Breaking: Coinbase CEO Brian Armstrong Races to DC as New Crypto Bill Drops – Here’s What’s at Stake

Capitol Hill braces for crypto clash as industry titan Brian Armstrong lands in Washington. The Coinbase chief isn't just visiting—he's storming the halls of power as lawmakers finalize sweeping digital asset legislation that could make or break the entire sector.

Behind closed doors, Armstrong's pushing for clear rules instead of regulatory chaos. He's arguing that smart legislation will protect consumers while letting innovation thrive—unlike the current patchwork of enforcement actions that leave everyone guessing.

The bill's details remain under wraps, but insiders say it tackles everything from exchange oversight to token classification. Traditional finance lobbyists are already circling—because nothing brings Wall Street to life like the scent of potential competition getting regulated into submission.

This isn't just another DC meeting—it's a defining moment for whether America leads the digital asset revolution or gets left behind. The outcome will ripple through every portfolio, protocol, and trading desk nationwide.

Coinbase And Stand With Crypto: Is Regulation About to Send Bitcoin to $150k?

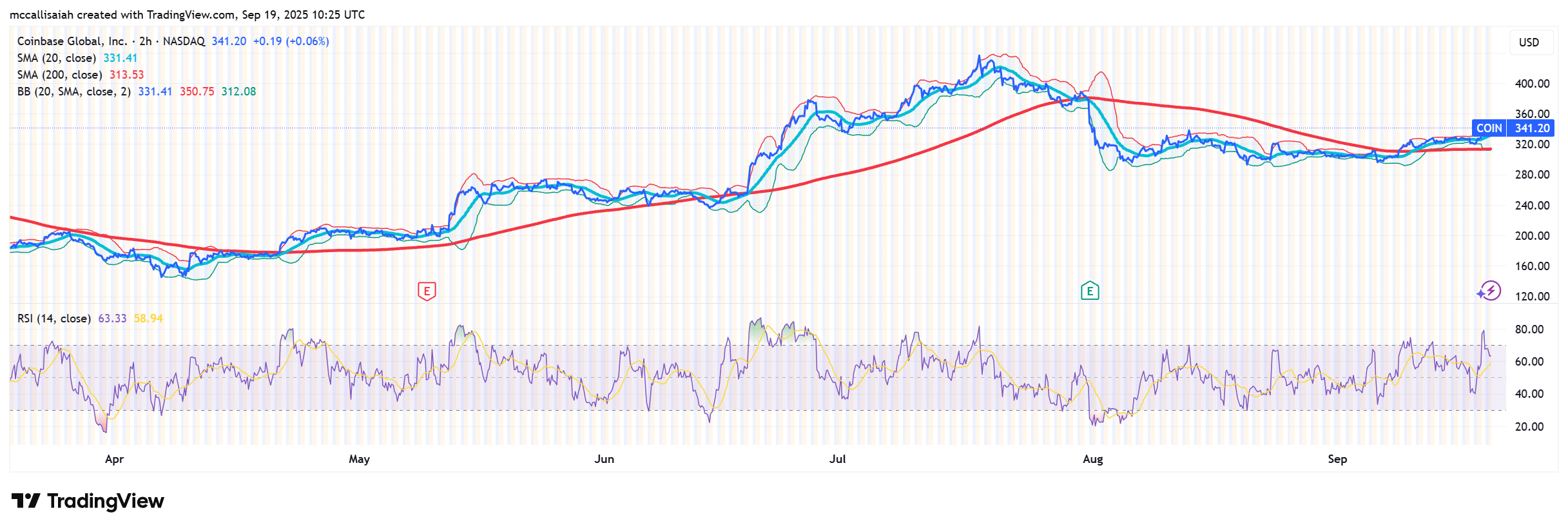

(Source: TradingView)Armstrong also urged retail investors to join the Stand With Crypto initiative, a grassroots platform that alerts users when to contact representatives. He framed it as a community-driven push, not just a corporate effort.

ICYMI: SWC Community Director @512mace recently spoke with @PunchbowlNews on the true weight of the crypto voter. pic.twitter.com/iTDu7FrtAh

— Stand With Crypto![]() (@standwithcrypto) September 8, 2025

(@standwithcrypto) September 8, 2025

He said active participation WOULD signal to lawmakers that constituents, not just companies, want a clear regulatory framework. Amen to that! Armstrong argued that this is a pivotal moment for the crypto industry that could prevent another wave of “hostile enforcement” or unregulated scam chains like Terra Luna.

Banking Lobby Pushback Over Stablecoin Yields: Should You Be Worried?

