$9B Tidal Wave of USDT & USDC Hits Exchanges Before FOMC—Is Bitcoin’s $130K Surge Imminent?

Crypto markets brace for impact as stablecoin liquidity surges past $9 billion ahead of the Fed's pivotal meeting.

The floodgates open: Traders position for volatility as USDT and USDC reserves stack up like casino chips before a high-stakes roulette spin.

Bitcoin's price engine revs: With this much dry powder waiting on exchanges, the stage is set for explosive moves—either toward $130,000 or into the Fed-induced abyss.

Wall Street's 'risk management' in action: Institutions park funds in stablecoins instead of cash—because why earn 5% in boring old Treasuries when you can chase 500% in crypto casinos?

(Source:)

Over $9B in Stablecoins Flood Top Crypto Exchanges

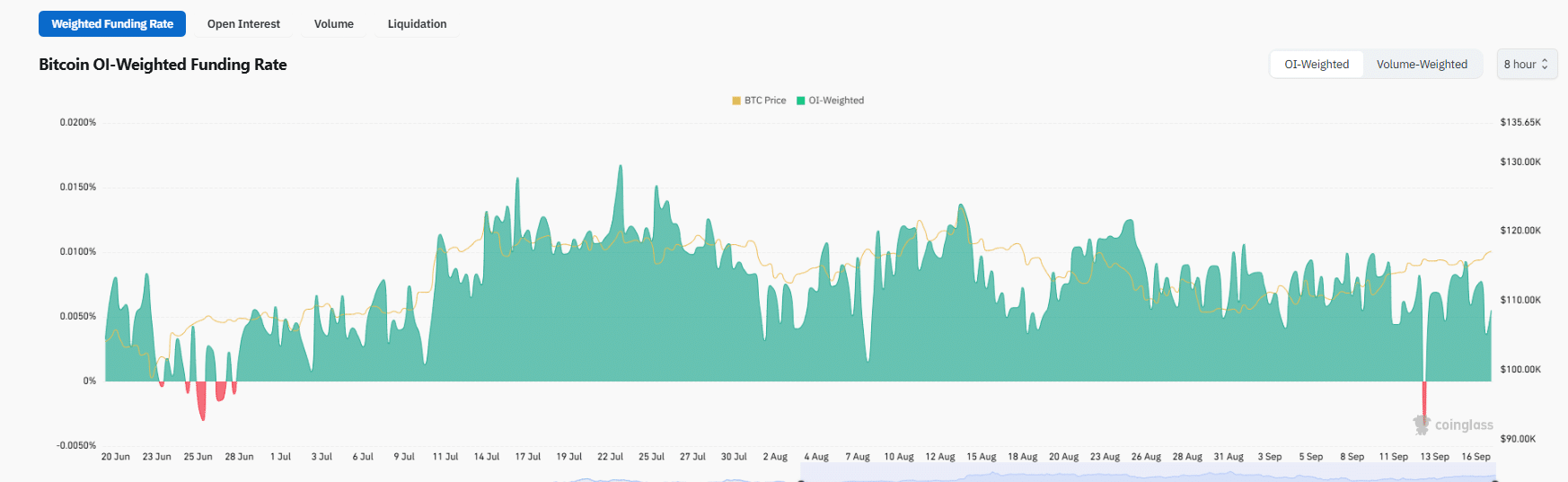

Looking at on-chain data, it is likely thatBTC ▲0.83%, top altcoins, and even some of the top solana meme coins will edge higher, pushing funding rates more into the positive territory.

Latest on-chain data shows that over the last 36 hours before the FOMC meeting, approximately $9B in top stablecoins, including USDT and USDC, was moved to crypto exchanges.

Over the last 1.5 days before the FED meeting, approximately $9 billion in stablecoins flowed into exchanges. pic.twitter.com/dD1WwK2tlv

— Axel![]()

![]() Adler Jr (@AxelAdlerJr) September 17, 2025

Adler Jr (@AxelAdlerJr) September 17, 2025

Stablecoins play a key role in the crypto ecosystem, allowing traders to get exposure to top coins and acting as a SAFE refuge during times of turbulence. Whenever stablecoins are moved to crypto exchanges like Binance, Coinbase, and Bybit, it could suggest that holders are keen on buying, a net positive for holders.

On the flip side, when altcoins, including ETH or BNB, MOVE to exchanges, it is bearish. If there are bulk inflows to exchanges, token prices may crash days later.

Over the last 1.5 days, there was a single $2Bn stablecoin transfer to Binance, the single largest movement in over a year.

$2B WORTH OF STABLES JUST GOT DUMPED INTO BINANCE.

RIGHT BEFORE FOMC.![]()

VOLATILITY INCOMING. pic.twitter.com/YIjEYrv1tT

— Kyle Chassé / DD![]() (@kyle_chasse) September 17, 2025

(@kyle_chasse) September 17, 2025

One analyst on X said these inflows are a clear sign of buying intent and “fresh powder” that could ignite crypto fireworks.

![]() $2B in stablecoins just hit Binance – the largest inflow in over a year.

$2B in stablecoins just hit Binance – the largest inflow in over a year.

And it happens right before the FOMC.

You don’t move that kind of size without intent.

It’s fresh powder, and it’s now sitting on-exchange.

— Alex Soh (@AlexSoh14) September 17, 2025

Will BTC USD Explode To Fresh New All-Time Highs Above $130,000?

Traders can only wait and see what the FOMC will decide on interest rates. Should they slash rates and project even more rate cuts by the end of the year, BTC USD could easily rally above $124,500 to reach fresh all-time highs.

On X, one analyst already notes that the Bitcoin price is trading at a +7% premium to its short-term cost basis, with traders targeting $130,000.

The price is currently trading at a 7% premium to Short-Term Cost Basis, target = $130K pic.twitter.com/w2oeS62cS1

— Axel![]()

![]() Adler Jr (@AxelAdlerJr) September 17, 2025

Adler Jr (@AxelAdlerJr) September 17, 2025

At this rate, BTC USD is up +7% from the average price short-term holders bought it at. Short-term holders are all addresses that bought BTC in the last 155 days. Presently, this cohort of bitcoin holders is in the money.

Meanwhile, the Bitcoin Risk index, which assesses the market vulnerability, is +23%, which is low by historical standards. This reading shows that the market is calm, reducing the probability of unwanted sharp pullbacks or liquidations.

Bitcoin Risk Index – the higher the value, the more dangerous the current market configuration relative to the last 3 years, with increased probability of rapid pullbacks/liquidations.

Currently, the index is at a low level of 23%, the environment is calm, probability of sharp… pic.twitter.com/RDSjxfTWVg

— Axel![]()

![]() Adler Jr (@AxelAdlerJr) September 16, 2025

Adler Jr (@AxelAdlerJr) September 16, 2025

If history guides, BTC USD could soar by another +40%, placing the Bitcoin price above $150,000 by the end of the year.

Over $9B in Stablecoins Moved To Exchanges, BTC USD To $130,000?

- Bitcoin price firm ahead of FOMC meeting

- $9Bn in stablecoins moved to crypto exchanges

- FOMC likely to slash rates

- Will BTC USD surge to $130,000 in the coming weeks