Bitcoin’s Next Leap: Can BTC Smash $200K by Year-End or $180K in 2025?

Bitcoin's relentless surge defies traditional finance—again. The king of crypto charges toward unprecedented territory, leaving skeptics scrambling and believers counting gains.

The $200K Question

Year-end targets loom large as institutional adoption accelerates. Massive capital inflows from hedge funds and corporate treasuries fuel the fire—Wall Street finally plays catch-up with crypto natives.

2025 Horizon: $180K Floor or Springboard?

Long-term projections signal sustained momentum. Macroeconomic turbulence drives flight to hard assets—Bitcoin's fixed supply looks increasingly attractive against endless money printing. Traditional finance still doesn't get it, but their clients demand exposure anyway.

Market dynamics shift permanently. Decentralized finance infrastructure matures, bypassing legacy banking bottlenecks. The old guard dismisses digital gold at their own peril—remember when they laughed at internet stocks too?

Peter Schiff Pushes Back on Bitcoin Price Prediction: Will BTC USD Crack $200,000 By EOY?

Not everyone shares that optimism. Gold advocate and long-time Bitcoin skeptic Peter Schiff argued on X that the opposite could play out:

“Instead of hitting $200K by year-end after the Fed cuts rates, it’s more likely to sink below $100K.” – Peter Schiff.

![]() Peter Schiff: “Upcoming Fed rate cuts are a HUGE mistake”

Peter Schiff: “Upcoming Fed rate cuts are a HUGE mistake”

He publicy predicted 2008 crisis and made $70M

Now he warns it'll spark inflation and crash markets

Here’s what it means for crypto and what's next![]()

![]() pic.twitter.com/uGaooJXFiS

pic.twitter.com/uGaooJXFiS

— NoName (@WhaleNoName) September 15, 2025

Bitcoin maxis act like the fiat collapse will only benefit BTC instead of all high-quality limited supply assets (real estate, stocks, gold, Ethereum, etc.).

And this is Schiff’s point. Whether bitcoin is the largest beneficiary of Q4 rate cuts remains to be seen.

BTC ETF Flows Increase, Can They Create New ATHs?

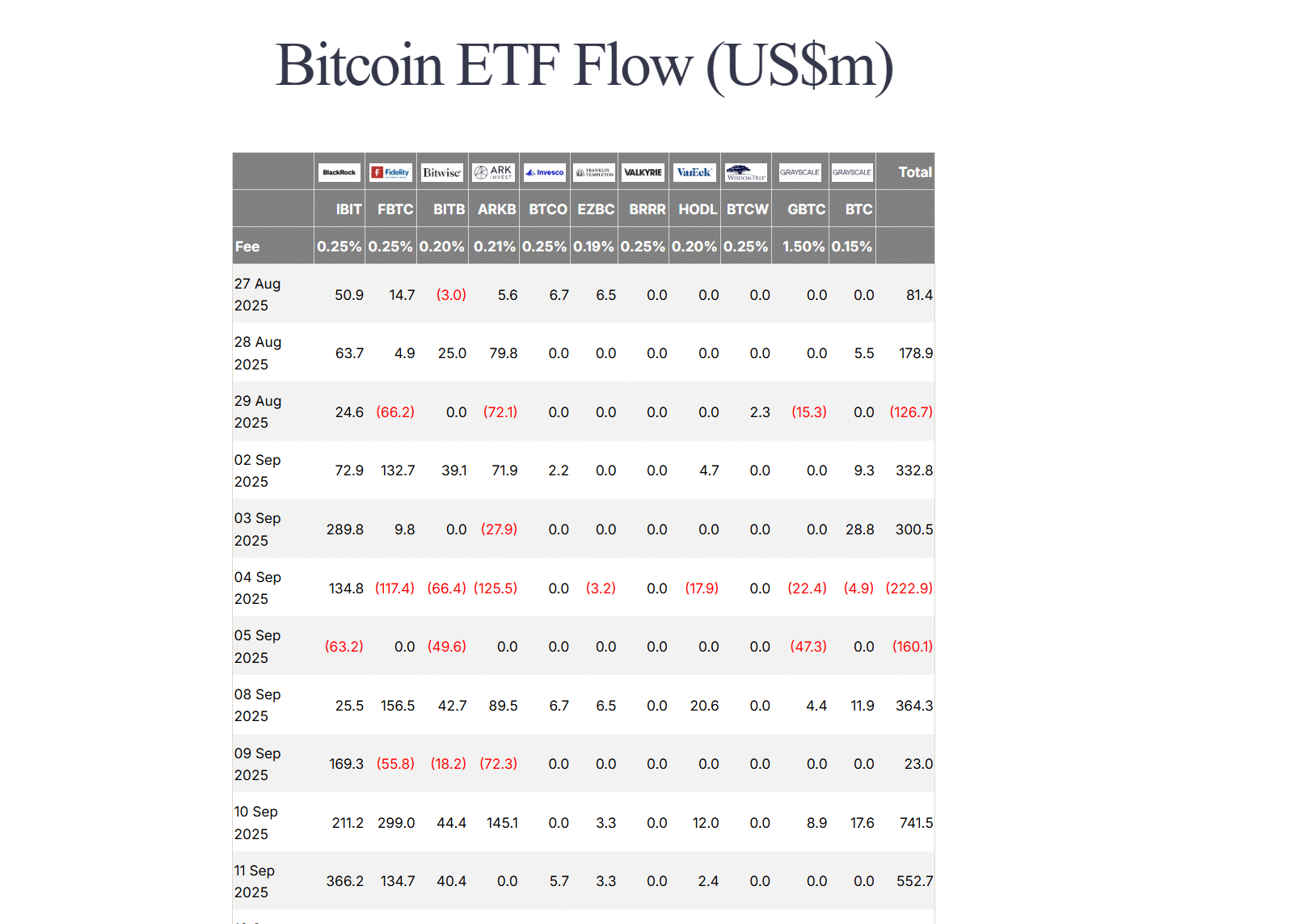

Spot Bitcoin ETFs logged more than $2.3 billion in inflows last week, according to Farside Investors, extending a steady September streak. K33 Research reports corporate treasuries now hold close to 950,000 BTC worth over $110 bn.

CoinGlass data shows that future open interest has increased by more than +15% since September 1, with longs outweighing shorts. The setup mirrors conditions that preceded strong Q4 rallies in 2017, 2020, and 2021.

Bitcoin 2025: $180K Becomes the Baseline

The headline call is Lee’s $200K target, but most crypto expert consensus online sits around $180K. VanEck has backed that figure through multiple updates, citing ETF demand, corporate balance-sheet buying, and Bitcoin’s growing status as digital gold.

SkyBridge’s Anthony Scaramucci also ranges between $180K and $200K. 99Bitcoins analysts argue that the mix of halving-driven supply pressure and rate cuts could create Bitcoin’s most favorable setup since the last major bull run.

Key Takeaways

- Tom Lee, head of research at Fundstrat Global Advisors, connected the dots during a CNBC interview with a new Bitcoin price prediction

- The headline call is Lee’s $200K target, but consensus sits around $180K..