XRP Price Prediction 2025: Can Institutional Surge Propel It to $10+?

- Current XRP Market Position: Bullish Consolidation or Precarious Balance?

- Institutional Tsunami: How ETFs Are Reshaping XRP's Future

- Price Projections: Realistic Targets or Wishful Thinking?

- Market Cap Concerns: Why Traditional Metrics Might Not Apply

- Technical Patterns: The Bullish Case in Charts

- Risks and Volatility: What Investors Should Watch

- Investment Strategies: Navigating the XRP Opportunity

- FAQ: Your XRP Questions Answered

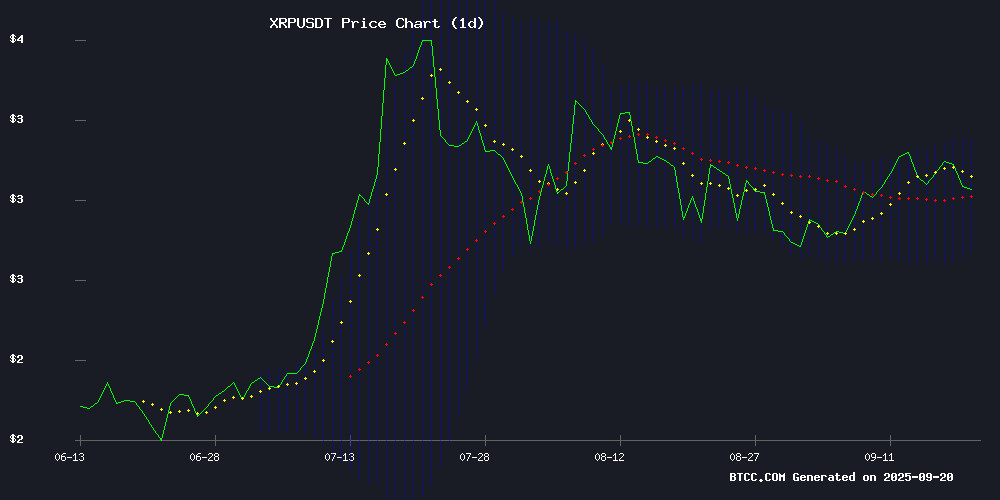

As we approach Q4 2025, XRP stands at a critical juncture - currently trading at $2.9877 with strong technical support and unprecedented institutional interest. The recent 762% surge in ETF inflows and analyst predictions ranging from $10 to $30 by 2026 suggest we might be witnessing the early stages of a major breakout. But is this just HYPE or is there real substance behind these projections? Let's dive deep into the technicals, fundamentals, and market dynamics shaping XRP's potential path forward.

Current XRP Market Position: Bullish Consolidation or Precarious Balance?

XRP is currently showing textbook consolidation behavior, trading slightly above its 20-day moving average of $2.9562. The MACD indicator reveals bearish momentum (-0.1339 | -0.0724 | -0.0615) but with decreasing negative divergence - often a precursor to trend reversal. Bollinger Bands paint an interesting picture with the price sandwiched between $3.1738 (upper) and $2.7386 (lower), suggesting we're in a defined trading range.

What's particularly fascinating is how XRP has maintained this technical posture despite the massive 762% surge in exchange inflows following the ETF launch. Normally, such inflows WOULD create selling pressure, but XRP actually climbed 5% on launch day - a clear signal of robust underlying demand.

Institutional Tsunami: How ETFs Are Reshaping XRP's Future

The institutional landscape for XRP has transformed dramatically in recent months. The REX-Osprey XRP ETF (XRPR) smashed records on its CBOE debut, attracting $24 million in volume within just 90 minutes. According to CryptoQuant data, exchange inflows exploded to 11.57 million XRP on September 18, 2025, up from a mere 1.34 million the previous day.

This institutional frenzy isn't happening in isolation. We're seeing:

- The first XRP-backed stablecoin launch on Flare Network

- Growing political acceptance (remember Trump's crypto reserve proposal?)

