XRP Price Prediction 2025: Can XRP Hit $5 by December Amid Regulatory Breakthroughs?

- XRP Technical Analysis: Is the Bottom In?

- Regulatory Catalysts: How Legal Clarity Could Propel XRP

- Institutional Adoption: Japan's Real Estate Revolution

- Market Sentiment: Whales vs. Fundamentals

- Price Prediction Scenarios for XRP

- XRP's Utility Debate: Bridge Currency or Bust?

- Frequently Asked Questions

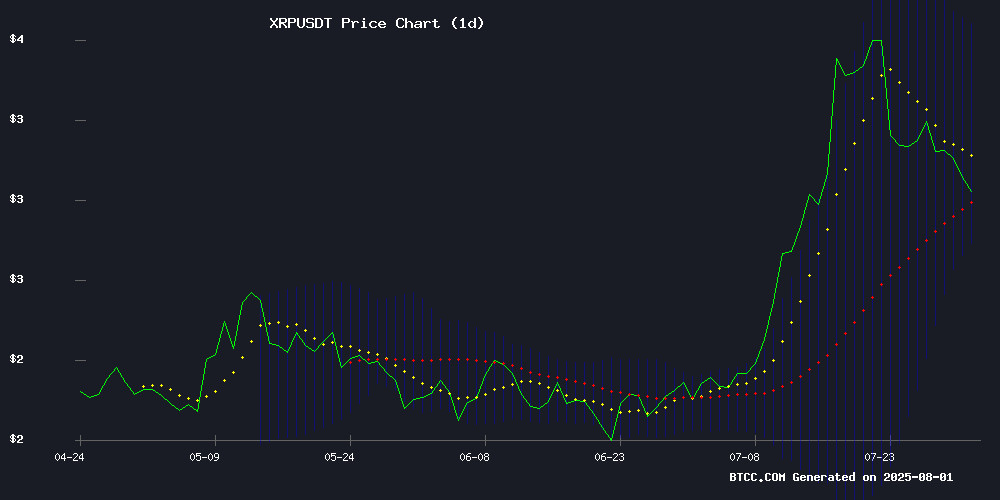

XRP is showing signs of a major technical breakout as regulatory clarity emerges and institutional adoption accelerates. With the SEC case nearing resolution and Japan's MUFG Bank preparing to tokenize real estate on the XRP Ledger, analysts are increasingly bullish about XRP's prospects. The cryptocurrency recently bounced off key support at $3.00 after a volatile period that saw whales dumping $28 million worth of tokens. Technical indicators suggest we could see XRP test $3.60-$4.20 by September if current support holds, with the $5 target remaining viable for Q4 2025. However, traders should watch the critical $3.19 resistance level and be prepared for potential pullbacks to $2.80 if market sentiment sours.

XRP Technical Analysis: Is the Bottom In?

XRP's chart tells a fascinating story of consolidation and potential reversal. After dipping to $2.91 during August's volatility, the price has stabilized around $3.00 - precisely where the 26-day exponential moving average currently sits. What's particularly interesting is the Bollinger Band squeeze we're seeing, which typically precedes significant volatility. The MACD shows a slight bullish divergence, though it remains in negative territory for now.

According to TradingView data, XRP's RSI has climbed out of oversold territory to a more neutral 45, suggesting there's room for upward movement before becoming overbought. The $3.19 level remains critical - a weekly close above this WOULD confirm the BTCC team's $5 year-end target. Below current prices, $2.80 stands as strong support, with $2.60-$2.30 acting as the next major demand zone if that fails.

Regulatory Catalysts: How Legal Clarity Could Propel XRP

The Ripple-SEC saga appears to be reaching its final chapters, with market observers anticipating a joint dismissal of appeals by mid-August. This would remove a significant overhang that's weighed on XRP since 2020. More importantly, the SEC's new streamlined ETF rules could pave the way for an XRP ETF as early as September 2025.

Coinbase's derivatives exchange emerges as a key player here, with its futures products now qualifying under the SEC's reduced 240-day review process. The potential approval mechanism - allowing in-kind creation and redemption of ETF shares using actual XRP - could dramatically improve market efficiency. As Ripple CTO David Schwartz noted, "The market's been waiting for this resolution like traders waiting for a breakout."

