at $104K-$106K before a rebound to a record level was likely.

“Can $BTC push to uncharted territory? A reset could fuel the next leg.”

Source: Swissblock

The attached chart showed that BTC was in full bullish momentum, but current levels also marked a retracement in the last November-December rally.

But True MVRV, a valuation metric that flagged early and late 2024 local peaks and bottoms, disagreed with the Swissblock outlook.

Source: CryptoQuant

The metric’s reading was at 1.7, slightly far from the potential local peak level of 2. In other words, BTC still had room for growth before a likely massive pullback.

On the Options market, traders positioned themselves for either scenario.

In the past 24 hours, $95K put options (bearish bets) were the largest by trading volume, while calls for $105K and $115K (bullish bets) ranked second and third.

Put differently, traders expected BTC to hit $115K in May but were prepared for a potential dip to $95K.

Source: Deribit

Overall, the positive macro environment could fuel further risk-on sentiment and push BTC to a new ATH. However, there were still chances of BTC dipping below $100K.

Subscribe to our must read daily newsletter