Dogecoin Buyers Stage Comeback—But DOGE Needs This One Thing to Flip the Script

Memecoins don’t die—they just nap. Dogecoin’s latest price action shows buyers creeping back in, but a true reversal hinges on clearing a critical resistance level. Until then, it’s all hopium and trader chatrooms.

Key signal to watch: If DOGE can smash through $0.15 with volume, the rocket emojis might actually mean something this time. Until then? Just another ’institutional adoption coming soon’ circus—right after these hedge funds finish their golf rounds.

Source: Coinalyze

However, this trend appears to be reversing, with buyers making a comeback.

Analyzing the Buy-Sell Volume, buyers have purchased 748.7 million DOGE in the past day, while sellers have offloaded 730 million tokens.

This results in a 14 million order imbalance, signaling that buying pressure is outweighing selling activity. A positive order imbalance suggests that buyers are currently gaining control of the market.

Source: CryptoQuant

Additionally, Futures Taker CVD and Spot Taker CVD cumulative are dominated by buyers. With buyers dominating both spot and futures markets, it signals an accumulating trend across all market participants.

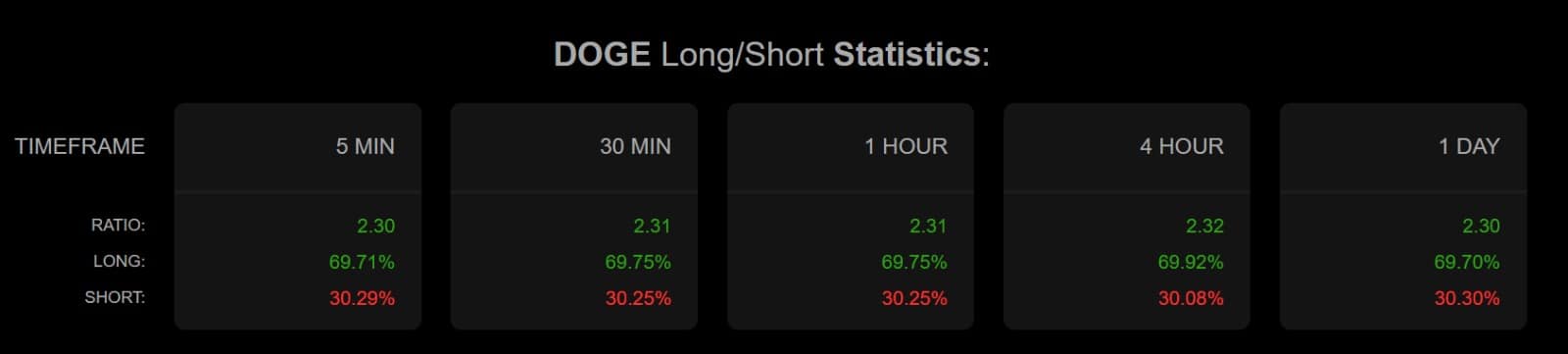

In the futures market, these buyers are entering the market and taking long positions. Inasmuch so, longs are currently dominating the market with 69.7% while shorts account for 30.3%.

When longs dominate, it suggests that most investors are bullish and expect prices to recover in the NEAR term.

Source: Coinalyze

AMBCrypto observed this trend in the spot market, as Dogecoin’s spot netflow has held within negative territory over the past three days.

A negative spot netflow suggests that exchange outflows outweigh inflows. This reflects strong accumulation behaviors in the market, with the memecoin seeing a growing demand.

Source: Coinglass

Dogecoin’s scarcity is increasing as buying pressure continues to strengthen.

The memecoin’s Stock-to-Flow Ratio has now climbed to 79, marking a weekly high. This signals that fewer DOGE tokens are available for sale, as buyers are holding onto their assets in cold storage or private wallets.

Typically, rising scarcity can drive higher prices, especially if demand remains steady or continues to grow.

Source: Santiment

What’s next for DOGE?

With buyers re-entering the market, Dogecoin may be on the verge of a trend reversal.

AMBCrypto’s analysis indicates a shift in market sentiment from bearish to bullish, as investors take advantage of the dip to accumulate DOGE before a potential price surge.

If this accumulation trend continues, Dogecoin could reclaim $0.187 and break out of its consolidation range.

However, if bullish momentum falters, DOGE may retrace to $0.165, reinforcing the importance of buyer strength in determining its next move.

Take a Survey: Chance to Win $500 USDT