Canary’s Proposal for a Staked TRX ETF Fails to Ignite Market Enthusiasm: Analyzing TRON’s Lackluster Investor Response

Despite Canary’s ambitious pitch for a staked TRX ETF, the market reaction has been tepid, with TRON’s bullish investors showing little interest. This article delves into the factors contributing to the underwhelming response, including market conditions, investor sentiment, and the broader implications for TRON’s ecosystem. We explore why the anticipated demand failed to materialize and what this means for the future of staked crypto ETFs in the current financial landscape.

Source: Sec.Gov

Over the past four months, in an attempt to capitalize on a pro-crypto SEC in the United States, there has been an outpouring of submissions aimed at listing ETFs.

Since the start of the Trump administration, U.S. regulators have received multiple filings.

Amidst this ETF frenzy, Canary has filed for various altcoin ETFs including Litecoin [LTC], XRP, Hedera [HBAR], Sui [SUI], and Pudgy Penguins [PENGU].

Is an ETF the boost that TRX needs for recovery?

While it’s expected for such good news to have a positive impact on price movement, this is yet to be reflected. Inasmuch, TRON remains in a strong downtrend.

In fact, at the time of writing, Tron was trading at $0.24. This marked a 1.28% drop on daily charts. On weekly charts, the altcoin has declined by 2.8%.

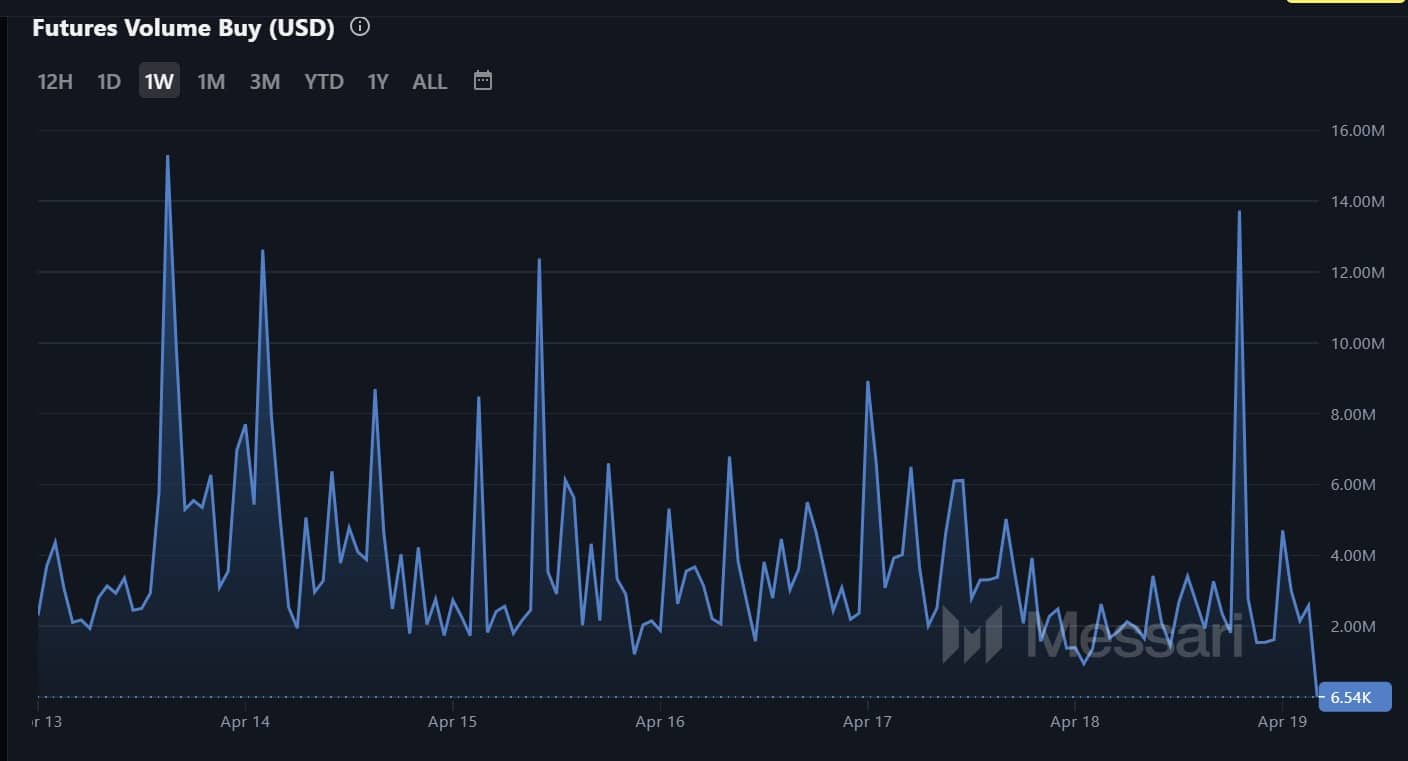

Amidst these losses is slowing demand and mounting bearish sentiments. For starters, Tron buyers have almost disappeared from the market. Futures buy volume too has declined to a weekly low of $6.5k.

Such a drop suggests that investors currently lack the motivation to believe in a potential uptrend. As such, there’s weak bullish conviction in the market.

Source: Messari

Per the Funding Rate (Volume Weighted), there has been a decline in demand for long positions, with the Funding Rate holding at a monthly low within negative territory.

When the metric is set like this, it suggests that investors are aggressively shorting Tron as they expect prices to decline.

Source: Messari

Therefore, an ETF would be a game changer for Tron and its native token. An ETF will create room for more adoption as institutional investors enter the market, leading to a higher demand.

As of now, the filing has not positively impacted TRX’s price action. If the development is felt in the market, we could see TRX reclaim $0.259.

However, if the prevailing market sentiment holds, a drop to $0.23 is inevitable.

Take a Survey: Chance to Win $500 USDT