Bitcoin Holds Its Breath as Whales Circle $150B in Unrealized Gains

Market lull masks a feeding frenzy—BTC’s price stability belies the largest concentration of paper profits since 2021. Whales now face a brutal calculus: cash out early or risk another cascade.

The ’HODL gang’ narrative gets stress-tested as on-chain data shows 47% of circulating supply held by addresses last active during sub-$30k prices. Meanwhile, derivatives traders pile into leveraged longs like it’s 2017.

One thing’s certain: when this dam breaks, the SEC will still be debating whether Bitcoin is a security or a commodity—and your portfolio won’t care either way.

The pot is boiling over, folks!

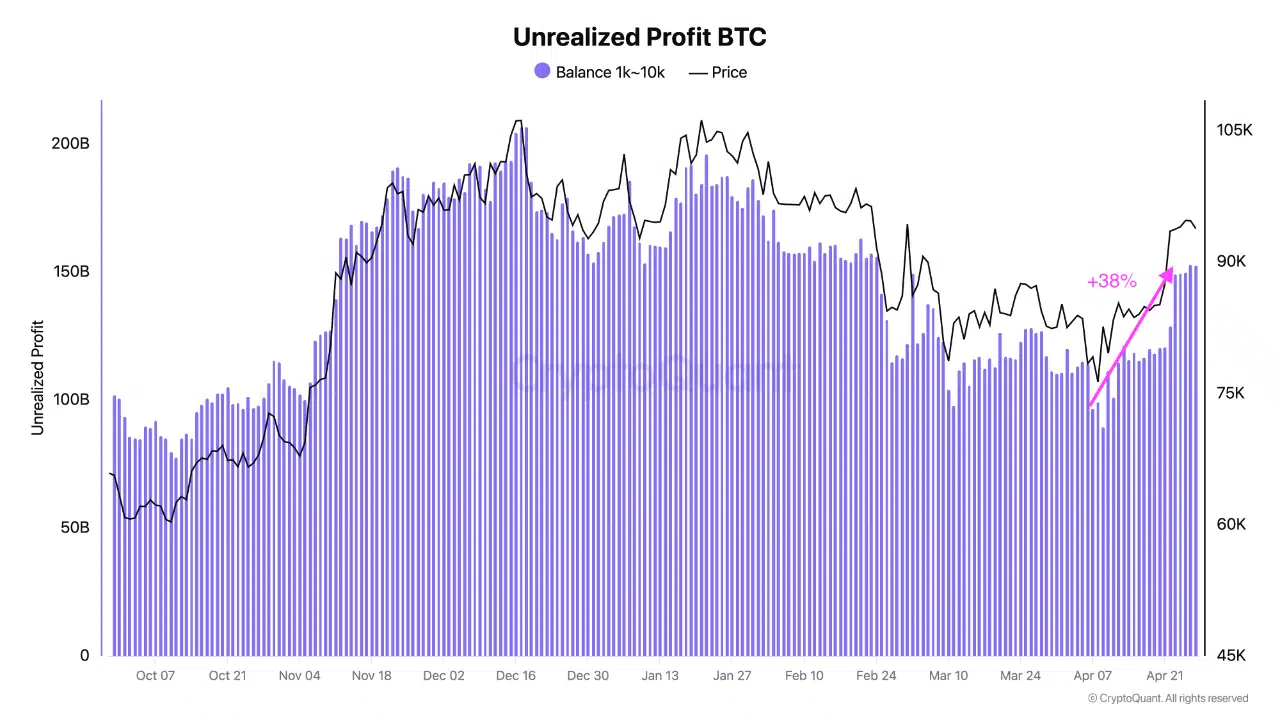

Bitcoin whales are up nearly $150 billion in unrealized gains — marking their biggest paper windfall since February. That’s a 38% jump just in April, according to CryptoQuant.

Historically, this kind of buildup doesn’t sit still. When the $200 billion level gets close, whales tend to trim the fat, triggering sell-offs that often cool down the market.

Source: Cryptoquant

It’s a classic pattern: huge profits, followed by calculated exits. While the price of BTC has surged back above $90K, the looming question is whether these unrealized gains will stay on paper, or start turning into sell pressure.

If history is any guide, the higher these profits climb, the shakier the next leg of the rally becomes.

Whale wallets multiply

The whale pod isn’t just getting richer — it’s getting larger.

Over the past two months, more than 100 new entities with 1,000+ BTC have emerged, pushing the total whale count NEAR 1,700. This uptick comes as prices rally and major players reposition.

Whether these are new deep-pocketed believers or old hands doubling down, the outcome is the same: whales are circling in greater numbers.

Source: X

It’s a sign of conviction, yes, but also a strategic setup. More whales mean more market-moving potential when the tide shifts. The quiet accumulation phase appears over; now it’s a question of timing.

Bitcoin at the brink

Bitcoin was hovering just below $95,000 at press time, showing signs of consolidation after its recent rally. The RSI was perched at 68, flirting with overbought territory, suggesting potential exhaustion.

Meanwhile, the MACD still showed strong bullish momentum, with a widening gap between the MACD and signal lines.

Source: TradingView

Daily candles are printing tight ranges, hinting at indecision. If bulls push past $95.5K with volume, $98K-$100K becomes the next logical test.

But a pullback to the $91K-$92K support zone remains in play if momentum fades. Short-term traders may want to tread carefully; momentum is high, but so is the risk of reversal.

Take a Survey: Chance to Win $500 USDT