XRP Open Interest Surges 42% – Bullish Momentum or Another Trader Delusion?

Futures markets just lit up with a 42% explosion in XRP open interest—the kind of spike that either signals a rocket launch or yet another ’Wolf of Wall Street’ cosplay by leveraged degenerates.

Breaking Down the Bets

Deribit and Bybit data shows traders piling into XRP contracts like it’s 2017 again. Liquidations loom if this turns into another ’buy high, panic low’ circus.

The Institutional Whisper

Some desk jockeys claim hedge funds are quietly accumulating—but let’s be real, these are the same geniuses who thought Terra was ’stable.’

Bottom Line: Either Ripple’s legal wins finally matter, or we’re watching the prelude to a spectacular margin call bloodbath. Place your bets—just keep the ambulance on speed dial.

XRP Open Interest climbs sharply as conviction returns

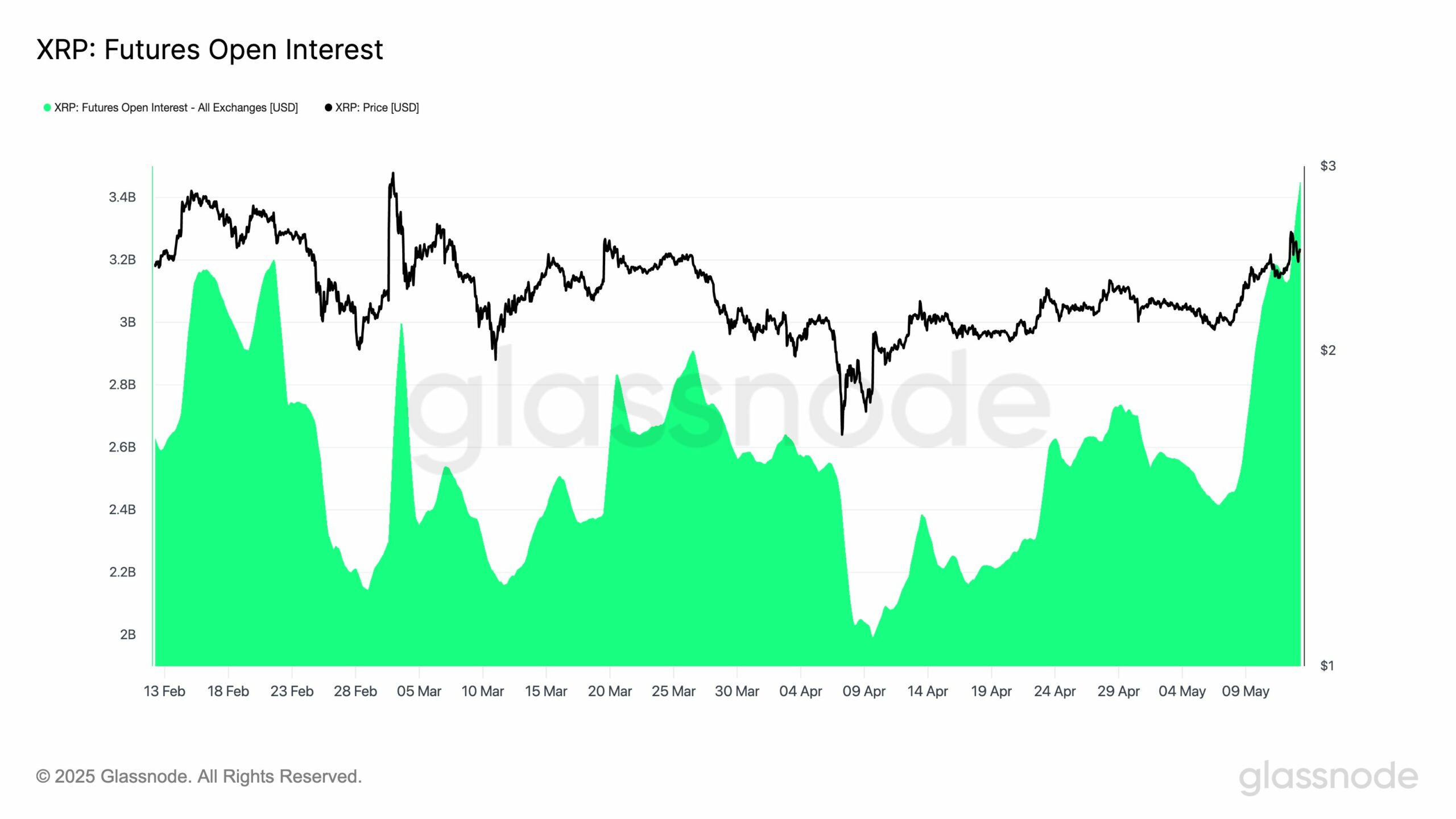

Futures OI on XRP surged by over $1 billion in the last week, rising from $2.42 billion to $3.42 billion — a 41.6% increase.

This aggressive spike reflects renewed directional conviction, as it coincided with a price rebound from $2.14 to $2.48.

Naturally, this reflects growing directional conviction. However, when OI rises without a spike in FR, the risk of overcrowded longs increases.

Still, at this stage, traders appear to be positioning for sustained upside.

Source: Glassnode

Breakout confirmed, but can bulls maintain momentum?

XRP has broken out of a descending channel that had capped price action since March.

The altcoin was holding above the crucial $2.38 level, which previously acted as resistance and now serves as support.

Fibonacci projections identify $2.82, $3.01, and $3.38 as the next upside targets if bulls maintain control. However, the Stochastic RSI is currently hovering above 98, suggesting overbought conditions. Therefore, a short-term retracement could occur if momentum stalls.

Despite this risk, the absence of any major resistance clusters ahead provides bulls with an open path. The structure remains bullish as long as XRP stays above $2.38.

Failure to hold this level could invite renewed selling pressure and invalidate the breakout. Traders should therefore watch price behavior around this zone closely, especially in relation to leverage activity.

Source: TradingView

Funding Rate signals indecision beneath the surface

Despite the leverage surge, XRP’s OI-weighted FR stood at +0.0128%. That neutrality implies no lopsided positioning just yet.

Therefore, the market remains in a delicate balance — one where aggressive longs could still face a squeeze if sentiment flips.

On the other hand, neutral funding also allows room for healthy continuation, as excessively long bias has not yet formed.

Source: CoinGlass

Will XRP hold $2.38 and push higher?

Ripple’s technical breakout and sharp rise in OI reflect growing trader conviction and bullish momentum. The MOVE above $2.38 marks a critical shift in market structure, and holding this level is key to sustaining the rally.

However, the Stochastic RSI remained in overbought territory, and FR are still neutral, signaling a potential tug-of-war between bulls and bears.

If buyers continue to absorb selling pressure and maintain control above support, a push toward $3.00 becomes increasingly likely.

Subscribe to our must read daily newsletter