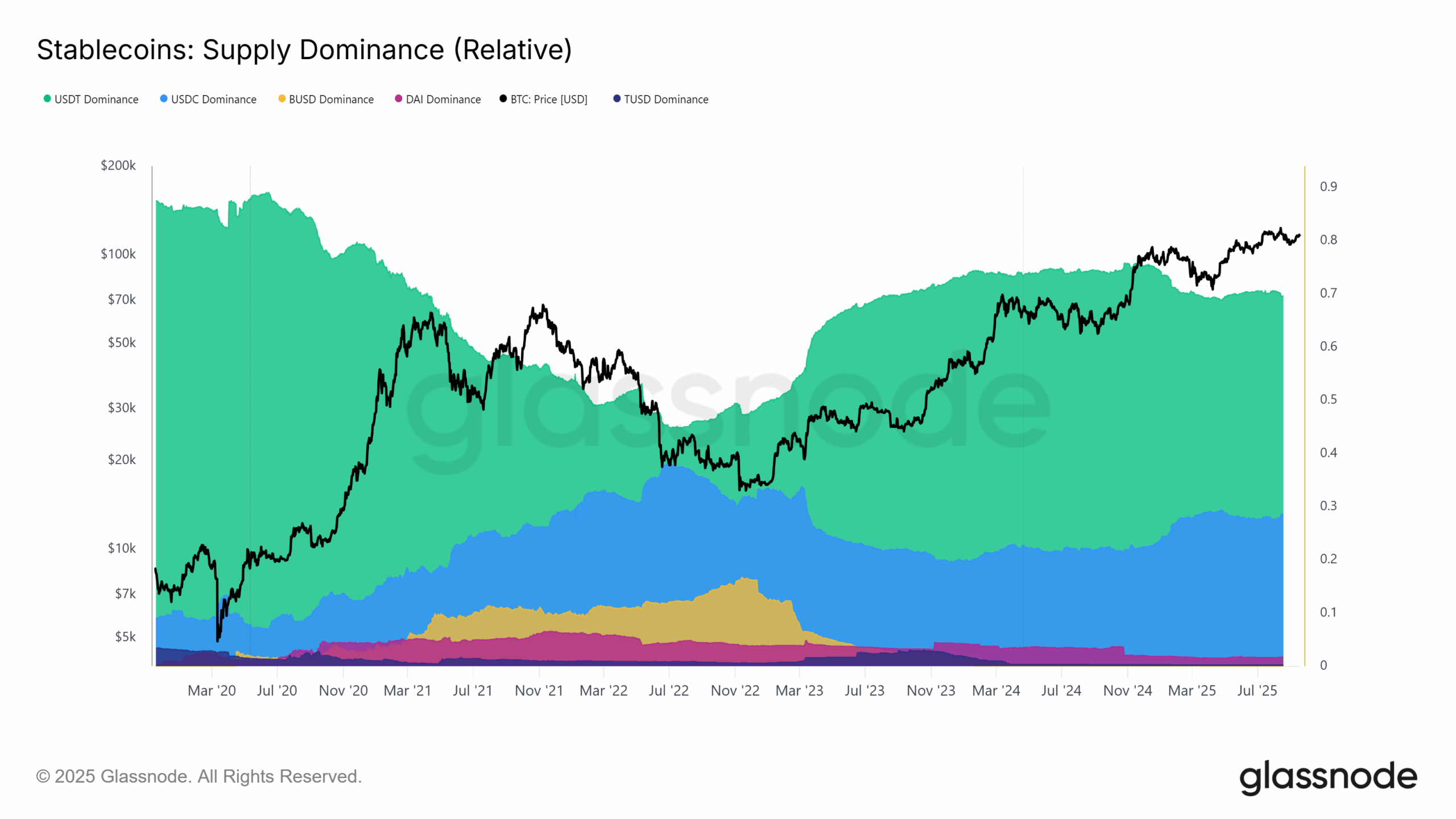

One of the sharpest battles could involve stablecoins. Armstrong claimed that US banking groups tried to insert language into the GENIUS Act earlier this year that would have banned yield-bearing stablecoins outright. That attempt failed, but banking lobbies are still pressing lawmakers to curb interest-based stablecoin products.

Crypto wasn’t just on Coinbase’s agenda. Lawmakers also met with 18 Bitcoin executives, including Michael Saylor of Strategy (formerly MicroStrategy), to discuss the BITCOIN Act sponsored by Sen. Cynthia Lummis.

The proposal envisions the US acquiring one million bitcoin over five years using “budget-neutral strategies” like revaluing Treasury gold certificates and reallocating tariff revenues.

“This has a good chance of getting done… it’s a freight train leaving the station.” – Brian Armstrong

Bullish Market Data And Why Regulation Could Be the Spark

Institutional data shows why this legislation matters. According to CoinGlass, open interest in crypto futures has climbed steadily into September, while DeFiLlama reports over $290 Bn in stablecoin liquidity sitting on the sidelines.

For Armstrong, the stakes are high: seizing bipartisan momentum and enacting rules that balance consumer protection and innovation.

Key Takeaways

- Coinbase CEO Brian Armstrong believes US crypto legislation and Clarity Act finally has a shot at passing.

- For Armstrong, the stakes are to seize bipartisan momentum and lock down rules that balance consumer protection and innovation.