FOMC Rate Cut Unleashed: How the Fed’s September Move Supercharges Bitcoin’s Ascent

Fed slashes rates—Bitcoin catches fire.

The Federal Reserve just dropped interest rates, and crypto markets are roaring to life. Traditional finance gets another jolt while digital gold stands ready to capitalize.

Liquidity Floodgates Open

Cheaper money means more capital sloshing around—and historically, that excess finds its way into risk assets like Bitcoin. The Fed's dovish pivot couldn't come at a better time for BTC bulls.

Institutional Inflows Accelerate

With yields shrinking in bonds and savings accounts, big money starts hunting for returns. Bitcoin's finite supply and hardening narrative as a macro asset make it a prime candidate.

Market Sentiment Shifts

Risk-on mode activated. Traders pivot from defensive plays to growth-oriented bets. Crypto volatility picks up—but so does upward momentum.

Another reminder that while the Fed plays with blunt tools, Bitcoin operates with surgical precision. The old guard cuts rates; the new guard builds value.

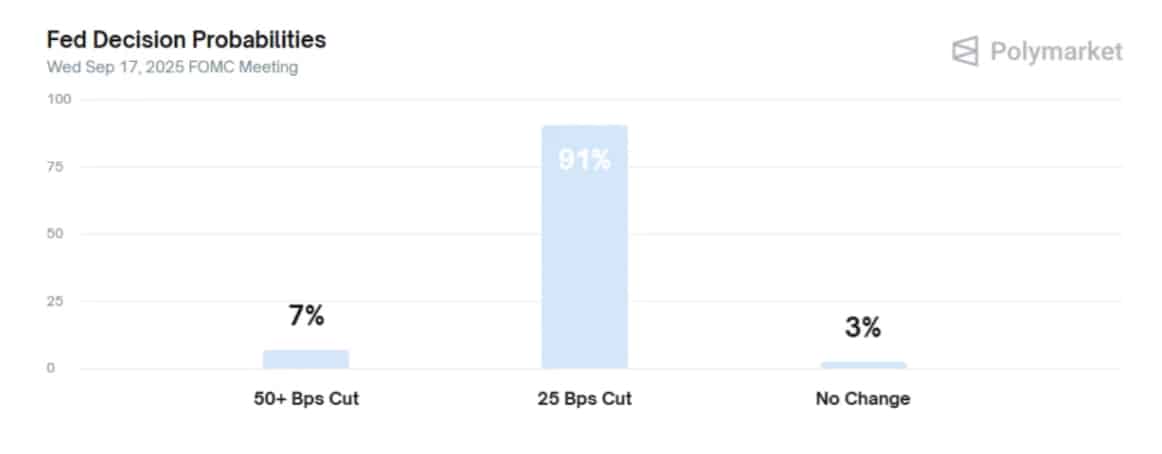

(Source –)

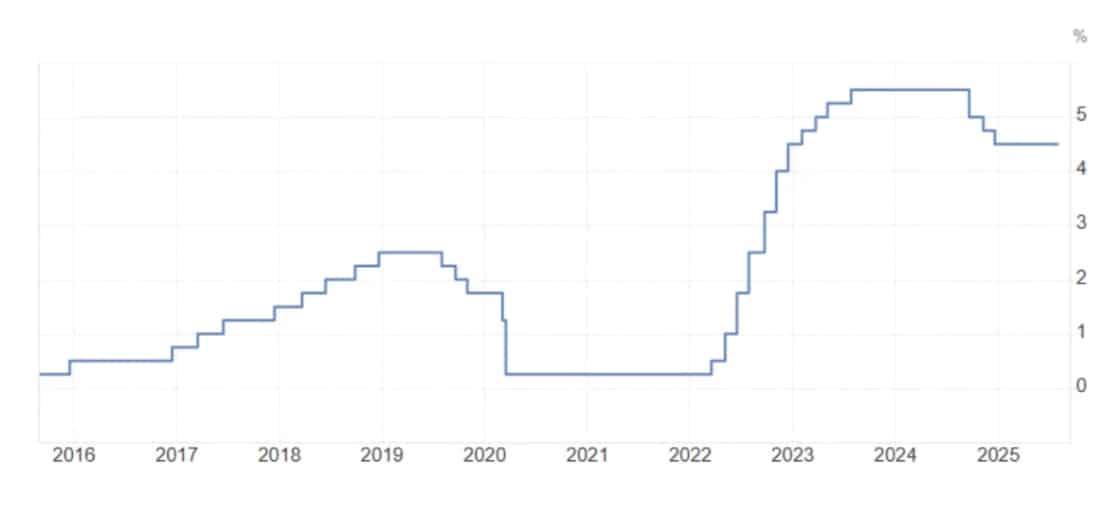

The Fed kept interest rates at 5.5% for more than a year, holding steady from July 2023 through August 2024.

Cuts began in August and ran through December, lowering the rate to 4.5%. Since then, policy has been on pause.

