Metaplanet Outpaces El Salvador in Bitcoin Holdings—Aims for 10K BTC by 2025

Tokyo-based investment firm Metaplanet has quietly amassed a Bitcoin treasury larger than El Salvador’s national stash—proving corporate balance sheets can move faster than sovereign adoption.

The firm now holds over 2,500 BTC ($150M+) after its latest purchase, surpassing the Central American nation’s 2,381 BTC reserve. Their roadmap? Aggressively scaling to 10,000 BTC within 12 months.

Why the rush? Metaplanet’s CFO cites ’asymmetric upside’ in Bitcoin’s scarcity—though skeptics note they’re conveniently timing buys during a 30% market dip. Classic hedge fund behavior: buy low, issue a press release, let FOMO do the rest.

Meanwhile, El Salvador’s ’volcano bonds’ remain in regulatory limbo—because nothing says ’sound monetary policy’ like tying your economy to an illiquid, volatile asset while begging Wall Street for approval.

Metaplanet’s BTC plan

For comparison, El Salvador began its BTC acquisition plan in 2021, while Metaplanet jumped on the trend last year.

In fact, the Tokyo-based firm has a target of buying 10,000 BTC by the end of 2025.

With more than six months left to go and about 30% shy of the target, the company could even surpass the 10K BTC mark if the aggressive buying trend remains on track.

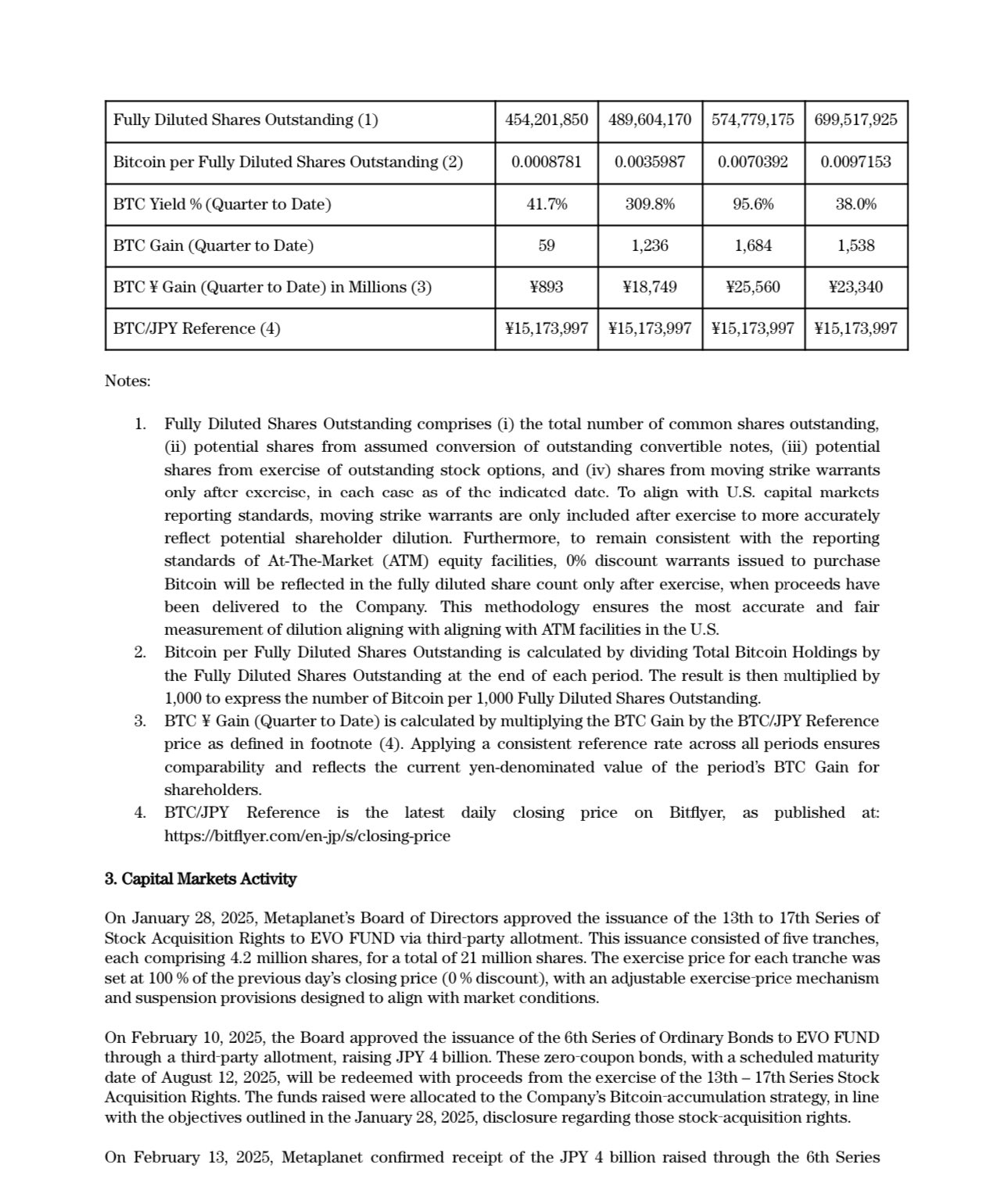

The firm uses the Strategy playbook, including the capital raising model based on debt and equity issuance.

Source: Metaplanet (Capital raising model)

Strategy (formerly MicroStrategy) has an overwhelming stash of 568,840 BTC as of the time of writing. The massive BTC exposure has allowed the firm’s MSTR shareholders to benefit handsomely.

From a year-over-year basis, MSTR has jumped 238% while BTC gained 63%. But Metaplanet share has offered better returns than MSTR and BTC.

On a yearly basis, Metaplanet increased by 1,800% while on YTD (year-to-date), the share price ROSE 58%.

On a YTD returns, MSTR rallied 28% while BTC pumped 6%, meaning Metaplanet outperformed on the price front, despite having relatively less BTC stash than Strategy.

Source: TradingView (BTC vs MSTR, Metaplanet performance)

That said, several public firms have jumped on the BTC corporate treasury bandwagon to offer shareholders better Metplanet-like returns.

According to Bitbo, public companies alone have acquired 724K BTC (worth $75B) or about 3.4% of the total BTC supply.

Overall, the BTC adoption by countries and firms (public and private) accounts for 15% of the total supply (over 3 million BTC) or $330B.

Simply put, institutional and nation-state adoption has become a significant catalyst for the BTC price.

Take a Survey: Chance to Win $500 USDT