XRP Soars on ETF Rumors and Legal Optimism While Bitcoin Defends $95K

XRP rockets 18% as whispers of a crypto ETF approval collide with bullish court sentiment—meanwhile, Bitcoin scoffs at volatility and plants its flag above $95K.

The ETF Gambit Pays Off (For Now)

Speculators pile into XRP after a leaked BlackRock memo hints at groundwork for a spot ETF—never mind that the SEC still treats crypto filings like a toddler with a ’DENIED’ stamp.

Legal Winds Shift

A surprise pro-Ripple comment from a SEC commissioner sends traders into a frenzy, proving once again that in crypto, hope is a more potent fuel than actual utility.

Bitcoin’s Iron Grip

While altcoins convulse, BTC holds $95K with the serene detachment of an asset that’s survived a dozen ’existential threats’—and Wall Street’s sudden urge to ’adopt the technology’ (read: monetize it).

Funny how a 200% yearly gain turns skeptics into true believers—just ask the hedge funds now quietly long crypto between client golf rounds.

XRP ETF — Bad for traders?

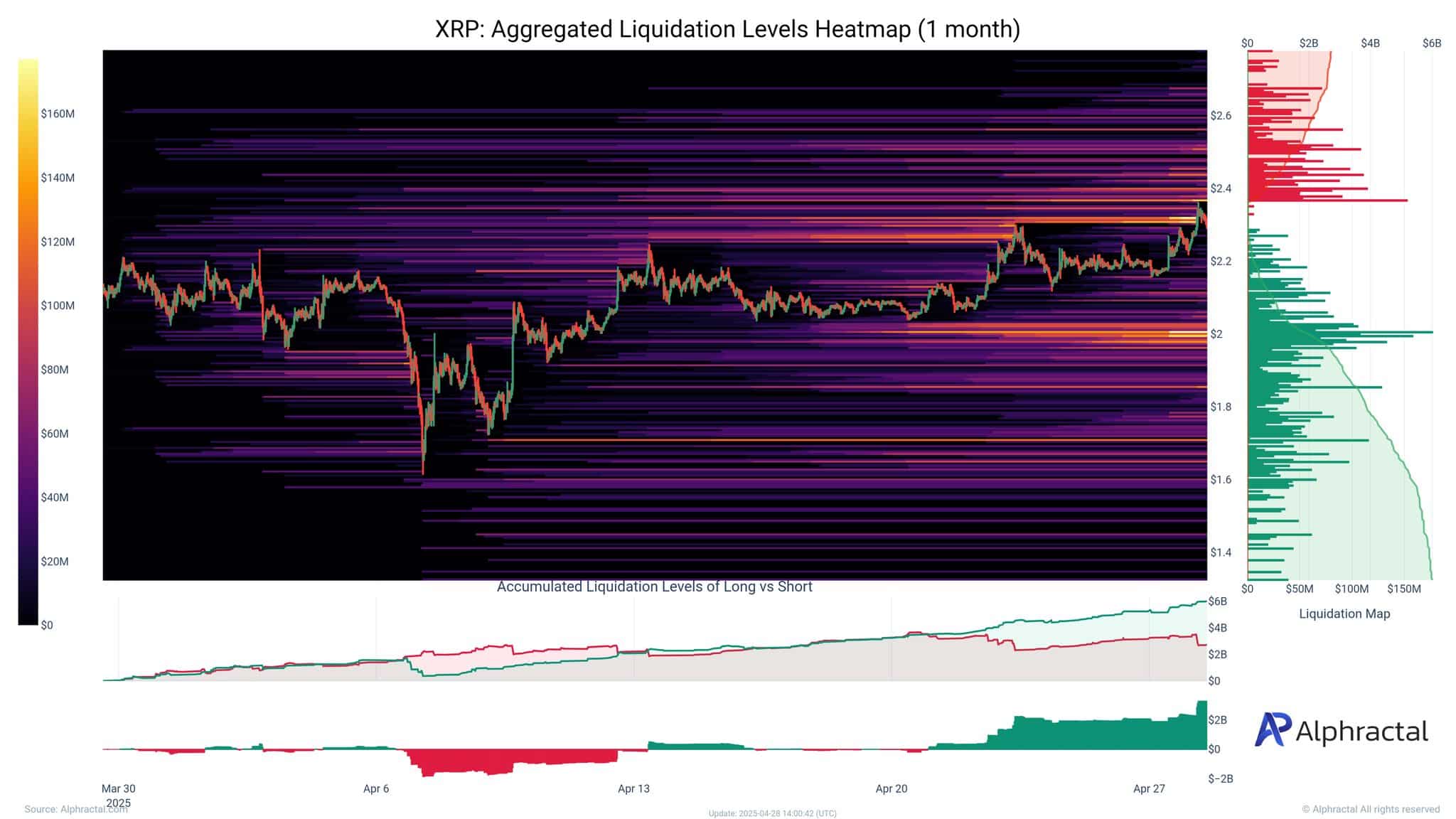

Despite the bullish outlook on the ETF front, analytics firm Aphractal was cautious, drawing parallels to BTC ETF approval. There was a massive build-up of unliquidated longs around $2 and below.

Aphractal noted that a similar scenario for BTC ETFs dragged BTC down $11K before bouncing back.

Source: Alphractal

For the unfamiliar, such massive liquidity, whether from long or short positions, tends to act as price magnets. As a result, an asset price could drop to these levels during liquidity-driven rallies.

Simply put, the firm speculated a potential dip to $2 or below when any XRP ETF debuts soon. A similar sentiment was echoed in the options market.

According to Deribit, the top volume for XRP was a put option (bearish bet) for a $1.4 target by the 30th of May.

Source: Deribit

The second most traded instrument was a call option (bullish bet) for $2.275 for the 30th of April. Put differently, large players were hedging against a potential decline below $2 next month.

On the price chart, XRP defended the $2.1 short-term support but was yet to clear the downtrend. However, price action was above the 200DMA (Daily Moving Average).

This meant bulls were in a good place but could gain a better edge when they push above $2.4.

Source: XRP/USDT, TradingView

Any sharp decline could be stopped at the $2.1, 200DMA, or $1.4 (a key November consolidation zone).

Take a Survey: Chance to Win $500 USDT