Institutional Adoption: Japan's Real Estate Revolution

Perhaps the most groundbreaking development comes from Japan, where Mitsubishi UFJ Financial Group (MUFG) is preparing to tokenize real estate on the XRP Ledger. This isn't just another partnership announcement - it represents a fundamental shift in how major financial institutions view XRP's utility beyond payments.

The initiative builds on MUFG's existing RippleNet collaboration but moves into entirely new territory. By anchoring Japan's blockchain-driven asset revolution, XRP could see transaction volumes explode as tokenized properties change hands. This real-world use case addresses one of the main criticisms leveled by crypto influencer Andrei Jikh - that XRP lacks substantial on-chain activity despite Ripple's 300+ bank partnerships.

Market Sentiment: Whales vs. Fundamentals

Recent price action reveals an intriguing tug-of-war between short-term traders and long-term holders. That 8% drop to $2.91? That was whales dumping $28 million worth of XRP in a single hour. Yet despite this, weekly performance remains positive (+4.45%), and monthly candles closed bullish.

The volume tells the real story - that sell-off saw hourly volume spike to 259 million XRP, four times the average. But here's the kicker: exchange balances had been declining before the drop, suggesting accumulation by larger players. This classic "distribution before accumulation" pattern often precedes major moves.

Price Prediction Scenarios for XRP

Let's break down the potential paths for XRP through 2025:

| Scenario | Target | Timeframe | Key Triggers |

|---|---|---|---|

| Bullish | $3.60-$4.20 | August-September | ETF approval, Ripple legal win |

| Bearish | $2.40-$2.76 | Next 2 weeks | Market-wide correction |

| Breakout | $5+ | Q4 2025 | Institutional adoption, XRPL growth |

The wild card? BlackRock's involvement. Their Digital Assets Director Maxwell Stein attending Ripple Swell 2025 has fueled speculation about institutional interest. Combine that with the technical double bottom formation currently playing out, and you've got a recipe for potential fireworks.

XRP's Utility Debate: Bridge Currency or Bust?

Ripple CTO David Schwartz recently found himself defending XRP's utility against stablecoins in a viral debate. His argument? XRP's speed makes it ideal for bridge transactions, especially in volatile markets where stablecoins can get stuck. Schwartz acknowledged sluggish on-chain activity but pointed to upcoming "permissioned domains" that could change the game for regulated entities.

What often gets missed in these discussions is XRP's growing role in sectors beyond payments. The Japan real estate play demonstrates how the XRP Ledger is evolving into a platform for tokenized assets - a narrative that could ultimately dwarf its original cross-border payments use case.

Frequently Asked Questions

What is the XRP price prediction for 2025?

Analysts predict XRP could reach $5 by Q4 2025 if key resistance at $3.19 is broken and regulatory clarity emerges. Short-term targets include $3.60-$4.20 by September, contingent on ETF approvals and the resolution of Ripple's SEC case.

Is XRP a good investment in 2025?

XRP presents an intriguing risk-reward proposition in 2025, with major catalysts including potential ETF approval, the conclusion of the SEC lawsuit, and growing institutional adoption through initiatives like Japan's real estate tokenization. However, as with all cryptocurrencies, investors should be prepared for volatility.

Why did XRP price drop recently?

XRP experienced an 8% drop to $2.91 on August 1 due to whale selling ($28 million worth of tokens dumped in one hour) and broader market volatility. Despite this, weekly performance remains positive (+4.45%), suggesting the drop may represent profit-taking rather than a trend reversal.

What is the next big catalyst for XRP?

The next major catalysts include: 1) Resolution of the SEC appeal (expected by mid-August), 2) Potential XRP ETF approval (possible September-October window), and 3) Expansion of Japan's real estate tokenization on the XRP Ledger through MUFG Bank.

How does XRP's technology compare to competitors?

XRP Ledger offers 3-5 second settlement times and handles 1,500+ TPS, making it significantly faster than many competitors. Its growing focus on tokenized assets (like Japan's real estate initiative) differentiates it from pure payment networks, while its regulatory clarity advantage over many altcoins could prove decisive in 2025.