Ripple-SEC Showdown Nears Climax: How a $50M Settlement Could Reshape XRP’s Future

The crypto courtroom drama of the decade inches toward resolution—Ripple’s $50 million settlement offer to the SEC isn’t just a check, it’s a strategic gambit with industry-wide implications.

The fine print that matters: While regulators pop champagne over the headline number, XRP holders are scrutinizing whether this ’slap on the wrist’ establishes precedent or just kicks the can down the road.

Market calculus: Watch institutional players—nothing makes TradFi hedge funds salivate like regulatory uncertainty getting priced out of a top-10 crypto asset.

The cynical take: Another day, another eight-figure settlement where lawyers emerge as the only clear winners. The blockchain doesn’t lie—legal fees are the real ’killer app’ of crypto regulation.

SEC vs. Ripple Labs ends

In a recent move, the SEC submitted a settlement letter urging Judge Analisa Torres to vacate her previous judgment against Ripple, signaling that the four-year legal saga may finally end.

On the 8th of May, the SEC formally announced its settlement with Ripple, marking a major breakthrough in a case that has cast a long shadow over the crypto industry.

On what grounds?

As per the agreement, Ripple, along with CEO Brad Garlinghouse and Executive Chairman Chris Larsen, will pay a total of $50 million to resolve the matter, far less than the $2 billion initially pursued by the SEC.

Ripple had already disclosed this settlement figure earlier in March, hinting at a shift in tone from the regulator.

With this resolution in hand, both Ripple and the SEC are now expected to jointly request a limited remand from the Court of Appeals.

They seek to finalize the remaining issues in the District Court, pending Judge Torres’ approval of the terms.

The reduced penalty is widely viewed as a strategic victory for Ripple, offering a clearer path forward for the company and setting a precedent for future regulatory disputes in the crypto space.

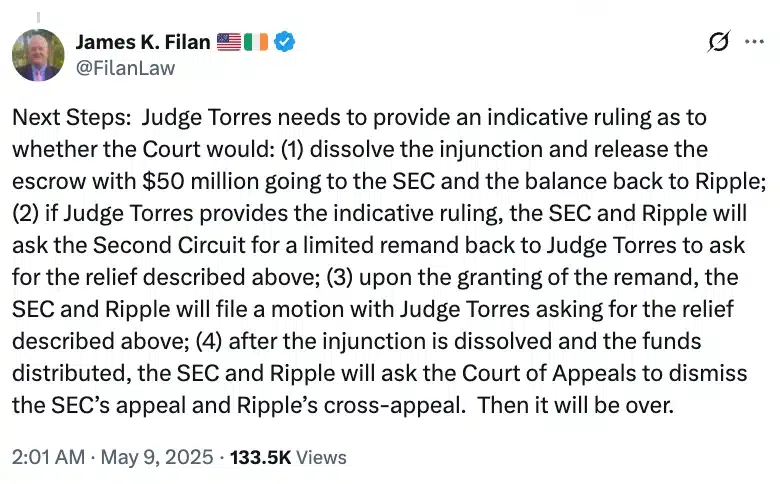

Remarking on the same, Defense lawyer James K. Filan noted,

Source: James K. Filan/X

Now, with both parties expected to formally request the dismissal of their respective appeals following a limited remand, the Ripple-SEC saga appears to be nearing its long-awaited conclusion.

Impact on XRP price action and Ripple ETF odds

Needless to say, the settlement news has already sparked a bullish wave in the XRP market, with the token surging 6.93% in the past 24 hours to trade at $2.33, according to CoinMarketCap.

Technical analysts like CasiTrades believe the momentum could continue, pointing to $2.25 as a key breakout level that XRP has been testing since January.

After a rebound from the $2.08 support, the altcoin now faces a decisive retest at this macro resistance.

Meanwhile, market Optimism is also building around the potential approval of a Ripple ETF in 2025, with odds currently pegged at a promising 75% as per Polymarket.

Therefore, as legal clouds clear and institutional confidence grows, XRP’s path forward appears increasingly defined by opportunity rather than uncertainty.

Take a Survey: Chance to Win $500 USDT