- Analysts drawing parallels to the 2017 bull cycle

The BTCC research team notes, "The combination of ETF success, institutional adoption through XRP-backed financial products, and strong technical support creates a perfect storm for potential upside."

Price Projections: Realistic Targets or Wishful Thinking?

Analyst predictions for XRP range from conservative to downright euphoric:

| Analyst/Institution | Price Target | Timeframe |

|---|---|---|

| XForceGlobal | $4-5 (initial), $14 later | By 2026 |

| EtherNasyonaL | $5-$7 | 2025 |

| BTCC Research | $10-$30 | 2026 |

The most bullish projections point to a potential test of $34 by 2026, which would represent a 10x gain from current levels. While these numbers might seem outrageous to skeptics, remember that XRP has historically delivered these kinds of returns during bull cycles.

Market Cap Concerns: Why Traditional Metrics Might Not Apply

One common counterargument to these lofty price targets revolves around market capitalization. "How can XRP possibly reach $10+ without an unrealistic market cap?" critics ask. Analyst XForceGlobal has been particularly vocal in dismissing these concerns:

"Don't be fooled by those who say the price cannot rise to $10+. Traditional market cap calculations simply don't apply to cryptocurrency valuations in the same way. We're seeing a fundamental shift in how value is assessed in this space."

This perspective gains credibility when you consider Bitcoin's own journey - from being dismissed as overvalued at $1,000 to now trading orders of magnitude higher. The crypto market has repeatedly defied conventional valuation metrics.

Technical Patterns: The Bullish Case in Charts

Technical analysts are flagging several compelling patterns:

- Double Bottom Breakout: Visible on longer timeframes, suggesting potential for significant upside

- 2024 Triangle Breakout: A formation that historically precedes major rallies

- Key Support Holding: Despite volatility, XRP maintains critical support levels

TradingShot notes, "The $3 level has emerged as critical support - a potential springboard for upside should ETF approvals materialize. We're seeing striking similarities to the 2017-2018 cycle."

Risks and Volatility: What Investors Should Watch

While the outlook appears bullish, crypto analyst Austin Hilton offers a crucial reminder:

"Macroeconomic events matter, but disciplined portfolio management matters more. Know your position size, understand your cost basis, and establish clear profit-taking levels before volatility hits."

Key risks to monitor include:

- Regulatory developments (SEC actions, global policies)

- Macroeconomic conditions (Fed rate decisions, inflation)

- Competition from other payment-focused cryptocurrencies

Investment Strategies: Navigating the XRP Opportunity

For investors considering XRP exposure, several approaches emerge:

- Direct Holdings: Buying and holding XRP for long-term appreciation

- ETF Exposure: Through products like XRPR for institutional-grade access

- Mining Contracts: Platforms offering dual-return models (price appreciation + mining income)

- Presale Opportunities: Like XRP Tundra, though these carry higher risk

The BTCC team suggests, "A balanced approach combining Core XRP holdings with strategic exposure to emerging XRP ecosystem projects may offer the optimal risk-reward profile."

FAQ: Your XRP Questions Answered

What is XRP's current price and technical position?

As of September 2025, XRP trades at $2.9877, showing consolidation above its 20-day moving average ($2.9562) with Bollinger Bands between $3.1738 and $2.7386.

How significant is the recent XRP ETF launch?

Extremely significant - the REX-Osprey XRP ETF saw $24M volume in 90 minutes and triggered a 762% surge in exchange inflows to 11.57 million XRP.

Are the $10+ price predictions realistic?

While ambitious, they're not unprecedented. XRP has historically delivered 10x returns during bull cycles, and current institutional interest suggests potential for significant upside.

What are the main risks for XRP investors?

Key risks include regulatory uncertainty, macroeconomic conditions, and competition from other payment-focused cryptocurrencies.

How does the XRP-backed stablecoin work?

Launched on Flare Network, it uses a Collateralized Debt Position model where users lock FXRP or wFLR as collateral to mint dollar-pegged stablecoins while maintaining XRP exposure.