Bitcoin vs. Gold: Investor Rejects Notion of BTC Losing Dominance

Amid ongoing debates about Bitcoin’s position relative to gold, a prominent investor has pushed back against claims that BTC is ceding ground to the precious metal. The argument hinges on Bitcoin’s unique properties as a decentralized, finite-asset store of value, contrasting with gold’s physical limitations and centralized custodial risks. Key metrics such as institutional adoption, on-chain activity, and macroeconomic hedging behavior suggest Bitcoin continues to carve its niche rather than retreat. While gold maintains historical prestige, analysts highlight BTC’s programmability, portability, and verifiable scarcity as competitive advantages in today’s digital economy. Market data shows both assets attracting capital, but with distinctly different investor profiles and use cases that diminish direct comparability.

BTC vs. gold

Source: BTC vs. gold performance, TradingView

Indeed, BTC (yellow) has a history of positively correlating with gold (cyan) after decoupling periods, as Pompliano stated.

Per the chart, BTC and gold decoupled in early November and February but became positively correlated again in December and January.

Even so, gold has outperformed BTC by 37% in 2025 per BTC/gold ratio. Although the indicator retreated to pivotal trendline support at press time, it remains to be seen if BTC could regain lost ground against gold.

Source: Source: BTC/gold ratio, TradingView

In the past few days, BTC has tightly consolidated between $83K and $85K, while the U.S. equities dumped.

Reacting to the resilience, Bloomberg ETF analyst Eric Balchunas stated,

“$MSTR up 7% YTD while $QQQ is down 10% is not something i would have predicted. I’m also surprised BTC is at $85k after all this; both good signs imo, shows toughness and counters that its just high beta version of tech.”

He added that Michael Saylor and ETFs bought so much BTC in the past 12 months that it found a stronger base than past cycles.

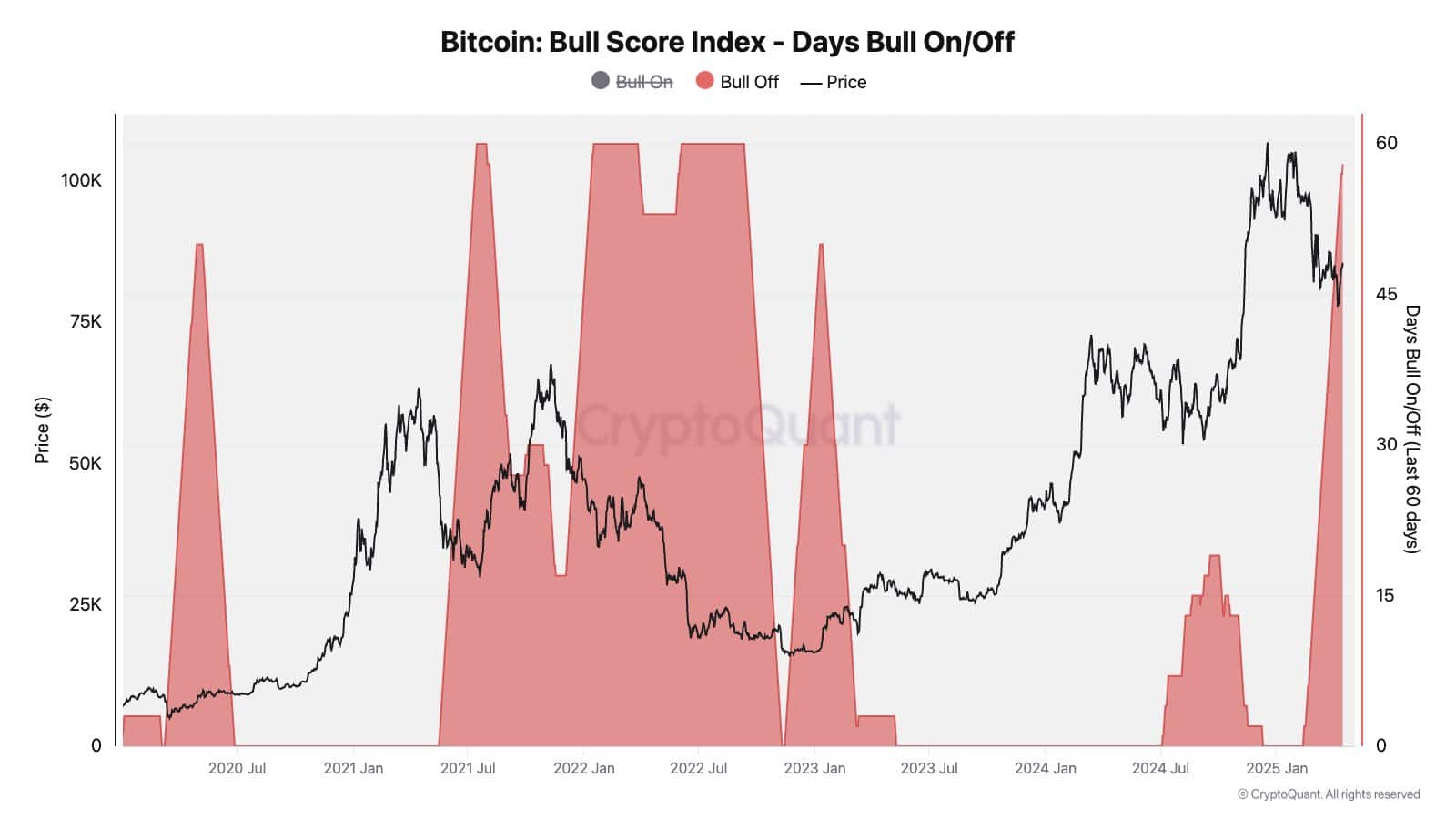

That said, overall demand and bullish conditions for BTC remained elusive. According to CryptoQuant’s Bitcoin Bull Score Index, it has been a ‘Bull Off’ season in the past 60 days.

This mirrored the weak conditions seen during the 2022 crypto winter and was marked by negative price action.

Source: CryptoQuant

The overall market sentiment has been ‘fear’ since February, and a decisive rebound could only be determined by an end to ongoing tariff uncertainty.

In the meantime, the uncertainty could tip gold to extend its winning streak against BTC.

Take a Survey: Chance to Win $500 USDT