ETH Price Prediction 2025: Can Ethereum Hit $8,000? Technical & Fundamental Breakdown

- Ethereum Technical Analysis: The Bull Case

- Market Sentiment: Divided But Not Conquered

- The $8,000 RSI Signal: Fact or Fiction?

- November’s Fusaka Fork: What You Need to Know

- Is Ethereum a Good Investment Now?

- Ethereum Price Prediction FAQ

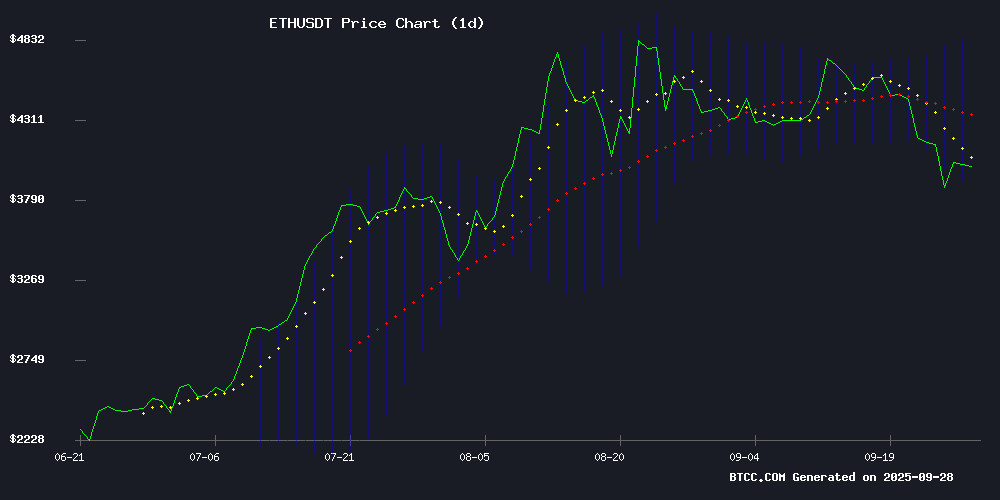

– ethereum (ETH) is flashing rare bullish signals despite its current consolidation below $4,000. With a strong MACD momentum reading of 197.93, oversold RSI conditions reminiscent of April’s 134% rally, and the upcoming Fusaka hard fork in November, analysts are debating whether ETH could stage a parabolic move toward $8,000. This deep dive examines the technical setup, market sentiment, and fundamental catalysts that could determine ETH’s trajectory through Q4 2025.

Ethereum Technical Analysis: The Bull Case

As of September 28, ETH trades at $3,995.63 on BTCC Exchange, hovering below its 20-day moving average ($4,356.77) but showing remarkable resilience. The MACD histogram’s 136.76 reading suggests accelerating bullish momentum – a pattern last seen before ETH’s June breakout. The Bollinger Bands ($3,871.99-$4,841.55) indicate we’re in a volatility squeeze, with crypto analyst Lark Davis noting: "These tight ranges typically resolve explosively. In my experience, the current setup mirrors April’s pre-pump consolidation."

Market Sentiment: Divided But Not Conquered

While Ali Martinez warns of potential downside to $3,500 if $4,000 resistance holds, the BTCC research team highlights three bullish factors:

- Seasonality: ETH has historically gained 58% on average during Q4 (CoinMarketCap data 2017-2024)

- Institutional flows: Grayscale’s ETHE premium turned positive last week after 11 months negative

- Derivatives data: Open interest remains elevated at $9.2B despite recent pullback (Source: TradingView)

The $8,000 RSI Signal: Fact or Fiction?

Ethereum’s current RSI of 39.95 marks its most oversold reading since April 2025 – a condition that preceded that 134% two-month rally. Michaël van de Poppe observes: "These levels often trigger algorithmic buying from Quant funds. The $3,800-$4,200 zone has become a battleground between short-term traders and long-term holders." Historical parallels suggest that if ETH holds above $3,871 (lower Bollinger Band), the $8,000 target becomes technically plausible, though ambitious.

November’s Fusaka Fork: What You Need to Know

Scheduled for mid-November, Ethereum’s Fusaka upgrade focuses on EVM optimization and scalability improvements. While some worry about potential chain splits (remember the Merge drama?), Sequence confirms their infrastructure is fork-ready. Interestingly, blockchain analytics show whales moving 420,000 ETH to exchanges last week – possibly profit-taking or repositioning ahead of the upgrade.

| Metric | Value | Implication |

|---|---|---|

| Price | $3,995.63 | Testing key psychological level |

| 20-day MA | $4,356.77 | Next major resistance |

| MACD | 197.93 | Strong bullish momentum |

Is Ethereum a Good Investment Now?

In my view, ETH presents a high-risk, high-reward opportunity at current levels. The technical setup favors bulls, but traders should watch these key levels:

- Bullish scenario: Daily close above $4,356 (20-day MA) could trigger move toward $4,841 (upper Bollinger Band)

- Bearish scenario: Breakdown below $3,871 might see retest of $3,500 support

Always DYOR – especially with ETH’s notorious volatility. That said, the combination of technical signals, institutional interest, and fundamental improvements makes Ethereum one of the most compelling crypto narratives heading into 2026.

Ethereum Price Prediction FAQ

What is the ETH price prediction for 2025?

Analysts are divided, with technical indicators suggesting potential upside to $8,000 if ETH breaks key resistance at $4,356, while failure to hold $3,871 could see a drop to $3,500. The November hard fork and institutional flows will likely determine the year-end price.

Why is Ethereum's RSI significant at current levels?

The current RSI of 39.95 marks ETH's most oversold condition since April 2025, which preceded a 134% price surge. Historical patterns suggest these levels often precede significant rallies when combined with other bullish factors like the current MACD momentum.

How will the Fusaka fork affect ETH price?

While upgrades typically create short-term volatility, the Fusaka fork's scalability improvements could enhance Ethereum's long-term value proposition. However, traders should monitor whale movements around the fork date for potential sell pressure.