(Source –)

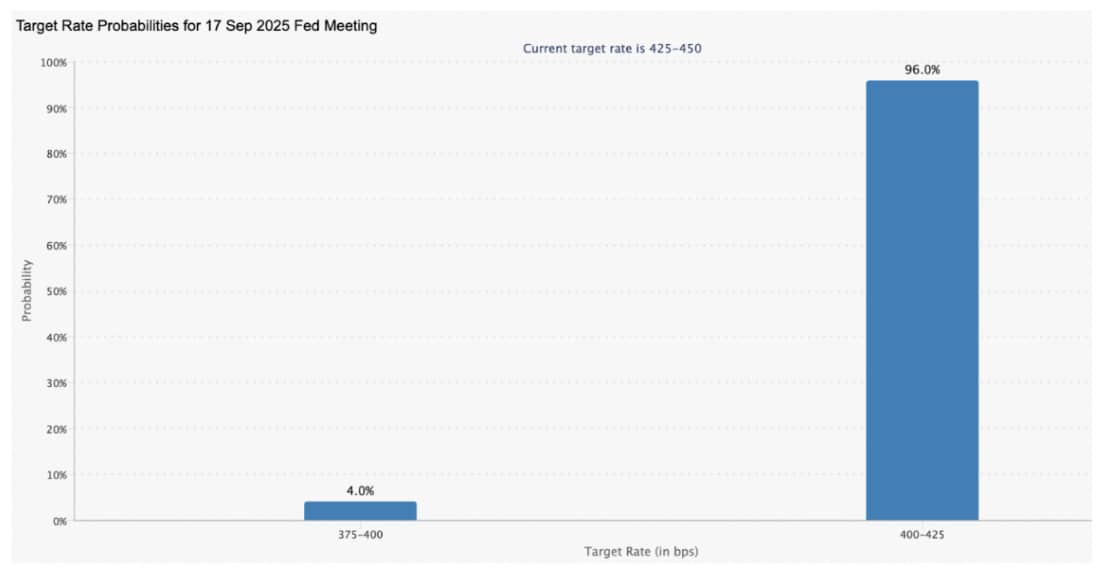

Polymarkets forecasts a 91% chance of a 0.25% cut, a 7% chance of a 0.5% cut, and only a 3% chance of no change. In other words, investors are almost certain that September will mark the Fed’s first rate adjustment of the year.

(Source –)

What was Bitcoin Response to Previous Rate Cut?

The Federal Reserve’s last rate cut cycle left a clear mark on Bitcoin’s price. The reduction news, which coincided with the asset bottoming out in September 2024, in turn triggered a rally that has since characterized the market.

Bitcoin has since increased two times over. The bulk of profits was also made in a relatively short time, in the period between September and December 2024, which highlights the close correlation between the monetary policy of the tightening and the performance of the coin.

The initial response of the market to the move made by the Fed was mixed. The central bank took a step bigger than they thought, cutting by half a point on September 19, 2024, and leaving the investors shocked.

Even with that unexpected move, bitcoin closed the day with only a modest +1% gain.

Momentum carried for a week before fading. The price slipped back toward pre-announcement levels, then regained its broader uptrend in the weeks that followed.

Later cuts had a steadier impact. Moves on November 7 and December 17 pushed Bitcoin to new highs.

Analysts caution that the rally in November was not only about rates the timing also overlapped with Donald Trump’s election win, which added to the upward pressure.

DISCOVER: Top 20 crypto to Buy in 2025

Bitcoin Price Prediction: How Can the FOMC Decision Impact Bitcoin’s Next Move?

Crypto analyst Daan Crypto posted Bitcoin’s short-term chart, which shows classic stop hunts ahead of the FOMC decision.

$BTC Commence the low timeframe stop hunts of overleveraged positions trying to pre-position into FOMC.![]() pic.twitter.com/JAvnM9Nryf

pic.twitter.com/JAvnM9Nryf

— Daan Crypto Trades (@DaanCrypto) September 17, 2025

On the 1-minute BTC/USDT perp, price whipped both ways, a move that often catches traders who are too heavy into leverage before big macro news.

Bitcoin spent most of the session inside a tight band at $115,350-$116,200. A quick push above $116,200 drew stops, then faded fast, sending the price back toward $115,900 within minutes. That rejection points to liquidity being taken above resistance before sellers stepped back in.

On the downside, $115,350 acted as short-term support. A sharp dip into that zone was bought, and the price rebounded.

(Source –)

The sequence flushes the lows, then runs the highs fits a textbook liquidity sweep meant to clear positions and reset order flow.

Volume backed the story. Activity spiked on the break over $116,200, signaling stops getting hit. But the lack of follow-through showed it for what it was: a grab for liquidity, not a clean breakout.

Structure remains range-bound. Lower intraday highs into the spike show sellers leaning on resistance.

Buyers continue to defend NEAR $115,350. Until one side wins a decisive break, expect more raids on obvious pockets of liquidity.

Traders are positioning into the FOMC, where a rate cut is in play. That uncertainty is feeding short-term swings as participants hedge and, in some cases, overextend.

Analysts flagged the quick sweeps as targeted stop hunts aimed at crowded positions.

A sustained close above $116,200 WOULD mark a shift in momentum and open room higher. A break below $115,350 would put the range at risk and invite deeper pressure.

Until then, it’s a choppy tape focused on shaking out weak hands while the market waits on the Fed.

DISCOVER: 20+ Next Crypto to Explode in 2025

Join The 99Bitcoins News Discord Here For The Latest Market Updates