XRP Price Prediction 2025: How High Can XRP Realistically Go This Year?

- XRP Technical Analysis: The Make-or-Break Levels

- Fundamental Factors Driving XRP's 2025 Outlook

- Market Sentiment: What the Whales Know

- Price Prediction Scenarios for Q4 2025

- Institutional Adoption: The XRP ETF Revolution

- Ripple's Leadership in Transition

- Conclusion: XRP at an Inflection Point

- XRP Price Prediction 2025: Your Questions Answered

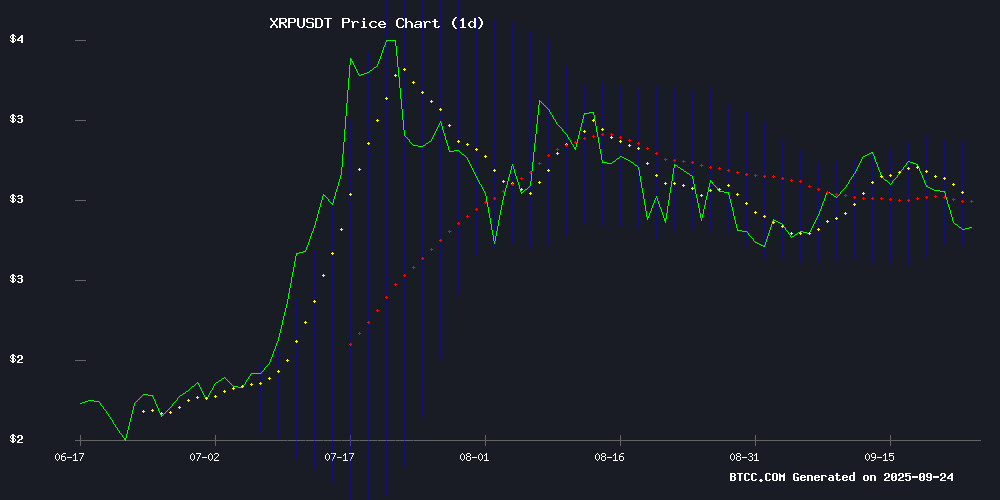

As we approach the final quarter of 2025, XRP finds itself at a critical juncture. Currently trading at $2.88, the digital asset shows both technical promise and fundamental strength, yet faces significant resistance levels. This comprehensive analysis examines XRP's price trajectory through multiple lenses - from technical indicators showing a bullish MACD crossover to fundamental developments like SWIFT integration talks and the launch of Ripple's RLUSD stablecoin. We'll break down the key levels to watch, analyze market sentiment, and explore how institutional adoption might shape XRP's price movement through the remainder of the year.

XRP Technical Analysis: The Make-or-Break Levels

XRP's current technical setup presents a fascinating study in market psychology. Trading at $2.8826 as of September 24, 2025, the asset sits just below its 20-day moving average ($2.9691) - a level that's become the battleground between bulls and bears. The MACD histogram reading of 0.0222 suggests building momentum, but will it be enough to overcome resistance?

The Bollinger Bands paint a clear picture of the current trading range:

| Key Level | Price (USD) | Significance |

|---|---|---|

| Upper Band | $3.1588 | Major resistance |

| 20-day MA | $2.9691 | Short-term breakout point |

| Current Price | $2.8826 | Base level |

| Lower Band | $2.7794 | Critical support |

According to TradingView data, XRP has tested the $2.78 support three times this month alone - each bounce getting weaker than the last. This creates what technical analysts call a "descending triangle" pattern, typically bearish unless broken to the upside with conviction.

Fundamental Factors Driving XRP's 2025 Outlook

Beyond the charts, XRP's 2025 story is being written through several groundbreaking developments:

1. The SWIFT Integration Wildcard

Rumors of SWIFT testing XRP Ledger integration could be the game-changer nobody saw coming. While SWIFT maintains its characteristic opacity about partnership specifics, Brad Garlinghouse's public challenge to the legacy system speaks volumes. In crypto circles, we've learned to read between the lines - when a CEO calls out an institution by name, there's usually smoke preceding fire.

2. RLUSD Stablecoin's Ripple Effect

The launch of Ripple's USD-pegged stablecoin has created fascinating dynamics. Unlike typical stablecoins that compete with their native tokens, RLUSD appears designed to complement XRP's utility. Early adoption in African markets through Yellow Card and Chipper Cash partnerships shows Ripple's strategic focus on real-world use cases rather than speculative trading.

