Bitwise Set to Transform RWA Crypto Landscape This Thanksgiving

Institutional heavyweight Bitwise drops Thanksgiving bombshell that could reshape real-world asset tokenization forever.

RWA Revolution Accelerates

Bitwise's latest move sends shockwaves through traditional finance circles. The firm's Thanksgiving announcement positions crypto to eat Wall Street's lunch—serving real-world assets on blockchain platters while traditional bankers scramble for leftovers.

Tokenization Tidal Wave

Real estate, commodities, and traditional securities now face blockchain disruption. Bitwise's play doesn't just open doors—it kicks them down, proving crypto's appetite for tangible assets exceeds Wall Street's capacity to adapt.

Institutional adoption meets Thanksgiving tradition: everyone's suddenly thankful for blockchain while pretending they understood real-world assets all along.

What is Bitwise’s Stablecoin & Tokenization ETF and Why Does It Matter?

Bitwise’s ETF is designed to give traditional investors exposure to stablecoins and tokenized assets without directly holding crypto. According to its SEC filing, the fund will track an index split evenly into two components:

1. Equity Sleeve (50%)

- Targets public companies building in stablecoins and tokenization.

- Includes issuers, infrastructure providers, payment processors, exchanges, and retailers.

2. Crypto Asset Sleeve (50%)

- Exposure to regulated crypto exchange-traded products (ETPs) like

BTC ▲0.99% and

ETH ▼-0.17%.

- Focuses on blockchain infrastructure supporting stablecoins and RWAs.

To maintain balance, the largest crypto ETP in the sleeve will be capped at 22.5% with the index rebalancing quarterly to stay aligned with market trends. If approved, the launch would mark a milestone similar to the first Bitcoin ETF, which unleashed billions of dollars in institutional inflows earlier this year.

Bitwise w a new filing for a Stablecoin & Tokenization ETF which will have sleeve of equities and crypto assets seen benefiting from those two trends. 40 Act so prob launch around Thanksgiving pic.twitter.com/TkTLE91H9H

— Eric Balchunas (@EricBalchunas) September 16, 2025

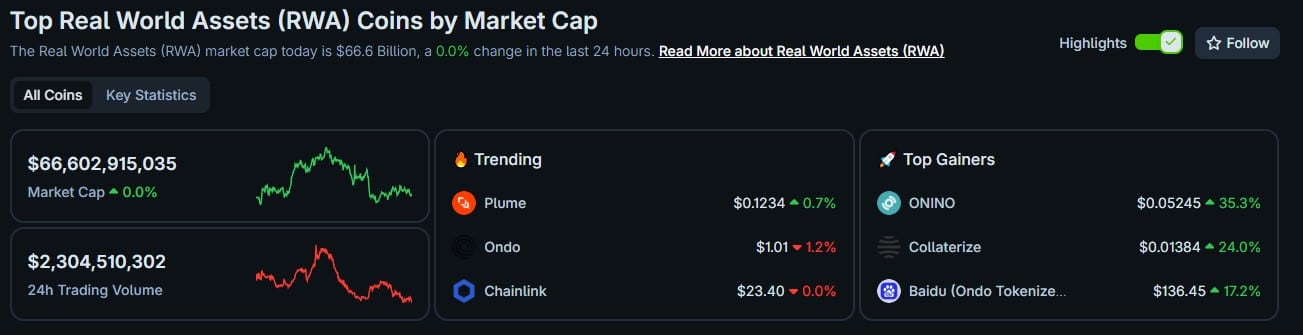

Why Are Stablecoins and RWAs Growing So Quickly in 2025?

The July 2025 passage of the GENIUS Act gave the U.S. its first comprehensive regulatory framework for stablecoins and tokenization. The impact has been dramatic:

- Stablecoins have grown from $205Bn in January to $289.7Bn, a 23% surge.

- Tokenized RWAs, like on-chain bonds and credit products, hit $15.6Bn by early September.

Stablecoins, on the other hand, serve as the backbone of crypto markets, powering everything from payments to decentralized derivatives. RWAs, meanwhile, are transforming traditional finance by moving assets like bonds and real estate onto blockchains, unlocking 24/7 global liquidity.

This growth has been accelerated by the TRUMP administration’s pro-innovation stance, with SEC Chair Paul Atkins publicly stating that tokenization is now viewed as a positive development to be supported, not restricted.

The future of RWA & stablecoins is not on ETH!

Institutional support is irrelevant when ETH lacks the capacity to trade these assets on-chain

Scalable chains like SOL, SUI & NEAR will reap the reward!

Not centralized L2s! Decentralization is more valuable, as the L1 must scale

— Justin Bons (@Justin_Bons) September 16, 2025

Could Thanksgiving Mark the Start of the Next RWA Crypto Bull Run?

The SEC has delayed multiple ETF proposals in recent weeks, with final decisions expected in October and November. Historically, ETF launches have acted as major catalysts.

- Bitcoin ETFs in early 2025 sparked a rapid surge to $117K

- Ethereum ETFs drove ETH above $4.5K

A similar dynamic could now play out for RWA-focused tokens like Centrifuge (CFG), Ondo (ONDO), and Avalanche (AVAX). Thanksgiving historically coincides with high liquidity and retail attention, amplifying any positive ETF news. The combination of institutional flow and holiday hype could create a perfect storm for RWA crypto markets heading into Q4.

As tokenized asset markets grow, they could easily reach hundreds of billions in value, mirroring the early growth trajectory of bitcoin and Ethereum. For investors, this means Thanksgiving could mark the beginning of a multi-year RWA narrative, with 2025 remembered as the year tokenized assets went mainstream.