Solana Transactions Spike 62.7% in April—Is $146 the Next Stop?

Solana’s network just flexed its muscles with a 62.7% surge in transactions last month. Traders are now eyeing the $146 price target like Wall Street eyes a taxpayer bailout—equal parts hope and skepticism.

What’s driving the surge? Fee cuts, NFT mania, and DeFi degens piling in. The chain’s speed keeps it ahead of Ethereum’s gas-guzzling traffic jams—for now.

But let’s not pop champagne yet. Crypto’s a casino, and SOL’s chart looks like a rollercoaster designed by a caffeinated algo trader. Bulls see ATHs; bears see another ‘buy the rumor, sell the news’ setup.

Network activity fuels climb

Solana’s price trajectory throughout April has closely mirrored a surge in daily transactions, signaling strong network engagement.

As shown in the chart, daily transactions ROSE from around 84 million to nearly 99 million by the end of the month, while SOL’s price jumped from under $120 to above $146.

Source: Artemis

This synchronized uptrend suggests that Solana’s rally is being driven by organic usage rather than mere speculation. Notably, transaction spikes preceded several price jumps, hinting at demand fueling momentum.

The consistency of this pattern strengthens the bullish case for SOL, especially if user activity continues to accelerate into May.

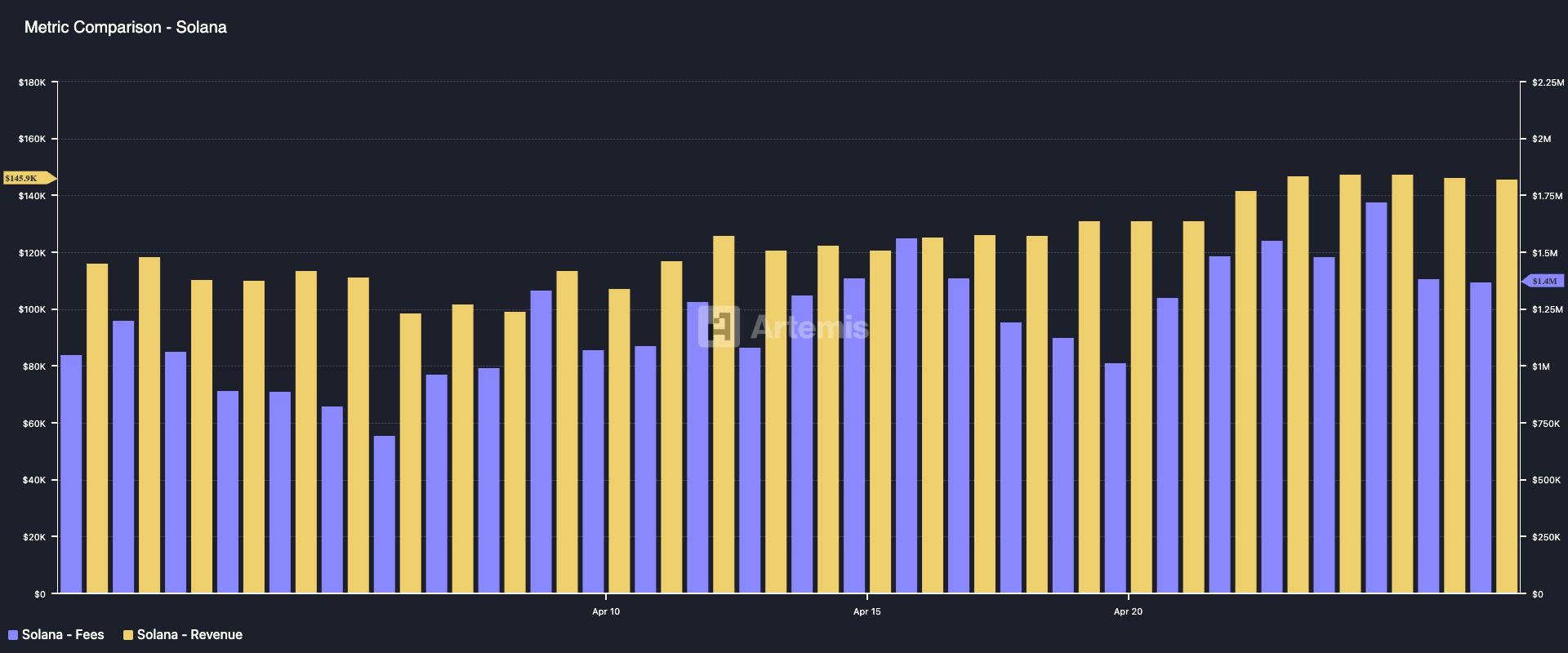

Fee growth shows monetization strength

April saw a steady climb in both fees and revenue on Solana, reflecting deeper network usage and enhanced monetization.

Daily fees rose from under $90K to around $1.4M, while revenue trended upward in parallel, hitting nearly $2M by late April.

The close alignment between fee generation and protocol revenue suggests sustainable economic activity, not just one-off surges.

Source: Artemis

This indicates not only high user demand, but also that Solana’s value capture mechanisms are functioning effectively — positioning it competitively against peers as on-chain activity continues to scale.

Open Interest points to sustained momentum

The chart revealed a notable correlation between SOL’s price (green) and Open Interest (red), with both trending upward through April. Open Interest surged alongside price — rising from approximately $1.6B to $2.3B.

This tandem movement suggests that market participants are increasingly confident in SOL’s trajectory, reinforcing the view that the rally is backed by strong capital inflows, not just spot buying.

Source: Santiment

Importantly, price pullbacks have often seen Open Interest hold steady or recover quickly — so bullish sentiment may carry through into May.

Take a Survey: Chance to Win $500 USDT