Bitcoin Consolidates Within $82,000–$86,000 Range: Will It Break Out, Collapse, or Rally?

As of April 21, 2025, Bitcoin’s price action has entered a consolidation phase, oscillating between the $82,000 and $86,000 levels. Market participants are closely monitoring this key range to determine whether the cryptocurrency will experience a breakout toward new all-time highs (ATH), face a downward correction, or continue trading sideways. The current indecision reflects broader macroeconomic uncertainty and mixed signals from institutional investors. Analysts suggest that a decisive close above $86,000 could trigger a fresh bullish wave, while a drop below $82,000 may lead to increased selling pressure. Traders are advised to watch liquidity zones and on-chain metrics for clues on Bitcoin’s next major move.

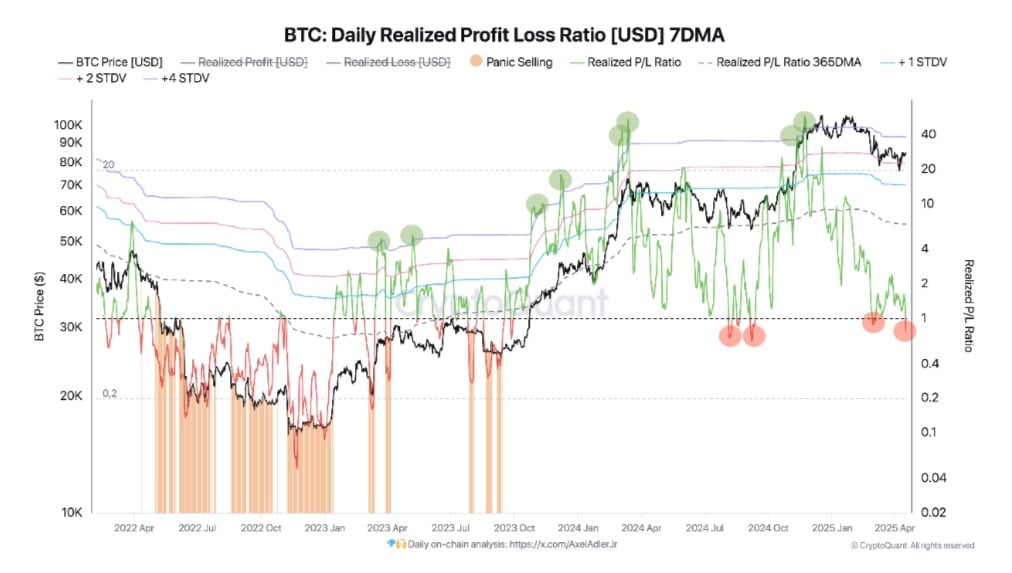

Source: CryptoQuant

These losses are mounting, especially among short-term holders. In fact, Bitcoin’s Short-term Holder SOPR has dropped below 1 to settle at 0.9 at press time.

The decline here suggests that short-term holders are selling at a loss.

Source: CryptoQuant

On top of that, Bitbo data confirmed that STHs faced Unrealized Losses. Their Realized Price stood at $92,174—far above current spot prices NEAR $84,000.

Source: Bitbo

However, it’s worth noting that the drop does not necessarily signal a full-blown capitulation but rather a phase of doubt or potential accumulation.

Looking at previous cycles, we can observe that whenever the ratio reached the +4 STDV deviation from the 365DMA, a local market top consistently formed, followed by a short-term correction during the bull phase.

With a high level of uncertainty prevailing in the markets, there is a better chance that a capitulation phase may unfold, potentially driving realized losses even higher.

Is capitulation ahead for BTC?

Although unrealized losses are dominating, investors have not turned to selling. On the contrary, investors are optimistic and expect Bitcoin prices to move higher in the near team.

Source: CryptoQuant

For instance, Bitcoin’s Fund Flow Ratio fell from 0.13 to 0.06 over four days—indicating fewer exchange deposits from retail investors.

Moreover, whale behavior echoed this restraint. The exchange whale ratio dropped from 0.51 to 0.37, implying whales were staying put—or even accumulating.

Source: CryptoQuant

What comes next?

In conclusion, although unrealized losses continue to rise, investors have yet to capitulate. As such, Bitcoin holders are hopeful and expect prices to regain higher levels.

If these sentiments can hold, we could see Bitcoin reclaim $86078. However, if STH starts to sell to avoid more losses, BTC will retrace to the lower boundary of the consolidation channel around $82800.

Take a Survey: Chance to Win $500 USDT