Ethereum vs. BNB: The Billion-Dollar Layer 1 Cage Match for 2025

Two blockchain titans enter—only one leaves with the developer crown. Ethereum’s ecosystem moat battles BNB’s ruthless efficiency in a high-stakes war for dominance.

The Scalability Smackdown

Ethereum’s rollup-centric roadmap promises to finally fix its gas fee nightmare—if devs can wait. Meanwhile, BNB’s low-cost transactions keep sucking in users like a vacuum pump on a Vegas casino floor.

Adoption Arms Race

ETH’s first-mover advantage shows in its $50B+ DeFi empire. But don’t sleep on BNB’s growth—its centralized roots let it move fast and break things (mostly regulators’ patience).

The Verdict?

Smart money says Ethereum keeps its throne—but only if it delivers upgrades without another ’two more weeks’ delay. BNB’s play? Keep printing tokens and buying market share while TradFi isn’t looking.

Battle of the blockchains

On the 29th of April, BNB fired back with the Lorentz hard fork, unlocking a series of speed boosts across the network. Block intervals were chopped to a slick 1.5 seconds, meaning faster consensus, quicker confirmations, and way less waiting around.

On the DeFi front, BNB Chain is flexing its muscles as the fourth-largest blockchain by Total Value Locked (TVL), at a hefty $9.34 billion. Yet, it’s still trailing Ethereum’s $122 billion by a wide margin.

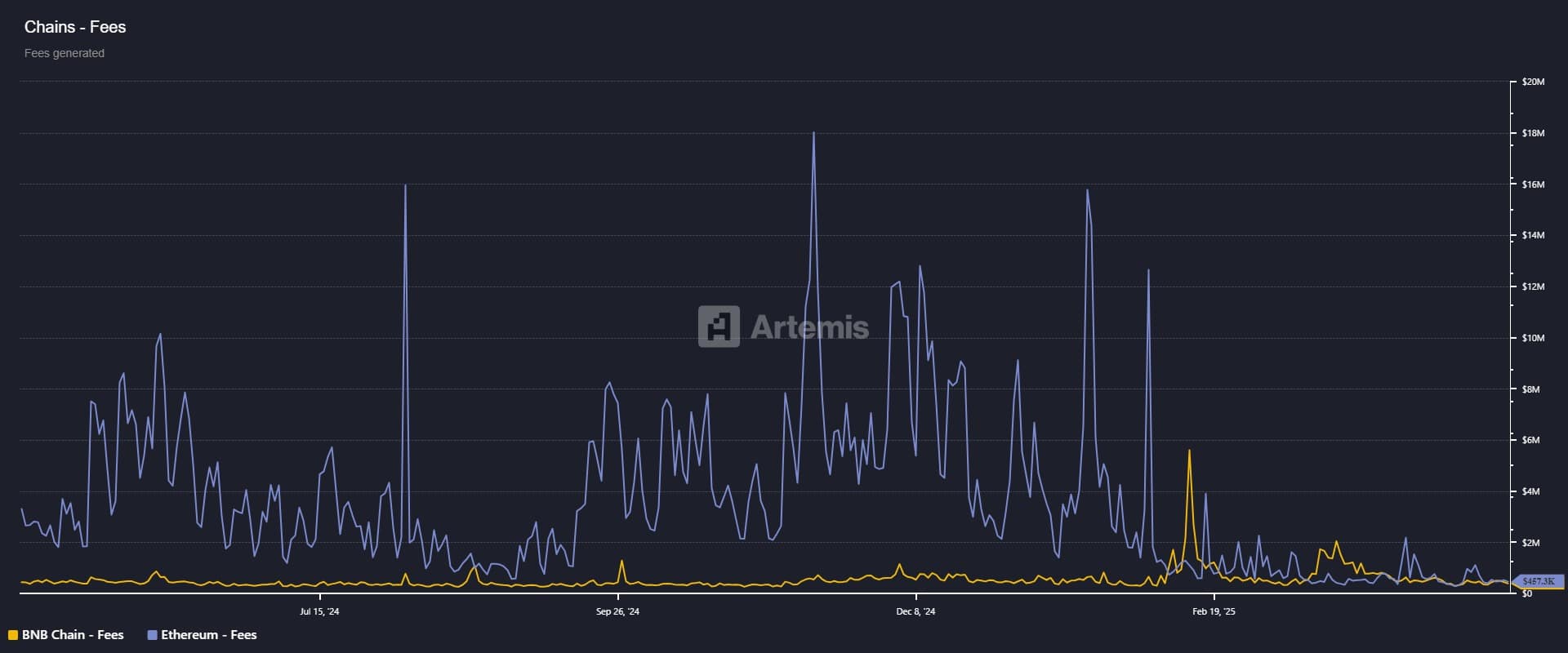

However, it has outpaced Ethereum in daily transaction fees on multiple occasions, proving that activity is thriving on its network.

Source: Artemis Terminal

To top it off, Resolv Labs has expanded into the BNB Chain ecosystem, rolling out its USR stablecoin and RLP risk-buffer token. Hence, these are fresh additions that signal growing confidence and depth in BNB’s DeFi landscape.

As for user engagement? BNB Chain is crushing it, boasting 1.06 million active addresses and comfortably outpacing Ethereum’s 376k.

BNB’s backbone is getting buff

BNB Chain isn’t just watching from the sidelines while Ethereum gears up for its next big leap with the Pectra upgrade.

In fact, the whales have spoken. Just take a look at the chart below. BNB’s spot average order size has been stacked with heavy whale orders for over a year. It’s no coincidence this lines up with its rocket ride to $720 in Q4.

Source: CryptoQuant

Sure, BNB is about 20% off that all-time high, but with whales still backing the play and strong fundamentals in place, it’s clear that BNB’s got legs to run.

So, while Ethereum’s Pectra upgrade might be the talk of the town, Binance Chain’s undeniable momentum is hard to ignore.

Both of these L1 blockchains are locked in an epic battle, and while Ethereum holds the crown for now, Binance Chain is closing the gap – fast.

Take a Survey: Chance to Win $500 USDT