Meta’s Crypto Gambit Throws Gasoline on Ethereum-Tron Stablecoin Battle

The stablecoin cold war between Ethereum and Tron just got hotter—and weirder. With Meta now muscling into payments, both chains face a make-or-break moment. Here’s how the chessboard shifts.

Ethereum’s fortress cracks under pressure

High fees and glacial speeds already pushed stablecoin issuers toward Tron. Now Meta’s looming entry threatens to siphon even more volume from the OG smart contract platform. Vitalik’s scaling promises need to materialize yesterday.

Tron’s dirty little secret: Centralization pays

Justin Sun’s chain dominates stablecoin transfers precisely because it sacrifices decentralization for speed. But when Meta—a company that treats user privacy like an afterthought—enters the fray, even Tron’s ’efficiency’ starts looking questionable.

The wild card no one wants

Mark Zuckerberg’s play could trigger a race to the bottom on compliance standards. Because nothing says ’financial revolution’ like watching crypto giants grovel before the same regulators they vowed to disrupt. Place your bets—the house always wins.

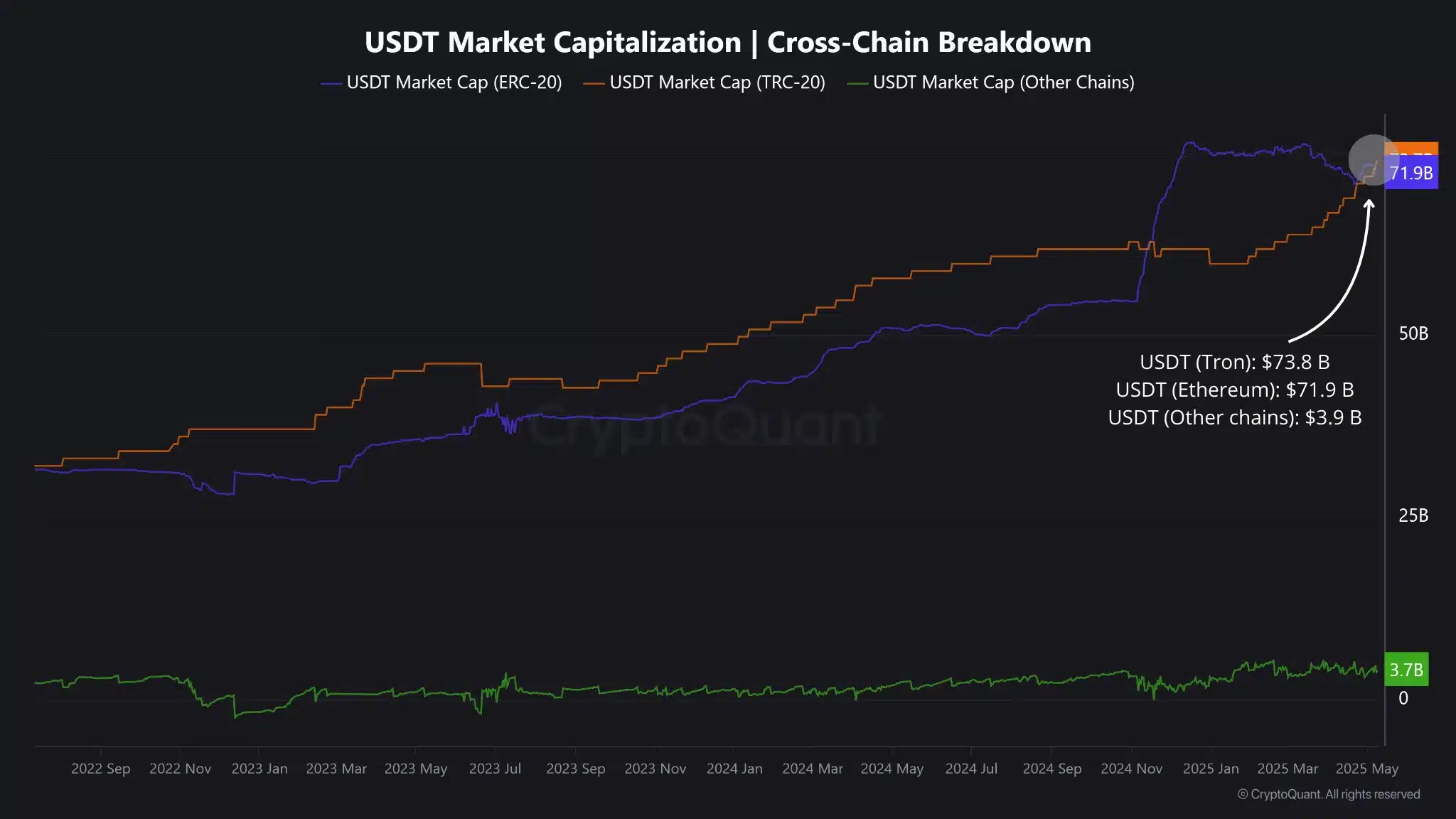

Stablecoin supply on Tron vs. ETH network

The USDT supply on TRON [TRX] officially exceeded Ethereum’s, with $73.8B on the former and $71.9B on the latter. This was a huge transition in regard to preference of stablecoin on blockchain networks.

From early 2023, the records consistently rose for Tron. Meanwhile, Ethereum’s USDT issuance sped up in late 2024 but leveled off in 2025. Tron’s rise showed stable demand, aided by its low fees and stable performance.

At the same time, ETH, even with huge DeFi activity, came under pressure. This was due to costly transactions and increasing pressure of Layer-2 solutions.

Source: CryptoQuant

Given the amount of $3.9B USDT present on other chains, the market appeared to be still largely divided between tron and Ethereum.

Positions change in terms of liquidity flows – Tron emerged as the favored go-to network for regular stablecoin transfers, while Ethereum continued to hold its grip on more complicated financial activity.

Looking forward, the trend might determine how developers and institutions allocate liquidity-hungry applications, changing the architecture of crypto’s financial system.

USDT supply surge

Meanwhile, there was an increase in USDT market cap by $6B in the last 20 days, which took stablecoin’s total to $150B. In the past, similar spikes were experienced before strong crypto rallies.

Source: CryptoQuant

Bitcoin [BTC] dominance, however, dropped, which meant that the capital injection might be finding its way into ETH and other altcoins.

This transition is consistent with Meta’s expected stablecoin launch, which may power ETH’s position in the market.

If this continues, ETH may regain lost territories, particularly if institutions are looking for alternatives to Bitcoin. Nevertheless, patterns of the past indicate that inflows may also fly back soon.

Take a Survey: Chance to Win $500 USDT