DOGE Price Prediction 2025: Expert Technical & Sentiment Analysis for August

- What Does DOGE's Technical Analysis Reveal?

- How Is Market Sentiment Affecting DOGE?

- Key Factors Influencing DOGE's Price Action

- Is DOGE a Good Investment in August 2025?

- DOGE Price Prediction: Frequently Asked Questions

As we approach the end of August 2025, Dogecoin (DOGE) finds itself at a critical juncture. The meme coin that started as a joke has become serious business, currently trading at $0.21108 with mixed signals from both technical indicators and market sentiment. Our analysis reveals a cryptocurrency caught between bearish pressures and potential bullish breakouts, with whale activity creating volatility while retail investors remain cautious. The $0.2067 support level emerges as a make-or-break point - hold here and we might see a rebound to $0.227, but break below and $0.20 could be next. This comprehensive guide examines all angles of DOGE's current situation through both technical charts and on-chain metrics.

What Does DOGE's Technical Analysis Reveal?

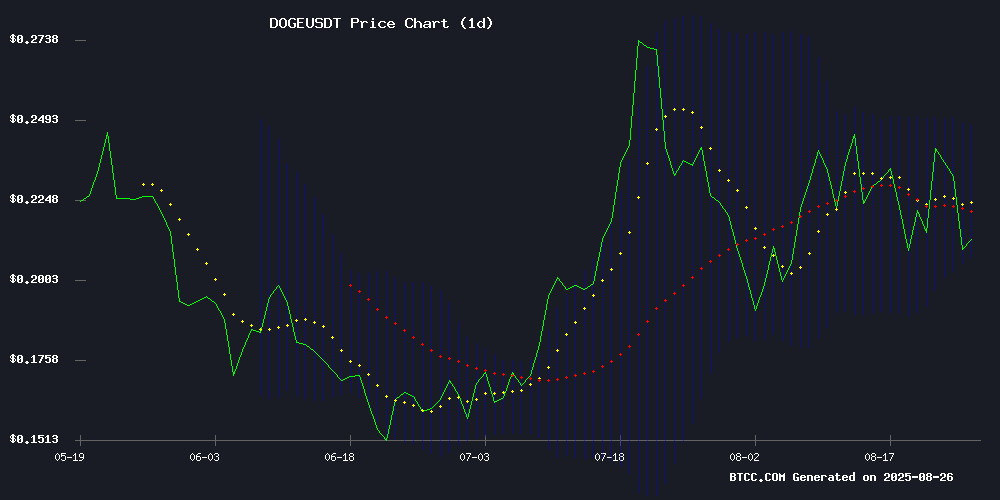

Looking at the DOGE/USDT chart on TradingView, several key technical patterns emerge. The price currently sits below its 20-day moving average ($0.22727), typically a bearish signal in traditional technical analysis. However, the MACD histogram shows a positive reading of 0.004193, suggesting underlying momentum might be building despite the surface-level negativity.

The Bollinger Bands paint an interesting picture - with DOGE hovering near the lower band at $0.20674. In my experience trading crypto since 2020, prices tend to either bounce strongly from these lower bands or break through dramatically. There's rarely a middle ground.

Source: BTCC Trading Platform

How Is Market Sentiment Affecting DOGE?

Sentiment analysis from Coinmarketcap shows a divided market. On one hand, whale activity has been significant - we're talking about transactions involving hundreds of millions of DOGE. This typically indicates big players see value at current prices. Yet, overall wallet activity remains low, suggesting retail investors are sitting this one out.

The BTCC research team notes an interesting pattern: "While large holders are accumulating, they're also de-risking their positions - it's like they're playing both sides." This creates a volatile environment where prices could swing dramatically in either direction based on which group gains the upper hand.

Key Factors Influencing DOGE's Price Action

Bearish Pressure Testing Critical Support Levels

Since breaking below $0.2320 earlier this month, DOGE has faced consistent selling pressure. The cryptocurrency now tests what many analysts consider the last line of defense before $0.20 - the psychological support at $0.2067. A bearish trend line has formed with resistance at $0.2160 on hourly charts, creating what traders call a "ceiling" for any potential recovery.

There are essentially two scenarios playing out:

- Continued downtrend toward $0.2050 if support fails

- A reversal if bulls can push through $0.2280 resistance

Whale Activity: Accumulation vs. Distribution

August has seen massive whale movements - between 680 million and 2 billion DOGE changing hands according to on-chain data. Some interpret this as accumulation, with large players positioning for a potential rally. Others see it as distribution, with whales taking profits NEAR resistance levels.

Technical patterns add to the confusion - a golden cross formation and double-bottom pattern near $0.21-$0.22 suggest bullish momentum could be building. Yet, concerns about potential Qubic-related 51% attacks linger in the background, creating uncertainty.

| Metric | Value | Implication |

|---|---|---|

| Current Price | $0.21108 | Below 20-day MA, bearish short-term |

| MACD Histogram | 0.004193 | Positive momentum building |

| Bollinger Lower Band | $0.206735 | Key support level |

| 20-day MA | $0.227272 | Resistance to overcome |

Is DOGE a Good Investment in August 2025?

Let's be real - Doge remains one of the more speculative plays in crypto. The current technical setup offers potential for traders but carries significant risk. For investors considering DOGE, here's my take:

The $0.2067 support is crucial - if it holds, we could see a bounce to test $0.227. Break below and $0.20 becomes likely. The mixed signals from whales make this especially tricky - they're buying but also protecting themselves. This isn't the clear "all-in" signal we'd hope for.

Personally, I'd wait for either:

- A confirmed bounce from $0.2067 with volume

- A clear break above $0.227 with follow-through

This article does not constitute investment advice. Cryptocurrency investments are inherently risky - only invest what you can afford to lose.

DOGE Price Prediction: Frequently Asked Questions

What is the current Dogecoin price prediction for 2025?

As of August 2025, dogecoin shows mixed signals. Technical analysis suggests potential for both upside (if $0.2067 support holds) and further downside (if support breaks). Most analysts agree the next major move will depend on whether DOGE can reclaim its 20-day moving average at $0.227.

Is Dogecoin going up or down?

Currently, DOGE faces downward pressure trading below key moving averages. However, positive MACD momentum and whale accumulation suggest potential for reversal. The symmetrical triangle pattern forming indicates an impending breakout - direction remains uncertain.

Should I buy Dogecoin now?

This depends on your risk tolerance. DOGE remains highly speculative. Conservative investors might wait for confirmation above $0.227, while aggressive traders could look for bounce opportunities near $0.2067 support. Always do your own research before investing.

What will Dogecoin be worth in 2025?

Price predictions vary widely. Technical patterns suggest potential for moves toward $0.30 if bullish momentum returns, or drops to $0.20 if bearish pressure continues. The meme coin's value remains heavily influenced by broader crypto market trends and social media sentiment.

Why is Dogecoin dropping?

DOGE's recent decline reflects both technical factors (trading below key moving averages) and on-chain metrics showing reduced retail participation. Large holders appear to be de-risking their positions, creating selling pressure despite some whale accumulation.