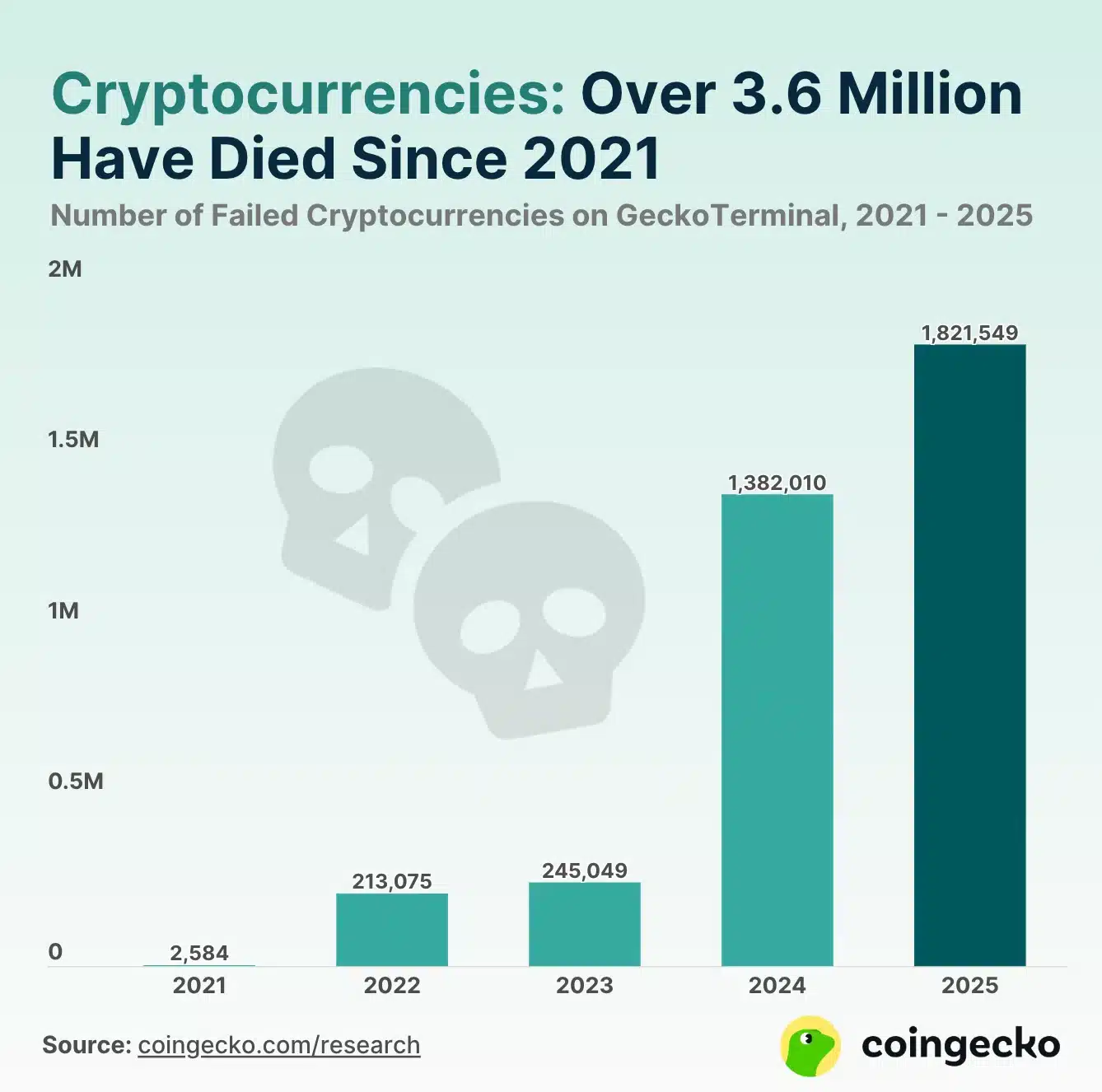

Crypto Carnage: 1.8 Million Tokens Implode in Q1 2025—Was It Inevitable?

The crypto graveyard just got crowded. A staggering 1.8 million tokens flatlined in Q1 2025—proof that Darwinism applies to blockchain too.

The trigger? A perfect storm of regulatory crackdowns, vaporware projects collapsing under their own hype, and leverage traders getting liquidated en masse. Even the ’stablecoin’ sector wasn’t immune—ironic, really.

Who’s left standing? The usual suspects: Bitcoin absorbing panic sells like a black hole, while ETH whales quietly accumulate. Meanwhile, VC-backed ’Ethereum killers’ now trade for less than their gas fees.

Funny how these ’decentralized’ ecosystems keep centralizing around two assets. Maybe Satoshi was right about human nature after all.

Source: CoinGecko

The most alarming trend emerged in early 2025, when 1.8 million tokens collapsed in just the first quarter, accounting for nearly half of all project failures.

This wave of token deaths appears closely tied to heightened market instability triggered around the time of Trump’s inauguration, raising questions about the sustainability of the crypto boom amid shifting regulatory and economic conditions.

In 2021, GeckoTerminal tracked just over 428,000 listed projects, but by 2025, that figure had surged to nearly 7 million.

How was pump.fun a catalyst for this crisis?

The dramatic rise in crypto projects can be largely attributed to pump.fun, a platform that simplified token creation. It lowered barriers significantly, leading to a surge in meme coins and hastily developed projects.

However, this growth has come with significant drawbacks. As of the 31st March 2025, 1.8 million crypto projects have failed. This marks the highest annual failure rate ever recorded, accounting for almost half of closures since 2021.

In 2024, a record-breaking 3 million new cryptocurrencies were launched. However, 1.4 million projects failed during the same year. This figure accounts for 37.7% of all closures from the past five years.

The launch of pump.fun played a key role in driving both project creation and collapse. It enabled the mass production of low-effort tokens, amplifying the failure rates. Before its launch, yearly failures rarely exceeded six digits.

Meanwhile, the broader crypto market paints a mixed picture, showing both opportunities and challenges

Overall market performance

The global crypto market cap has reached $3.01 trillion, with Bitcoin [BTC] nearing the $100K milestone. BTC was trading g at $96,311.37, at press time.

Meanwhile, the altcoin segment has experienced significant losses. Bitcoin’s dominance surged by 13% between January and April 2025. This increase reduced the altcoin market’s valuation by nearly $300 billion.

This widening gap between Bitcoin and the rest of the crypto market reflects a maturing industry. The focus appears to be shifting toward quality and resilience, away from speculative projects.

This trend suggests that the era of low-barrier meme token mania may be approaching its conclusion.

Take a Survey: Chance to Win $500 USDT