Bitcoin’s Reckoning: Will Mass Liquidation Pave Way for Epic Recovery?

Mass liquidations sweep through crypto markets—clearing leveraged positions like a financial forest fire. Could this brutal reset actually create the perfect conditions for Bitcoin's next major rally?

The Great Flush

When over-leveraged traders get wiped out, it removes weak hands from the market. This liquidation cascade creates what veterans call 'max pain'—the point where forced selling exhausts itself and true price discovery begins.

Recovery Mechanics

Bitcoin's historical resilience suggests these cleansings often precede substantial rebounds. The asset's fundamental value proposition remains untouched by margin calls—decentralized scarcity doesn't care about your leverage ratio.

Market Psychology Shift

Post-liquidation markets typically see renewed institutional interest. Bargain hunters emerge when blood runs in the streets—though traditional finance types will still call it 'speculative' while quietly accumulating positions.

Bottom Line: Sometimes markets need to break before they can boom. This purge might just be the painful reset that sets the stage for Bitcoin's next chapter—proving once again that crypto winters eventually thaw into springs. (Wall Street analysts will still be predicting its demise at $200k.)

The biggest long liquidation so far this year.

24h long liquidation:$1.62B

Total liquidation in the past 24 hours: $1.70B.https://t.co/C47AgBCcTk pic.twitter.com/IeIiCgz0zL

— CoinGlass (@coinglass_com) September 22, 2025

As of press time, BTC was trading NEAR $113,039, down about -2.18% on the day. The 24-hour range stretched from $112,209 to $115,759, with a market cap of $2.37Tn and volume close to $60Bn.

Intraday moves included a sharp drop toward $112,000 before slightly recovering above $113,000 during Asian trading. On a weekly view, Bitcoin is modestly lower by around 1-2%.

Bitcoin Sell-Off Comes After Spike in Funding Rates Post-FOMC

The sell-off followed a spike in funding rates after last week’s Federal Reserve cut, which left the market crowded with Leveraged longs. “The slump is primarily attributed to… excess leverage… leading to cascading liquidations,” Barron’s reported.

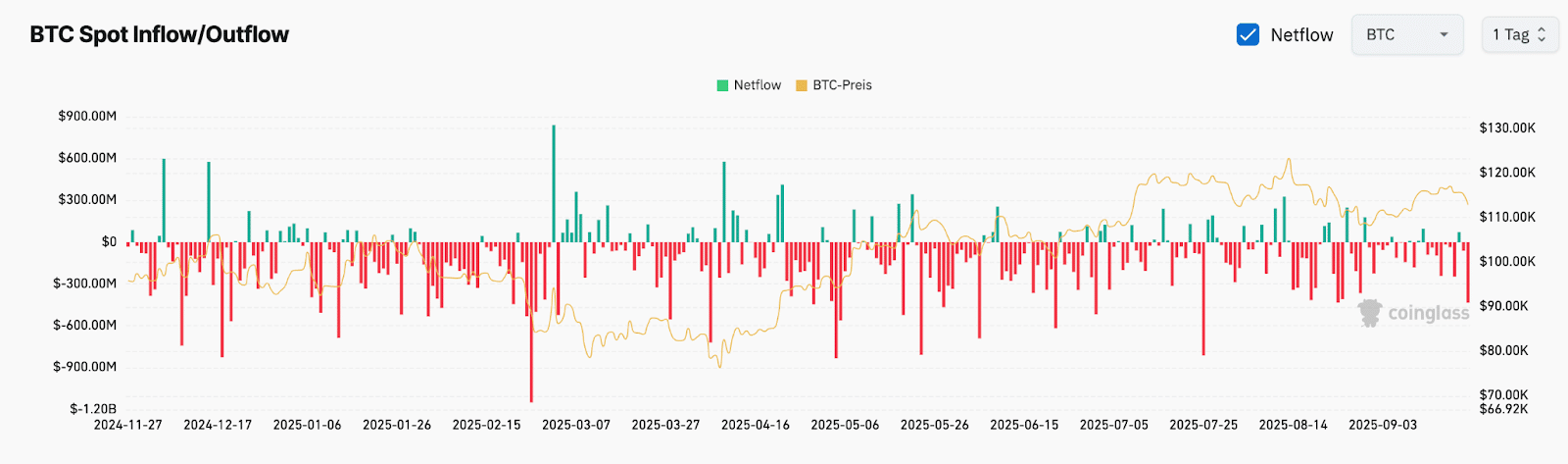

CoinGlass data showed about $3.3M in net inflows over 24 hours, suggesting more coins moved onto exchanges than left them, though the size is not large enough to set direction on its own.

