Bolivia’s Crypto Revolution Accelerates as USDT Powers Auto Market Transformation

Bolivia's automotive sector just slammed the accelerator on crypto adoption—and traditional banks are watching from the rearview mirror.

The USDT Integration Shift

Car dealerships across major Bolivian cities now bypass banking bottlenecks by accepting Tether's stablecoin for vehicle purchases. This isn't just dipping toes in crypto waters—it's a full-throttle embrace of dollar-pegged digital assets for big-ticket transactions.

Market Mechanics in Overdrive

Showrooms report settlement times crashing from weeks to minutes when using USDT. Buyers skip currency conversion fees while dealers lock in prices without volatility risk—everyone wins except the financial middlemen counting their disappearing commissions.

The Ripple Effect

This auto industry move signals broader acceptance of stablecoins for major purchases beyond remittances and small-scale trading. Real estate developers and electronics importers are already testing similar systems.

Because nothing disrupts legacy finance faster than car salesmen discovering they can make more money cutting out banks—who ironically taught them everything about aggressive monetization strategies in the first place.

Toyosa, the exclusive distributor of Toyota, Lexus, Yamaha and BYD in Bolivia, has partnered with the crypto custody firm BitGo and Panama’s Towerbank to enable USDT transactions, with showrooms across the country featuring signage promoting USDT as an “easy, fast and safe” way to purchase cars.

History was made tonight: the first Toyota was purchased in Bolivia with $USDT.![]() @ToyosaBolivia, and @Tether_to has partnered with BitGo to make stablecoin payments possible, delivering SAFE custody, stable transactions, and seamless experiences.

@ToyosaBolivia, and @Tether_to has partnered with BitGo to make stablecoin payments possible, delivering SAFE custody, stable transactions, and seamless experiences.

Stablecoins are powering a… pic.twitter.com/eFpfCMZTDg

— BitGo (@BitGo) September 20, 2025

Also, Bolivia’s Central Bank (BCB) recorded $294M in crypto payments during the first half of 2025, marking a 630% jump from $46.5M recorded in the same period last year.

Bolivia Crypto Adoption: Tracing the Turning Point

Bolivia’s USDT adoption skyrocketed after the country passed its landmark resolution on 25 June. The resolution officially recognised VIRTUAL assets and lifted longstanding bans on cryptocurrencies and other digital assets.

Yvette Espinoza from Autoridad de Supervisión del Sistema Financiero (ASFI), Bolivia’s financial regulator, noted the regulatory shift’s contribution in helping the country process crypto transactions within a structured and compliant framework.

Further to this, Bolivia’s crypto adoption in the public sector boomed post 13 March 2025, when President Luis Arce’s cabinet authorised the state-owned oil company, YPFB, to conduct crude oil imports using either US dollars or cryptocurrencies, signalling a willingness to integrate crypto within the country’s trade mechanisms.

The private sector got into the fray as well. Banco Bisa, one of Bolivia’s largest financial institutions, launched custody services for Tether’s USDT in October 2024, offering customers direct access to crypto trading and storage.

More recently, the BCB signed a Memorandum of Understanding (MoU) with EL Salvador’s National Commission of Digital Assets to collaborate on crypto projects, highlighting the region’s view of digital assets as a trusted alternative to traditional currency.

Bolivia’s growing crypto affinity is not a siloed trend either. Across Latin America, crypto payment adoption is surging. According to Bitso, a crypto exchange headquartered in Mexico, economic volatility and currency depreciation have pushed investors to park their funds in stablecoins such as the USDT and the USDC to preserve their wealth.

Stablecoins Rescue Inflation-Hit Economies In Latin America

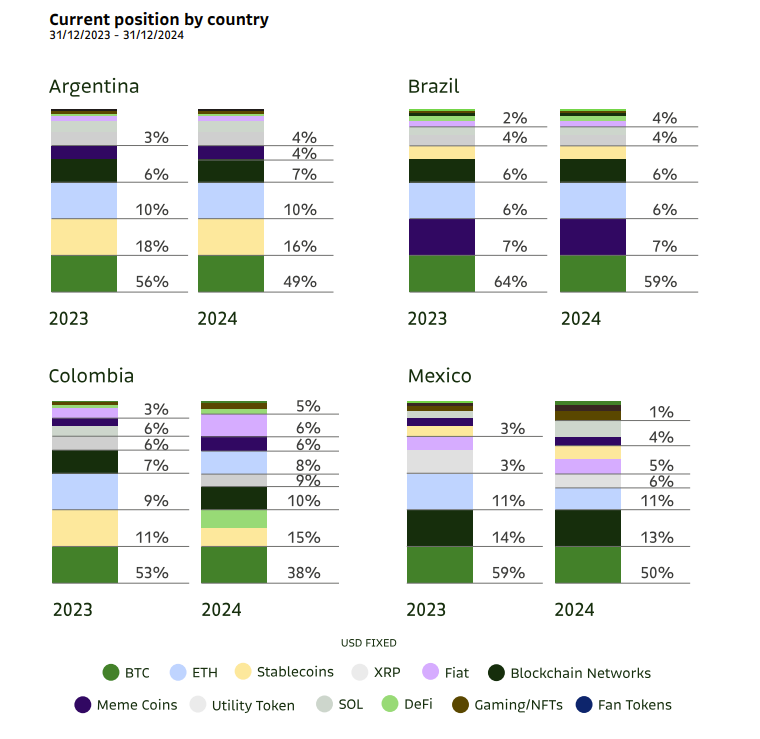

Latin American countries battling inflation have turned to stablecoins to hedge against economic volatility. Argentina, battling inflation of over 100% comes to mind. Other countries, such as Brazil, have consistently expanded their crypto holdings.

(Source: Bitso)

Brazil saw its crypto user base grow by 6% to 1.9M users, with stablecoins accounting for 26% of all transactions. This positive outlook towards crypto was also echoed in Colombia, as investors increasingly turned to stablecoins amid restricted USD banking services.

Meanwhile, Mexico continued its role as a regional crypto powerhouse, with Bitcoin and USDT dominating international transfers, especially with the Peso on a 23% year-over-year decline.

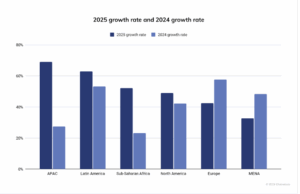

According to Chainalysis’s recent Global Crypto Adoption Index, Latin America’s crypto adoption ROSE from 53% in 2024 to 63% in 2025.

(Source: Chainalysis)

Further, between July 2023 and June 2024, Latin America accounted for 9.1% of the global cryptocurrency value, processing over $415 billion in digital assets.

This is further highlighted in the 2025 global rankings, where Brazil (5th), Venezuela (18th) and Argentina (20th) ranked among the world’s top 20 crypto adopters.

Key Takeaways

- Automakers in Bolivia, including Toyota, BYD, and Yamaha, have confirmed Tether’s USDT as a viable payment option

- Latin American countries are increasingly adopting stablecoins to hedge against economic volatility and depreciating local currency

- Toyosa, Bolivia’s exclusive auto distributor, partnered with BitGo and Towerbank to enable USDT payments