XRP Flips Tether to Claim #3 Spot—Is a Bull Run Brewing?

Ripple’s XRP just bulldozed past stablecoin giant Tether in market cap rankings—the first shake-up in the crypto top three since Bitcoin and Ethereum decided to play nice with ETFs. Traders are now eyeing the charts like Wall Street brokers staring at a Bloomberg terminal after three espressos.

Key signals to watch: On-chain activity spiked 40% post-relisting on major US exchanges, while derivatives open interest hits $1.2B. Skeptics counter that XRP’s ’utility token’ narrative still smells like the 2017 ICO hype cycle—just with better lawyers this time.

The real test? Whether institutional money cares about a token that exists primarily to help banks save $0.02 on cross-border settlements. Place your bets.

XRP reclaims #3 market cap spot

XRP has officially surpassed Tether to become the third-largest cryptocurrency by market cap, a position it hasn’t held since early 2021.

Trading at $2.49 – briefly touching $2.60 – XRP’s resurgence appears to be supported by more than just market sentiment.

Source: CoinMarketCap

A proposed Missouri bill (House Bill 594) could make the state the first in the U.S. to allow full income tax deductions on capital gains from digital assets, including XRP.

The number of XRP holders has also grown by over 11% in 2025, while increased real-world utility – like its new listing as a payment method on Travala – further boosts its narrative.

Signs of stabilization

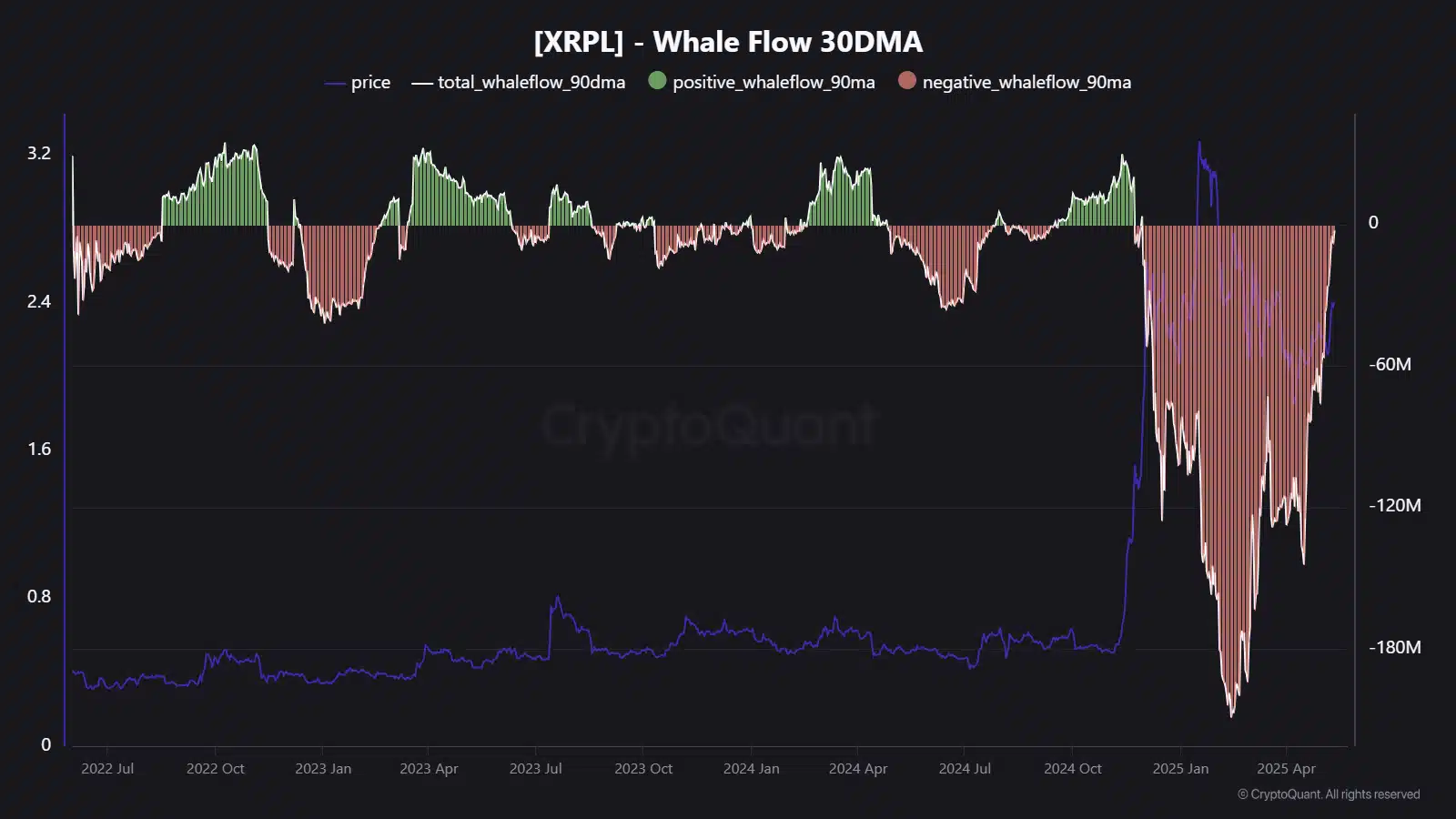

The 30-day Moving Average of whale activity is now curling upward.

Source: Cryptoquant

On-chain data shows that total whale FLOW remains negative, but its steep decline has eased significantly since March 2025.

Historically, such shifts have preceded sustained price recoveries. The chart reflects this trend, with red bars softening and nearing neutral territory.

Although the 30DMA has yet to turn green, the slowdown indicates weakening bearish pressure.

This shift may be laying the foundation for a more stable base—and possibly the next leg up.

Why the slowdown matters

XRP has faced months of sustained whale outflows, among the worst since early 2023. These outflows pressured both price and investor sentiment.

However, net flows are now stabilizing, and the price chart is showing renewed strength—suggesting cautious optimism.

Typically, when whale Flow bottoms out and starts recovering, it indicates accumulation or base-building.

In past cycles, like mid-2023, similar whale activity preceded multi-week rallies. If this current slowdown continues, it could signal a shift from volatility to consolidation.

What to watch for?

A flip of the 30DMA to green WOULD mark the first net whale inflows since late 2024 – a major shift in sentiment.

Reactivation of long-dormant whale wallets would further confirm renewed interest from large holders.

On the technical side, a sustained breakout above $2.60 with strong volume is crucial. Finally, improving liquidity and deeper order books would validate demand.

Take a Survey: Chance to Win $500 USDT