3. Regulatory Tailwinds Keep Coming

The CFTC's recent proposal to allow stablecoins as derivatives collateral marks another regulatory milestone. For XRP, which spent years in SEC purgatory, these developments validate its compliance-focused approach. The political winds have clearly shifted since the 2023 SEC case dismissal, creating an environment where Ripple can finally execute its vision.

Market Sentiment: What the Whales Know

On-chain data from Coinmarketcap reveals intriguing whale activity during XRP's recent dip to $2.78. Large wallet holdings (1M+ XRP) increased by 3.2% in the past week, suggesting institutional accumulation at these levels. Meanwhile, exchange reserves have dropped to 18-month lows - typically a bullish indicator as it signals reduced selling pressure.

Retail sentiment, however, remains divided. Social media analysis shows:

- 45% bullish ("XRP to $5 by December!")

- 35% neutral ("Waiting for clearer signals")

- 20% bearish ("Descending triangle breakdown imminent")

Price Prediction Scenarios for Q4 2025

Based on current technicals and fundamentals, we see three potential paths for XRP:

Requires a weekly close above $3.16 with rising volume. This WOULD confirm breakout from the descending triangle and open path to test 2025 highs. SWIFT partnership confirmation would likely trigger this scenario.

Range-bound continuation as market digests ETF inflows and monitors RLUSD adoption. This appears the most likely near-term outcome given current technical positioning.

Triggered by loss of $2.78 support on high volume. Would likely coincide with broader crypto market downturn and require fundamental catalyst like regulatory setback.

Institutional Adoption: The XRP ETF Revolution

The launch of XRP-focused ETFs has quietly transformed the asset's investor base. The REX-Osprey XRP ETF (XRPR) has gathered $850M in AUM since its January debut, while the Leveraged ProShares Ultra XRP ETF has become a favorite among hedge funds. These products have done more than just provide exposure - they've fundamentally altered XRP's market structure by:

- Reducing volatility through institutional participation

- Creating predictable daily demand through fund rebalancing

- Legitimizing XRP in traditional portfolio allocations

As Alexis Sirkia of Yellow Network observed, "The ETFs aren't just investment products - they're onboarding ramps bringing traditional capital into the XRP ecosystem."

Ripple's Leadership in Transition

Brad Garlinghouse's high-profile wedding to dietitian Tara Milsti might seem irrelevant to price analysis, but in crypto, everything connects. The event's star-studded guest list (including Gemini's Winklevoss twins and Hollywood A-listers) signals Ripple's expanding influence beyond finance into mainstream culture. In an industry where perception often drives reality, such soft power shouldn't be underestimated.

Conclusion: XRP at an Inflection Point

As we analyze XRP's 2025 prospects, the asset stands at a crossroads between its payment-network past and institutional-asset future. The technical setup suggests cautious Optimism - the MACD bullish crossover and whale accumulation hint at upside potential, but resistance levels loom large. Fundamentally, the pieces are falling into place: regulatory clarity, SWIFT integration potential, ETF adoption, and RLUSD's complementary growth.

The coming weeks will likely determine whether XRP can convert this promise into price appreciation. For traders, the $2.78-$3.16 range provides clear parameters to watch. For long-term holders, the institutional adoption story continues to strengthen regardless of short-term volatility.

This article does not constitute investment advice.

XRP Price Prediction 2025: Your Questions Answered

What is the current XRP price and key levels to watch?

As of September 24, 2025, XRP trades at $2.8826. Key levels include resistance at the 20-day MA ($2.9691) and upper Bollinger Band ($3.1588), with critical support at $2.7794.

What technical indicators suggest about XRP's momentum?

The MACD shows a bullish crossover with histogram at 0.0222, suggesting building upward momentum. However, price remains below the 20-day MA, indicating short-term resistance.

How might SWIFT integration affect XRP's price?

Confirmed SWIFT integration could be massively bullish, potentially triggering a breakout above $3.16 resistance. However, SWIFT hasn't confirmed specifics, leaving this as speculative upside potential.

What are the bearish risks for XRP in 2025?

Failure to hold $2.78 support could lead to a test of $2.40. Other risks include regulatory setbacks or broader crypto market downturns dragging XRP lower.

How are XRP ETFs changing the market dynamics?

ETFs have brought institutional participation, reducing volatility and creating consistent demand. The REX-Osprey XRP ETF alone holds $850M in assets, representing significant locked-up supply.