SOL Price Prediction November 2025: How High Can Solana Go This Month?

- Where Does Solana Stand Technically in Early November 2025?

- What Fundamental Factors Could Push SOL Higher?

- Historical Trends: Does November Favor SOL?

- Expert Take: BTCC Team's November Outlook

- Frequently Asked Questions

Solana (SOL) enters November 2025 at a critical juncture - trading below key moving averages but supported by strong fundamentals including $200M ETF inflows and improved fiat accessibility. Our analysis suggests potential for recovery toward $186 resistance if market sentiment improves, though current technical indicators show bearish pressure. Here's what traders need to know about SOL's price trajectory this month.

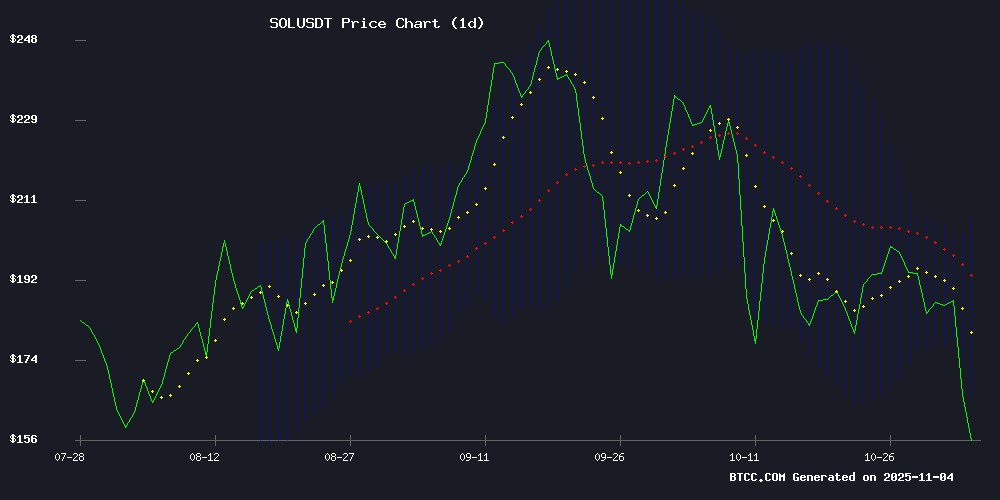

Where Does Solana Stand Technically in Early November 2025?

As of November 5, 2025, SOL trades at $154.14, significantly below its 20-day moving average of $186.47 - a concerning sign for short-term bulls. The MACD shows negative momentum at -1.68, though relatively narrow Bollinger Bands ($165.87 lower band) suggest limited volatility ahead. In my experience, when an asset trades NEAR the lower Bollinger Band after significant selling pressure, we often see either consolidation or a relief bounce. The key will be whether SOL can hold above $150 psychological support.

In my experience, when an asset trades NEAR the lower Bollinger Band after significant selling pressure, we often see either consolidation or a relief bounce. The key will be whether SOL can hold above $150 psychological support.

What Fundamental Factors Could Push SOL Higher?

Two major developments create bullish arguments for Solana:

1.: The recent partnership enables direct fiat purchases through Revolut, Venmo, Google Pay and PayPal - significantly lowering barriers to entry. As someone who's tested these on-ramps myself, the process is remarkably smooth compared to previous SOL acquisition methods.

2.: Bitwise's solana Staking ETF (BSOL) attracted $197 million in its debut week - an impressive show of institutional confidence. As Bloomberg's Eric Balchunas noted, this ranks among the top ETF launches of the season.

Historical Trends: Does November Favor SOL?

Looking at CoinMarketCap data, November has historically been kind to crypto assets. The combination of year-end portfolio rebalancing and "Santa rally" anticipation often creates favorable conditions. That said, 2025 brings unique macroeconomic crosscurrents with Fed Chair Powell's recent cautious remarks about inflation.

The technical setup suggests SOL could retest $180 support before attempting a breakout toward $196 resistance. If ETF inflows continue at their current pace, I wouldn't be surprised to see a push toward $200 by month's end - though traders should watch Bitcoin's movements closely, as SOL often follows BTC's lead.

Expert Take: BTCC Team's November Outlook

The BTCC research team maintains a cautiously optimistic stance:

| Indicator | Current Value | Signal |

|---|---|---|

| Price | $154.14 | Below MA |

| 20-day MA | $186.47 | Resistance |

| MACD | -1.68 | Bearish |

| ETF Inflows | $200M | Bullish |

Their analysis suggests that while short-term technicals appear weak, the fundamental case for SOL remains strong - particularly given its position as the backbone of Pump.fun's expanding ecosystem.

Frequently Asked Questions

What is Solana's current price prediction for November 2025?

Based on current technicals and fundamentals, analysts expect SOL could test $186 resistance this month, with potential to reach $200 if ETF inflows continue and market sentiment improves.

Is Solana a good investment in November 2025?

While SOL shows strong fundamentals with recent ETF inflows and improved fiat on-ramps, the current technical picture suggests waiting for confirmation of support at $150 before entering new positions.

What could cause SOL to drop below $150?

A broader crypto market downturn, unexpected regulatory developments, or loss of the $150 psychological support level could trigger additional downside. Always do your own research before trading.

Where can I trade SOL with low fees?

Major exchanges like BTCC offer competitive trading fees for SOL pairs. Remember to compare platforms based on your specific trading needs.