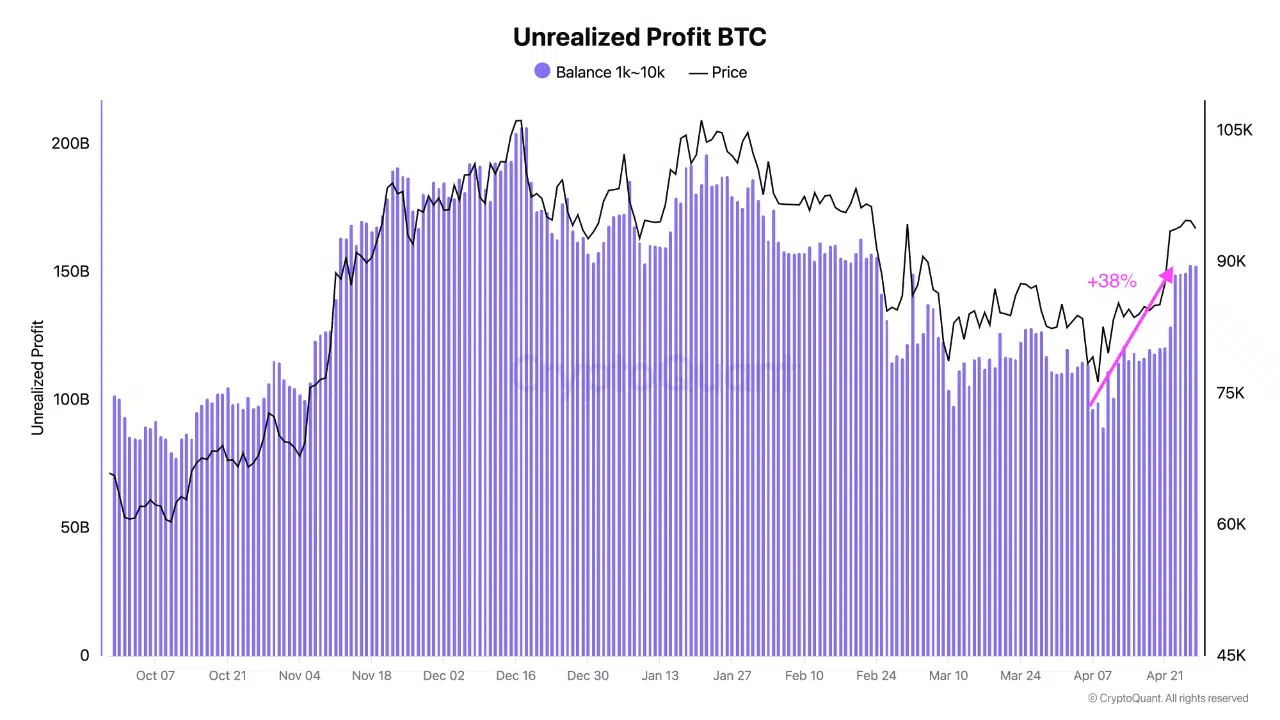

Bitcoin Whales Bank $95K Profits – Here’s the Real Trade Signal Everyone Missed

Whale wallets are cashing out at near-peak prices—but the smart money’s watching these three metrics instead.

Forget the hype cycles. While retail traders chase $95K headlines, institutional flows tell the real story. Exchange reserves just hit a 12-month low, derivatives open interest is overheating, and miner capitulation could trigger the next big move.

Wall Street’s playing a different game. As usual.

Source: CryptoQuant

Daily active addresses, transactions indicate healthy network growth

Bitcoin’s network activity has been robust, with 808.82k daily active addresses and 392.47k transactions recorded at press time. These numbers hinted at a growing level of adoption and transactional activity, supporting the bullish narrative for Bitcoin.

Now, while these metrics alone do not guarantee sustained price growth, strong network activity is often correlated with greater investor demand, which could further fuel Bitcoin’s rally.

As the number of active addresses continues to rise, the demand for BTC may climb too. This could potentially push the price higher in the coming weeks.

Source: Santiment

High MVRV ratio – What does it mean?

At press time, Bitcoin’s MVRV ratio stood at 2.37 – A high value that indicated potential overvaluation. This also suggested that BTC may be trading above its “fair” value, as measured by the average price at which coins were last moved on the blockchain.

Historically, when the MVRV ratio is high, it has often hinted at the beginning of a market correction.

The Stock-to-Flow ratio for BTC surged to 725.39 too, signaling increasing scarcity. This metric reflects Bitcoin’s diminishing supply over time – Traditionally, a long-term bullish indicator.

As BTC becomes more scarce, its value could rise, provided demand remains strong. The spike in the Stock-to-Flow ratio suggested that while Bitcoin faces short-term volatility, its long-term value proposition as a scarce asset could continue to attract investors.

Source: Santiment

Bitcoin battles key resistance – Can it break $95K?

Bitcoin has been testing critical price levels, including a resistance zone at $95k lately. At the time of writing, the RSI sat at 66.98, indicating that Bitcoin may be approaching overbought conditions. If BTC can break through the $95k resistance, it could target the next level around $105k.

However, if it faces rejection, it may test support at $85k. The Bollinger Bands underlined that BTC was near the upper range, further supporting the idea that the asset could face a pullback if momentum stalls.

Source: TradingView

Will BTC continue to rise or face a price correction?

Bitcoin’s market conditions have been flashing mixed signals. While whales are increasing their unrealized profits and network activity has been strong, the high MVRV ratio is a sign that Bitcoin may be overvalued.

The surge in the Stock-to-Flow ratio highlighted long-term scarcity – A bullish signal. However, Bitcoin’s press time price levels and technical indicators suggested that a potential price correction could be next if the resistance at $95k proves too strong.

Take a Survey: Chance to Win $500 USDT