Ethereum Stakers Back in the Green – Will Profits Ignite ETH’s Next Rally?

After months of grinding through bear-market trenches, Ethereum stakers finally see black ink. Validators now clearing profits as ETH claws back toward $4,000—but can this momentum hold?

Bullish signals flashing: The Merge’s energy efficiency play lured institutional stakers, while Shanghai upgrades unlocked liquidity. Yet crypto’s favorite ’wall of worry’ remains—regulators still eye proof-of-stake networks like tax auditors at a billionaire’s yacht party.

Key metrics to watch: Exchange reserves drying up as staking deposits swell. If ETH keeps defying gravity while Bitcoin stalls, we might just see altseason fireworks before summer’s end.

Staked ETH returns to profit

A recent CryptoQuant report has revealed that ethereum stakers are back in the green after more than two months of unrealized losses.

Since March, staked ETH had been underwater, with the realized price sitting above market levels. However, on the 9th of May, ETH crossed the $2297 mark, surpassing the realized price of – flipping stakers back into profit territory.

This recovery strengthens Ethereum’s network stability by reassuring validators and staking participants. As profit returns to stakers, it could be a sign of a larger bullish shift across the Ethereum ecosystem.

Ethereum as the biggest on-chain economy

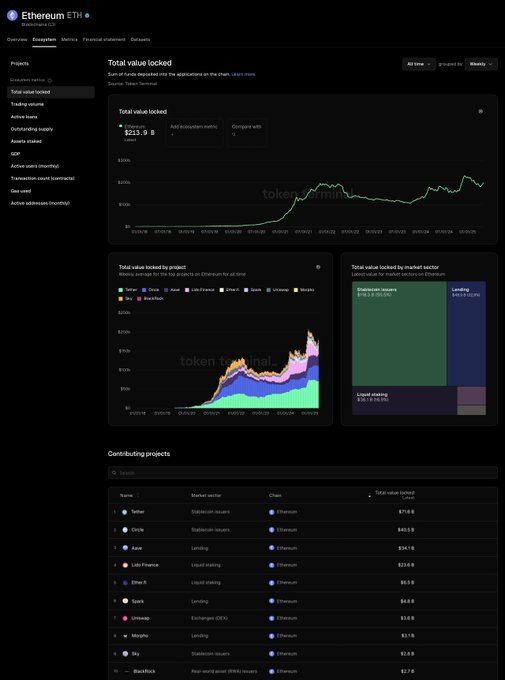

Ethereum continues to dominate as the largest on-chain economy, with over $213.9 billion in TVL across lending, staking, and other sectors.

This expansive activity shows Ethereum’s unmatched developer base and DeFi infrastructure, attracting the highest volume of app deployment and usage.

Source: X

However, the dominance isn’t without risk.

Incentives tied to scalability and app success create a real threat of app migration – especially to competing chains.

Ethereum’s new leadership has acknowledged these graduation risks and are reportedly working toward strategies that ensure value retention as apps evolve and expand.

Price momentum builds

ETH’s recent breakout pushed it above $2,550 at press time, marking a strong bullish continuation.

Technicals supported the rally – the RSI was at 80.58, indicating strong momentum but perhaps the asset is entering overbought territory.

Meanwhile, the MACD showed a widening gap between the MACD and signal lines, a bullish signal reflecting increased buying pressure.

Source: TradingView

With volume holding steady and sentiment turning optimistic post-staking profit recovery, Ethereum’s price may test higher resistances. However, overextension could lead to a brief consolidation before the next leg up.

Take a Survey: Chance to Win $500 USDT