(Source: Coinglass)

Despite the shake-out, open interest remains high relative to historical levels, keeping the door open for further volatility.

Near-term sentiment leans cautious with price capped below the $115k-$118k resistance band and coming off a $3,000 intraday swing. The broader structure, however, remains range-bound rather than firmly bearish.

What Does Metaplanet’s $632M Bitcoin Purchase Reveal About Institutional Demand?

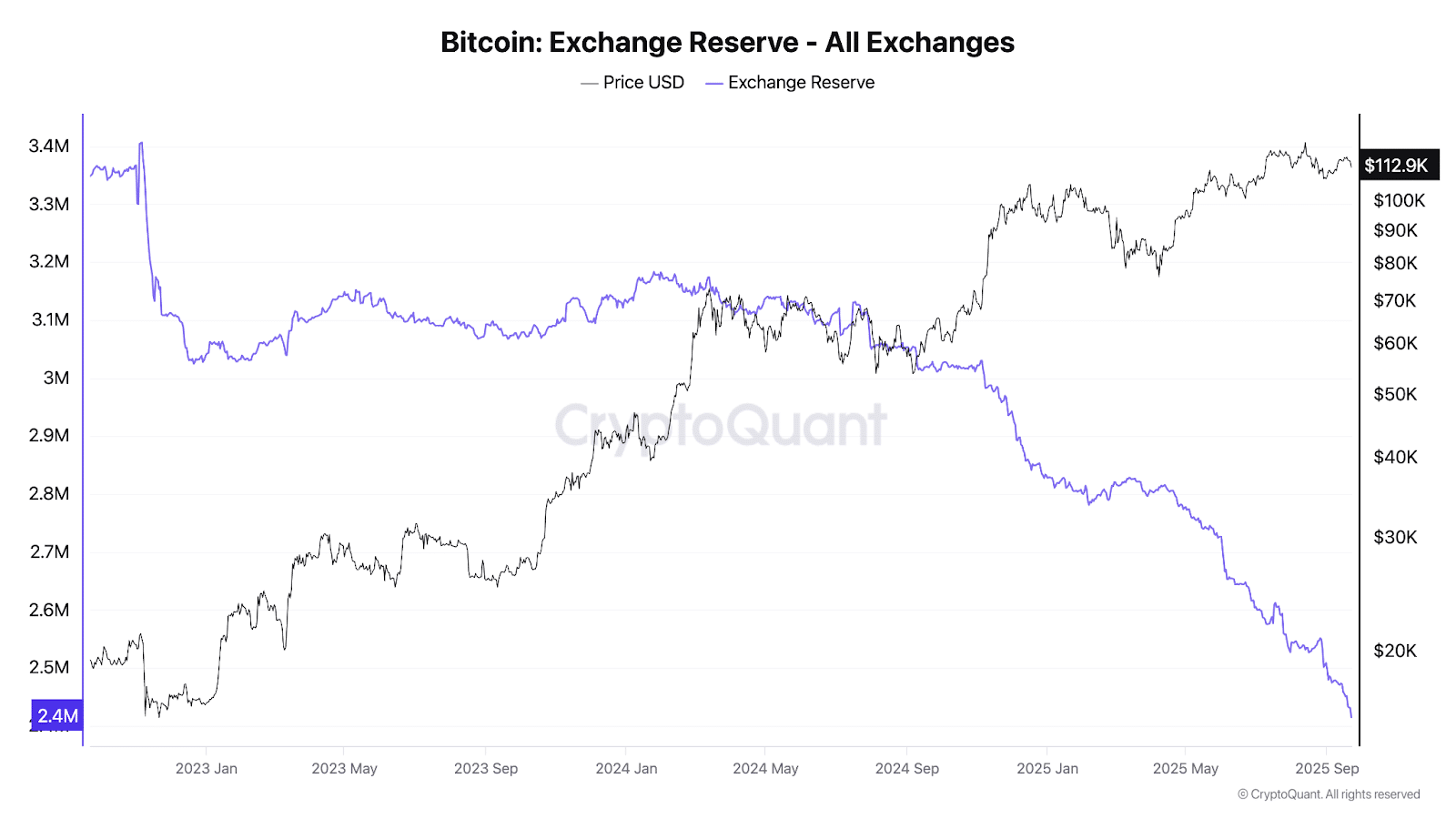

Bitcoin reserves on exchanges have slipped again, with CryptoQuant data showing about 2.43M BTC currently held and a -0.47% decline in recent days.

(Source: CryptoQuant)

The drop extends a broader year-long trend of shrinking spot supply, often linked to reduced short-term selling pressure.

At the same time, two of the largest corporate holders added to their positions. Michael Saylor’s Strategy disclosed the purchase of 850 BTC for $99.7M at an average price of $117,344.

Strategy has acquired 850 BTC for ~$99.7 million at ~$117,344 per bitcoin and has achieved BTC Yield of 26.0% YTD 2025. As of 9/21/2025, we hodl 639,835 $BTC acquired for ~$47.33 billion at ~$73,971 per bitcoin. $MSTR $STRC $STRK $STRF $STRD https://t.co/rG5pvryeYL

— Michael Saylor (@saylor) September 22, 2025

The buy lifted its total to 639,835 BTC, valued at around $47.3Bn, with an average entry cost of $73,971 per coin.

Tokyo-listed Metaplanet made the bigger move, acquiring 5,419 BTC worth $632.5M at $116,724 apiece. The company now holds 25,555 BTC in total, with an average purchase price of $106,065.

The combined 6,269 BTC purchase proves institutional buying has not wilted despite the fear and uncertainty clouding the market sentiment.

Both Strategy and Metaplanet remain on the list of leading corporate supporters of Bitcoin.

Bitcoin Price Prediction: Are Lower Highs Hinting at Bearish Momentum in Bitcoin’s Weekly Chart?

According to analysis shared by trader Broke Doomer, Bitcoin’s weekly chart signals a possible liquidity sweep.

