Bitcoin Whale Shifts $206M as BTC Defies Gravity Above $100K

Another day, another whale making waves—this time with a cool $206 million BTC transfer while the king coin laughs at the $100K ’resistance level’ like it’s a polite suggestion.

Market watchers scramble to decode whether this is accumulation or distribution—because apparently, moving nine figures worth of magic internet money requires an explanation.

Meanwhile, traditional finance bros still can’t decide if Bitcoin is a ’risk asset’ or ’digital gold’—maybe it’s both, or neither, and that’s exactly why it keeps winning.

Accumulation score flashes near-max levels

According to Glassnode, large wallets continued to lead accumulation, with those holding 1K–10K BTC accumulating a score of 0.9, almost 1, while sharks snapped up a 0.8 score.

Source: Glassnode

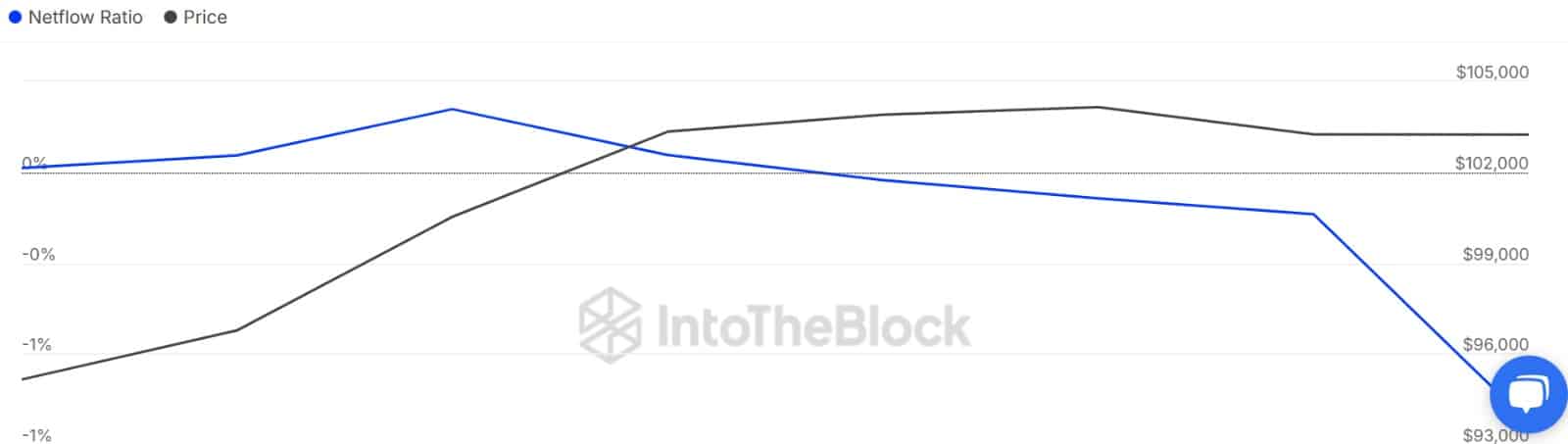

Meanwhile, whale exchange activity slowed.

For instance, ultra-large whales were at the neutral zone around 0.5. Therefore, Large Holders Netflow to Exchange Netflow Ratio continued to decline, reaching negative territory around -0.69.

Such a drop implied that whales were not sending BTC to exchanges instead, they were withdrawing extensively.

Source: IntoTheBlock

Retail exits could stall momentum

The rising whale activity, especially on the accumulation side, signals growing confidence in bitcoin as they expect prices to rise further.

Historically, growing accumulation among large players has resulted in higher prices as demand drives prices up. If the continuation of the trend holds with whale accumulation, BTC is likely to reach higher levels.

On the flip side, smaller investors were selling into strength.

Wallets holding less than $10 in BTC continued to distribute, reflecting a high selling activity from small holders as they take profit.

The profit taking from retailers has resulted in a positive Exchange Netflow, especially since ultra large wallets are also selling, although at the neutral zone.

A positive netflow suggests a higher exchange of inflows than outflows.

Source: CryptoQuant

If retail selling persists, BTC could chop between $100K and $105K for a while.

But if smaller holders cool off and ultra whales flip from neutral to accumulation, Bitcoin could break above $108K in the NEAR term.

Take a Survey: Chance to Win $500 USDT