Dont get trapped just following influencers who are always GIGA Bullish

Look at the other side, too.$BTC liquidity sweeps in pending, and i am not saying this is going to happen today or yesterday but very soon.

DYOR, major wyck coming. pic.twitter.com/ShY0CoHY1z

— Broke Doomer![]() (@im_BrokeDoomer) September 22, 2025

(@im_BrokeDoomer) September 22, 2025

The chart shows that the price action trendline has been on a prolonged rising trend over the past several months. The market is almost $113,000, having hit a snag at the resistance of about $120,000.

Technical patterns indicate that the pullback could be the next trend to trendline and a short descent below the support level, followed by a recovery.

This arrangement is similar to the Wyckoff pattern of the reaccumulation phase, where the positioning tends to be reestablished by seizing liquidity.

Doomer cautioned traders against taking overly optimistic stories and neglecting risks to the downside.

Despite the broader uptrend still intact, the chart points to possible short-term volatility. Key support zones remain under watch.

At the same time, Bitcoin began the new week with another sharp drop, repeating the pattern of weakness in the early weeks.

The most recent drop is a shaky one, with lower highs being formed over the past weeks. This implies that buyer strength is fading away.

Analyst TedPillows noted that each Monday, peak sets up liquidity sweeps, leading to accelerated drops by Tuesday.

$BTC started this week with a dump again.

Usually Bitcoin bottoms the next day, but this time it's looking weak, as I have said before.

All eyes are on equities now; if they show any weakness, the dump will continue. pic.twitter.com/G3yUlA5Tdf

— Ted (@TedPillows) September 22, 2025

He added that equities may hold the key: further weakness in traditional markets could deepen Bitcoin’s decline.

With $113,000 under pressure, sentiment has turned cautious. The usual post-dump rebound that often follows these moves looks less certain. For now, bearish momentum appears to be in control.